Please use a PC Browser to access Register-Tadawul

What UnitedHealth Group (UNH)'s Dividend Reaffirmation and Raised Earnings Outlook Mean for Shareholders

UnitedHealth Group Incorporated UNH | 286.93 | -1.83% |

- Earlier this month, UnitedHealth Group's board approved a bylaw amendment changing its registered office and agent in Delaware, while also filing a US$222.29 million shelf registration for 655,608 common shares linked to its employee stock ownership plan.

- The board also reaffirmed a quarterly dividend and management raised 2025 earnings guidance, boosting optimism despite ongoing regulatory investigations and recent portfolio adjustments by major investors.

- We'll explore how reaffirmed earnings guidance and strong premium growth shape the outlook for UnitedHealth Group within its updated investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

UnitedHealth Group Investment Narrative Recap

To be confident as a UnitedHealth Group shareholder right now, you need to believe that the company can successfully manage ongoing regulatory scrutiny and adapt to recent Medicare changes, while sustaining premium growth and delivering on its raised earnings guidance. The recent bylaw changes and the large ESOP-linked shelf registration do not materially impact the main short-term catalyst, management’s reaffirmed and raised earnings guidance, or the most pressing risk, which remains the Department of Justice investigation into Medicare billing practices.

Among recent announcements, the reaffirmation of the quarterly dividend stands out as a signal of financial stability at a time when investor focus is fixed on earnings momentum and regulatory risks. This move is particularly relevant for those watching the company’s commitment to shareholder returns as it navigates the uncertainties created by policy changes and compliance concerns in its Medicare business.

By contrast, investors should be aware that regulatory investigations tied to Medicare billing practices could still result in...

UnitedHealth Group's outlook anticipates $501.1 billion in revenue and $20.0 billion in earnings by 2028. This is based on a projected 5.8% annual revenue growth, but a decrease in earnings of $1.3 billion from the current $21.3 billion.

Uncover how UnitedHealth Group's forecasts yield a $385.40 fair value, a 20% upside to its current price.

Exploring Other Perspectives

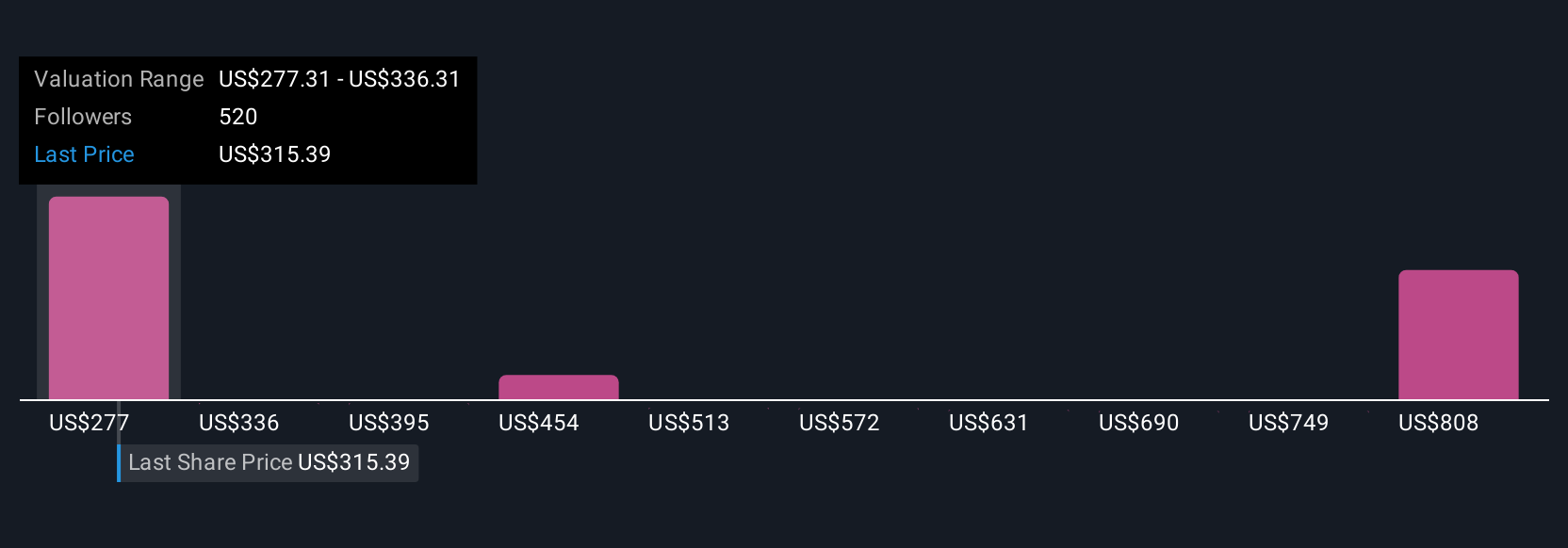

Private investors in the Simply Wall St Community offered 86 different fair value estimates for UnitedHealth, ranging from US$290 to as high as US$847. Even with this range in mind, ongoing regulatory risks remain a key variable affecting the company’s long-term performance. Consider how your own view compares and explore other perspectives in the Community.

Explore 86 other fair value estimates on UnitedHealth Group - why the stock might be worth over 2x more than the current price!

Build Your Own UnitedHealth Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UnitedHealth Group research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free UnitedHealth Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UnitedHealth Group's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.