Please use a PC Browser to access Register-Tadawul

Wheels Up Experience (UP) Files for US$50 Million Equity Offering

Wheels Up Experience Inc. Class A Common Stock UP | 0.68 | -3.30% |

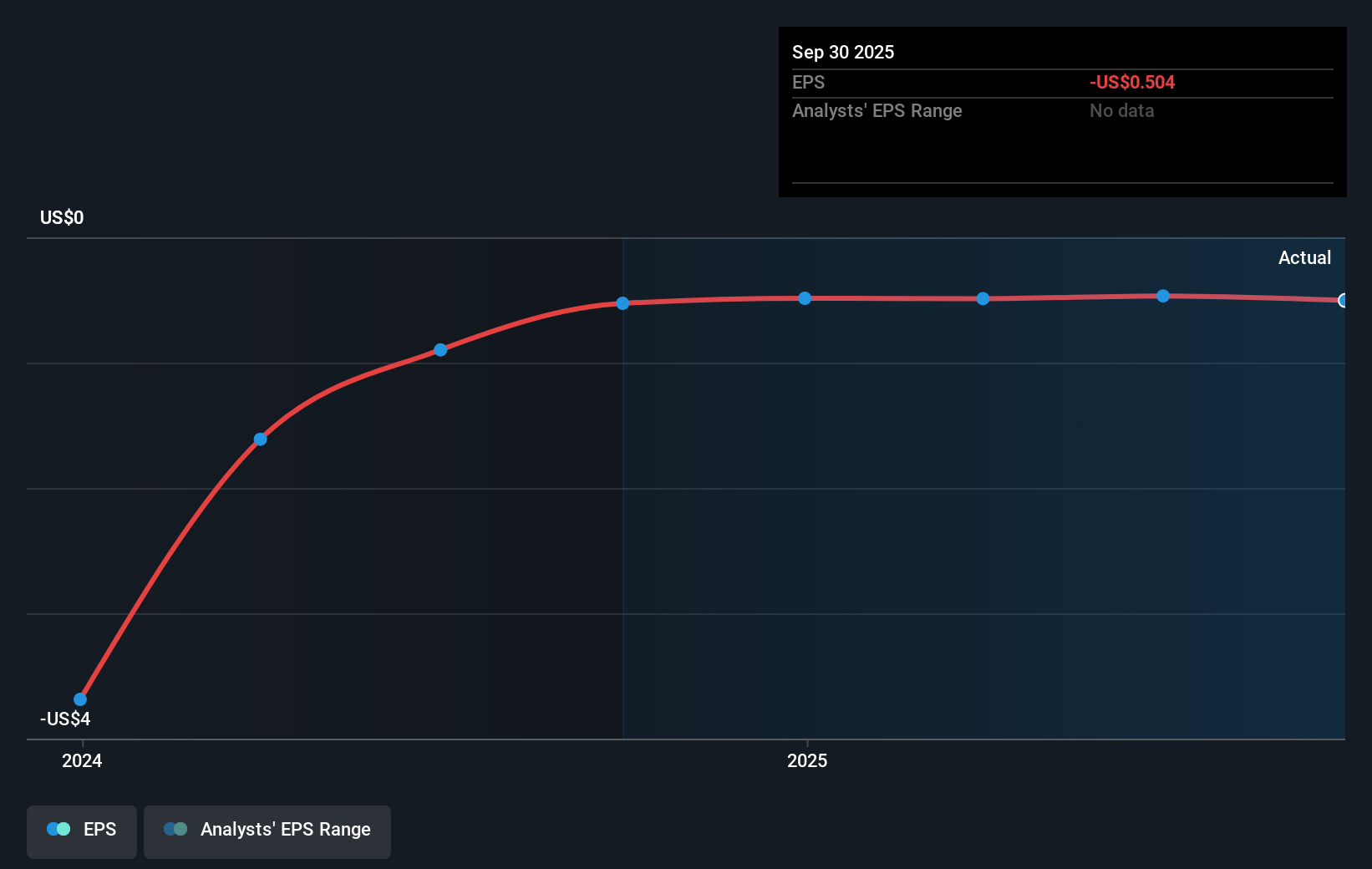

Wheels Up Experience (UP) recently filed for a follow-on equity offering to raise $50 million, an action that may have lent support to its 62% share price gain over the last quarter. This move positions the company for bolstered liquidity and potential growth opportunities. Additionally, UP reported narrower net losses in Q2, signaling some improvement in financials. These efforts to enhance company positioning stand amidst broader market fluctuations, with the Nasdaq posting record highs and the S&P 500 achieving gains. Though the market also experienced gains, Wheels Up's initiatives likely helped it achieve a more pronounced return.

Over the past year, Wheels Up Experience Inc. experienced a 0.92% decline in total shareholder returns, considering both share price and dividends. This return underscores the challenges it faces, particularly when contrasted with the US Airlines industry which saw a substantial 54.8% return and the broader US market with a 19.1% gain over the same period.

The company's latest initiatives, including the follow-on equity offering, may influence future revenue and earnings forecasts. The US$50 million raised could improve liquidity, possibly funding growth opportunities that enhance future financial performance. However, these improvements might not yet align the company's performance with analysts' expectations due to insufficient data on expected revenue growth. Additionally, the current share price of US$2.16 lacks a corresponding consensus analyst price target, creating uncertainty in the valuation context. Despite a recent quarterly increase in share price, it remains to be seen how these efforts will translate into long-term competitive positioning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.