Please use a PC Browser to access Register-Tadawul

What Waystar Holding (WAY)'s Swing to Profit and Raised Guidance Means For Shareholders

Waystar Holding Corp. WAY | 32.65 32.65 | +0.59% 0.00% Pre |

- Waystar Holding Corp. reported second-quarter earnings in the past, turning last year's net loss into a net income of US$32.18 million, with sales rising to US$270.65 million and improved earnings per share.

- In addition to reporting a stronger financial position, the company issued new full-year revenue guidance, signaling management's confidence in continued operational performance.

- We'll explore how these improved results and forward-looking guidance contribute to Waystar's broader investment narrative and outlook.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Waystar Holding Investment Narrative Recap

To own shares of Waystar Holding, an investor needs to believe in the company's ability to capitalize on growing demand for advanced, AI-powered revenue cycle management solutions among healthcare providers. The recent shift from net loss to net income and boosted full-year revenue guidance highlight near-term operating strength, but do not materially change the biggest short-term catalyst, the integration of the Iodine Software acquisition and realization of anticipated cost synergies. The main risk remains around successfully managing increased leverage if revenue momentum slows, which could strain net margins and earnings growth.

The company's July revenue guidance update, forecasting US$1.030 billion to US$1.042 billion for 2025, is especially relevant here. The raised outlook directly relates to market optimism about Waystar's ability to cross-sell new solutions and accelerate profitable growth, which would help offset financial risks tied to the Iodine acquisition. Still, for investors, there is a clear need to balance confidence in improved guidance with careful attention to debt and integration challenges.

However, investors should also be aware that if cost synergies and cross-sell benefits from the Iodine Software acquisition take longer to materialize than expected...

Waystar Holding's narrative projects $1.3 billion in revenue and $248.3 million in earnings by 2028. This requires 9.3% yearly revenue growth and an increase in earnings of about $162 million from the current $85.9 million.

Uncover how Waystar Holding's forecasts yield a $50.38 fair value, a 46% upside to its current price.

Exploring Other Perspectives

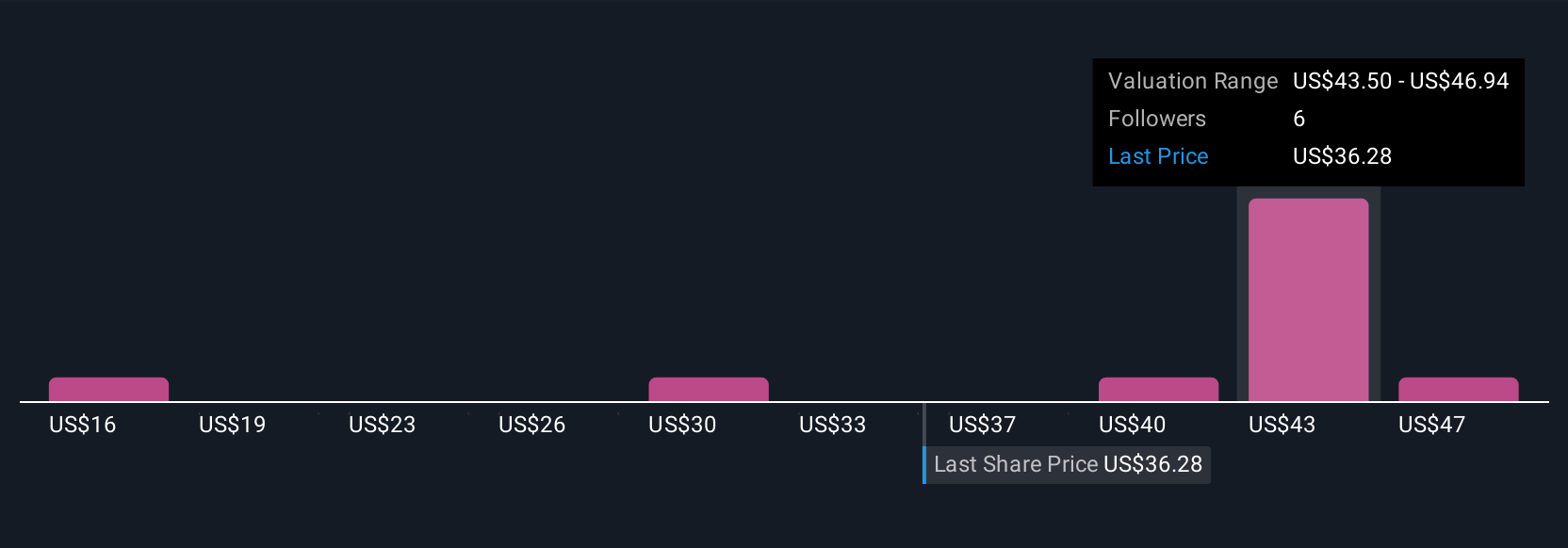

Simply Wall St Community members offered five fair value opinions for Waystar ranging from US$15.96 to US$50.38 per share. While some expect faster earnings growth to ease leverage risks, these differences highlight why you should explore a variety of views.

Explore 5 other fair value estimates on Waystar Holding - why the stock might be worth less than half the current price!

Build Your Own Waystar Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Waystar Holding research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Waystar Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Waystar Holding's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.