Please use a PC Browser to access Register-Tadawul

Why Air Products (APD) Is Up 10.7% After Strong Q1 2026 Earnings And NASA Hydrogen Deals

Air Products and Chemicals, Inc. APD | 281.18 | +0.16% |

- Air Products and Chemicals recently reported first-quarter fiscal 2026 results, with sales of US$3,102.5 million and net income of US$678.2 million, both higher than a year earlier, and reaffirmed its full-year adjusted EPS guidance.

- An interesting angle for investors is Air Products’ more than US$140 million NASA liquid hydrogen supply contracts, which highlight the company’s role in space-related hydrogen infrastructure alongside its broader clean hydrogen ambitions.

- With this backdrop and management’s emphasis on capital discipline, we’ll explore how the strong earnings performance shapes Air Products’ investment narrative.

Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

What Is Air Products and Chemicals' Investment Narrative?

To own Air Products and Chemicals, you really have to believe in its core industrial gases franchise and its ambition to be a key player in clean hydrogen, while accepting a premium valuation and some project risk. The latest quarter’s higher sales and earnings, along with reaffirmed EPS guidance and a 44th consecutive dividend increase, help support that case, but do not fully resolve concerns around past earnings volatility, leverage and an uncovered dividend. The new US$140 million NASA liquid hydrogen contracts fit neatly into the hydrogen narrative and underline Air Products’ role in space-related infrastructure, yet they are small relative to more than US$12 billion in annual sales, so they are unlikely to be a major near term financial catalyst. For now, the bigger swing factors still look to be execution on large hydrogen projects, capex discipline and the path back to consistent profitability.

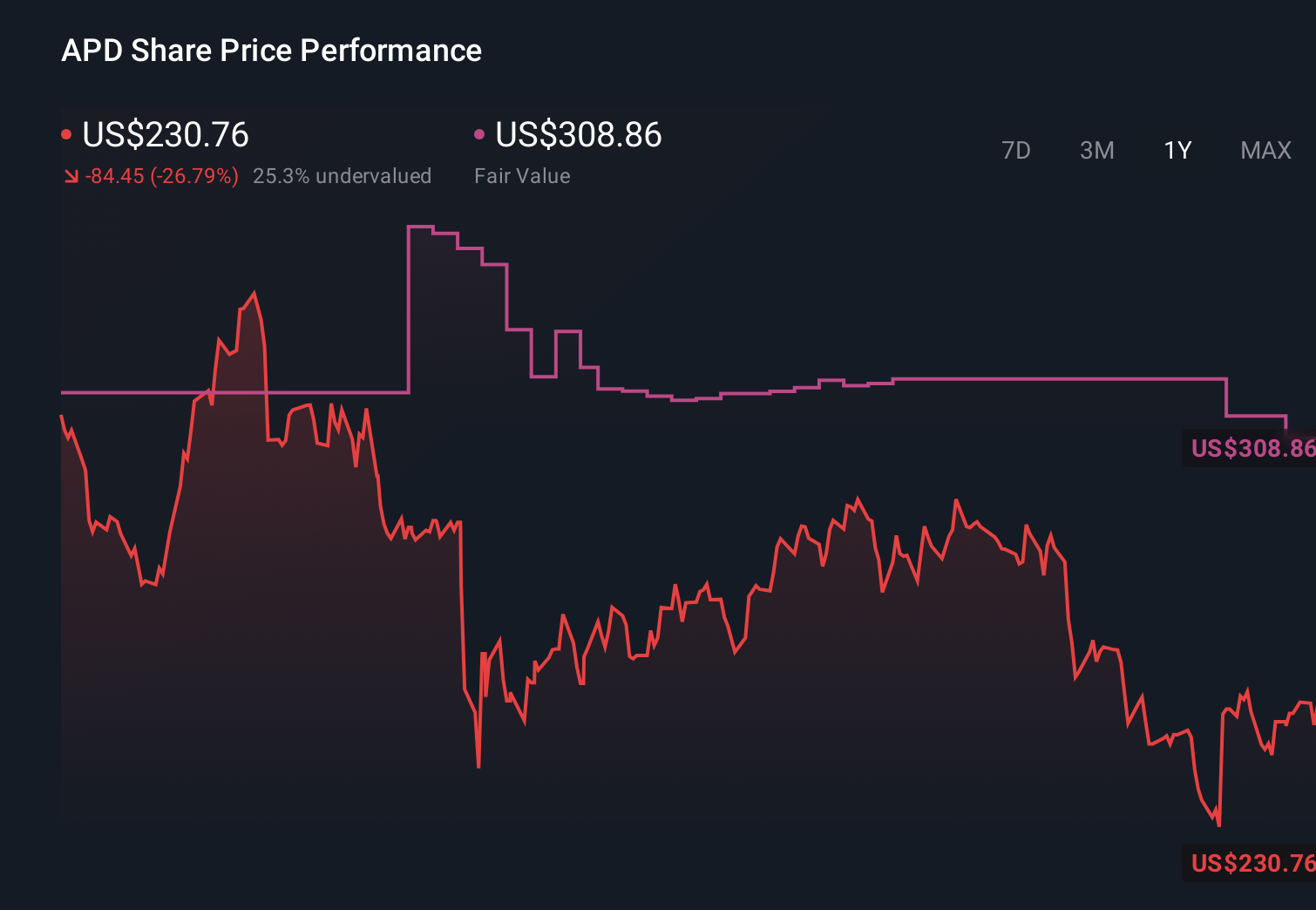

However, the premium pricing and uneven profitability are not risks to ignore. Air Products and Chemicals' shares are on the way up, but they could be overextended by 7%. Uncover the fair value now.Exploring Other Perspectives

Simply Wall St Community members’ fair value estimates run from about US$263.94 to US$300.43 across 2 views, underscoring how differently people are weighing Air Products’ premium pricing, large project exposure and the implications of its capital discipline story for future performance.

Explore 2 other fair value estimates on Air Products and Chemicals - why the stock might be worth 7% less than the current price!

Build Your Own Air Products and Chemicals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air Products and Chemicals research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Air Products and Chemicals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air Products and Chemicals' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Capitalize on the AI infrastructure supercycle with our selection of the 33 best 'picks and shovels' of the AI gold rush converting record-breaking demand into massive cash flow.

- The future of work is here. Discover the 28 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

- Uncover the next big thing with 25 elite penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.