Please use a PC Browser to access Register-Tadawul

What the G7 Rare Earths News Means for Neurocrine Biosciences Valuation in 2025

Neurocrine Biosciences, Inc. NBIX | 132.25 132.24 | +1.23% -0.01% Post |

Trying to figure out what to do with Neurocrine Biosciences stock right now? You're definitely not alone. Whether you’re an investor weighing a fresh entry or just holding on for the long run, Neurocrine has taken readers on quite a ride lately. In the past week, shares drifted down 3.5%, extending a dip that’s seen the stock lose 4.9% over the last month. Yet, if you zoom out, the story starts to look more optimistic, with a 20.2% gain over the past year and an even stronger 31.2% average annual return over five years.

Much of this volatility can be traced to shifting narratives in the rare earths sector. Recent headlines about U.S. and G7 governments ramping up support and supply protections, such as talks on price floors and new quotas, have nudged market sentiment in waves. While Neurocrine isn't a pure rare earths play, the drumbeat of global action in critical minerals seems to be shaping risk perceptions and growth forecasts for companies up and down the supply chain.

What about value? Based on our standard checklist, Neurocrine scores a 3 out of 6 on the undervaluation scale. That means it passes half of our valuation hurdles, which suggests it is neither a standout bargain nor overpriced according to these classic measures. Of course, conventional valuation approaches only tell part of the story. Up next, we'll unpack how those methods apply to Neurocrine, but stay tuned for an even more insightful framework that investors are starting to embrace.

Approach 1: Neurocrine Biosciences Discounted Cash Flow (DCF) Analysis

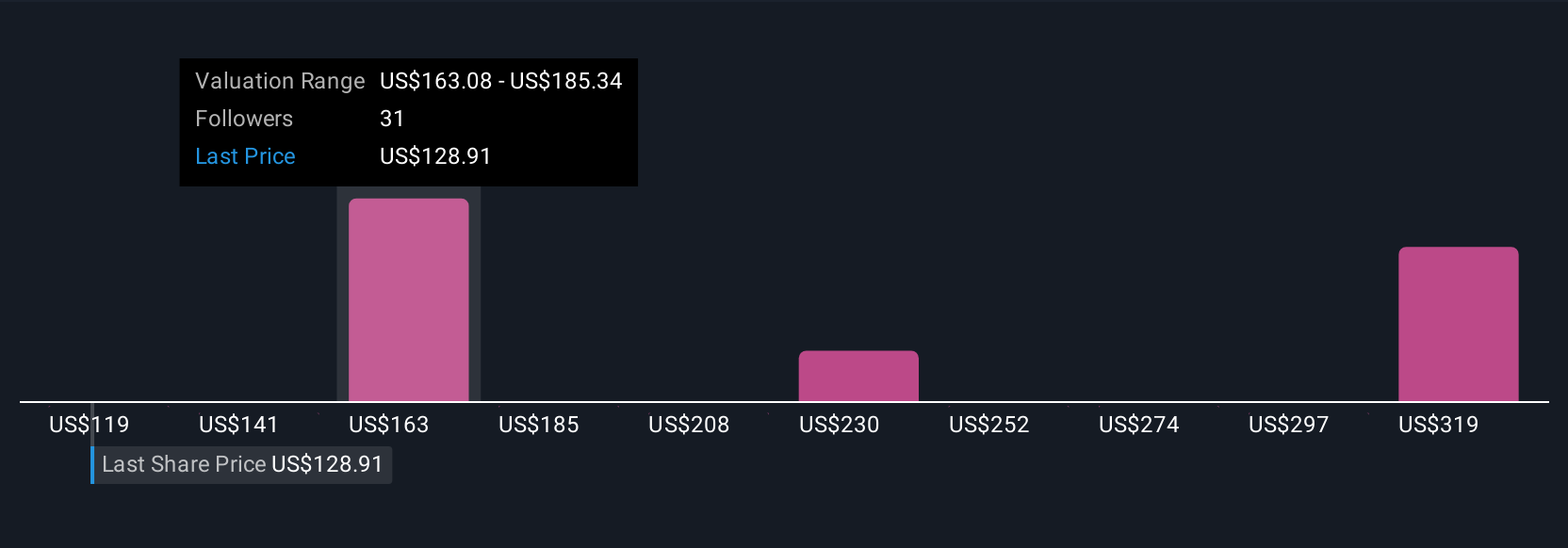

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them to present value. For Neurocrine Biosciences, the model uses the current Free Cash Flow (FCF) of $531.5 million and forecasts robust growth over the next decade.

According to analyst estimates, FCF is expected to rise from $786.97 million in 2026 to $1.26 billion by 2029. Beyond that period, projections are extrapolated, showing FCF potentially reaching $1.56 billion by 2035. All values are in U.S. dollars, and estimates beyond five years reflect longer-term trend assumptions rather than direct analyst forecasts.

Based on this DCF analysis, the estimated intrinsic value for Neurocrine Biosciences is $313.64 per share. This suggests the stock is trading at a 56.3% discount to its modeled fair value. According to the cash flow outlook, the shares appear significantly undervalued relative to current price levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Neurocrine Biosciences is undervalued by 56.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

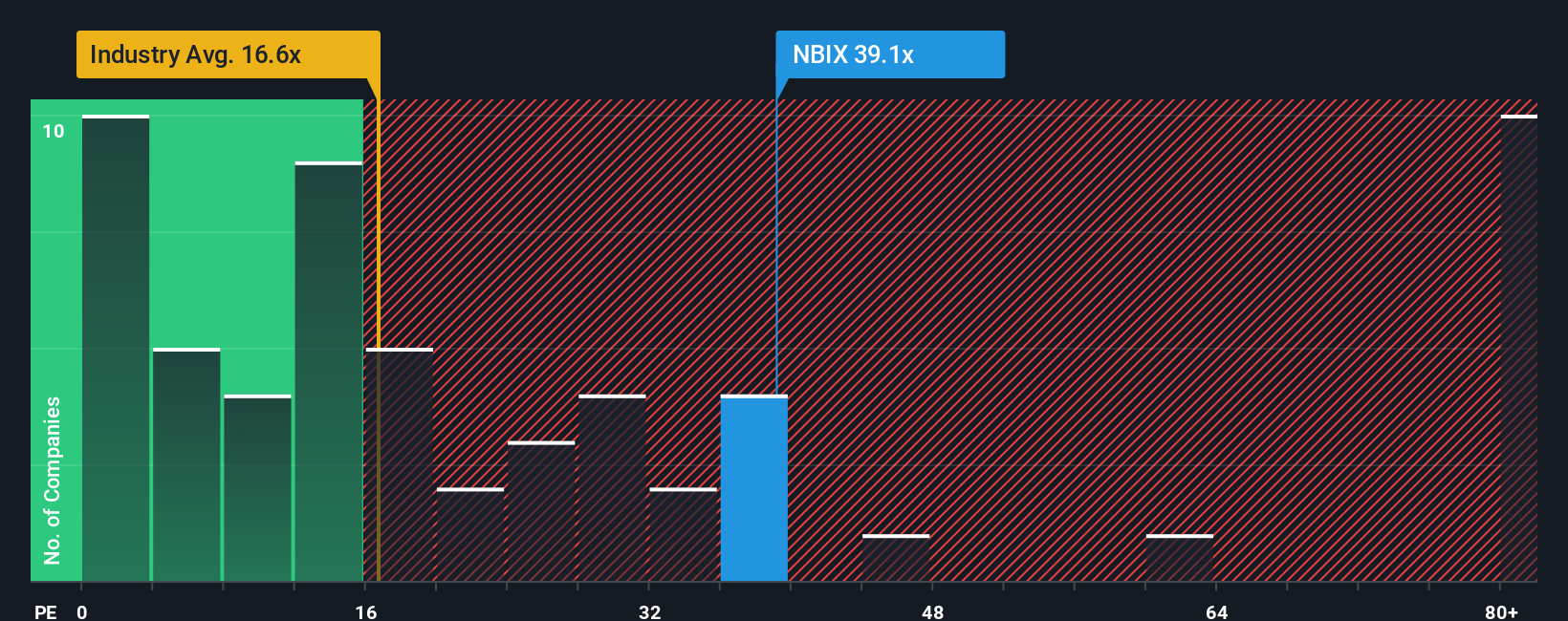

Approach 2: Neurocrine Biosciences Price vs Earnings

The Price-to-Earnings (PE) ratio is the preferred multiple here and is a standard go-to valuation tool for profitable companies. It tells investors how much the market is willing to pay for a dollar of current earnings, making it particularly useful when assessing established businesses like Neurocrine Biosciences that generate consistent profits.

What counts as a “normal” PE ratio can vary, often dictated by expectations for future earnings growth and risk. Fast-growing or lower-risk firms can command higher PE multiples, while riskier or slow-growing companies typically trade at lower ratios. This makes context and benchmarks critical for a clear view.

Right now, Neurocrine Biosciences trades at a PE of 39x. For reference, the average for Biotechs is 17x, while the peer group average sits at about 18x. At first glance, Neurocrine's multiple looks rich, but that doesn't tell the whole story.

This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio for Neurocrine is calculated at 24.29x, grounded in deeper factors such as projected earnings growth, profit margins, the company’s specific risks, size, and the broader industry landscape. Unlike a straightforward peer or industry average, the Fair Ratio's holistic approach means it adjusts for Neurocrine’s standout profitability and growth potential in a way other metrics do not.

Comparing the Fair Ratio of 24.29x to the current PE of 39x, Neurocrine is trading well above what would be considered fair on this basis, signaling the stock is likely overvalued based on these fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Neurocrine Biosciences Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. In simple terms, a Narrative is your story behind the numbers, an investor’s unique perspective about why a company is likely to succeed or face challenges, reflected in their assumptions for future revenue, earnings, margins, and ultimately, fair value.

With Narratives, you connect Neurocrine Biosciences’s story, whether it's their drug launches, risk factors, or market shifts, to a data-driven financial model that estimates what the company should be worth. This approach is not only more personalized and transparent, but also instantly accessible on Simply Wall St’s Community page, where millions of investors share, discuss, and update their views.

Narratives empower you to make informed buy or sell decisions by clearly showing whether your fair value forecast is above or below the current market price. The best part is that Narratives are dynamic. They update as soon as fresh news or earnings reports come in, keeping your analysis relevant without extra effort.

For example, one investor may believe Neurocrine will achieve a future PE of 40x on 17% revenue growth, leading to a fair value of $244.80 per share, while another sees industry risks capping fair value near $168.25 based on more cautious profit and growth assumptions.

By choosing your Narrative, you move beyond static ratios and start investing with context, clarity, and confidence.

Do you think there's more to the story for Neurocrine Biosciences? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.