Please use a PC Browser to access Register-Tadawul

Why Atlantic Union Bankshares (AUB) Is Up 5.9% After Stronger 2025 Results And Steady Dividends

Atlantic Union Bankshares Corporation AUB | 40.65 | +1.83% |

- Atlantic Union Bankshares recently reported stronger fourth-quarter and full-year 2025 results, highlighted by higher net interest income and net income, sharply lower net charge-offs, and the Board’s decision to maintain a quarterly common dividend of US$0.37 per share while declaring the regular Series A preferred dividend.

- Alongside these results, the company issued 2026 net interest income guidance and reiterated its growth and acquisition plans, signaling how management is aligning balance sheet quality, expansion initiatives, and shareholder returns.

- Against this backdrop, we’ll explore how the stronger asset quality trends could reshape Atlantic Union Bankshares’ investment narrative for investors.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Atlantic Union Bankshares' Investment Narrative?

For Atlantic Union Bankshares, the core thesis now rests on whether you’re comfortable with a regional bank leaning into growth while keeping a tight grip on credit quality and capital. The Q4 2025 results and 2026 net interest income guidance frame a story of scale and integration after recent acquisitions, with materially lower net charge-offs hinting that the spike in problem loans last quarter was tied to a handful of specific credits rather than a broad deterioration. The Board’s decision to maintain the US$0.37 common dividend and continue paying the Series A preferred dividend reinforces management’s confidence, but it also puts more focus on execution risk around deposit costs, commercial real estate exposure, and further M&A. Recent share price gains suggest the market is starting to price in that improvement, so any slip in asset quality or earnings delivery could quickly become a key near term catalyst.

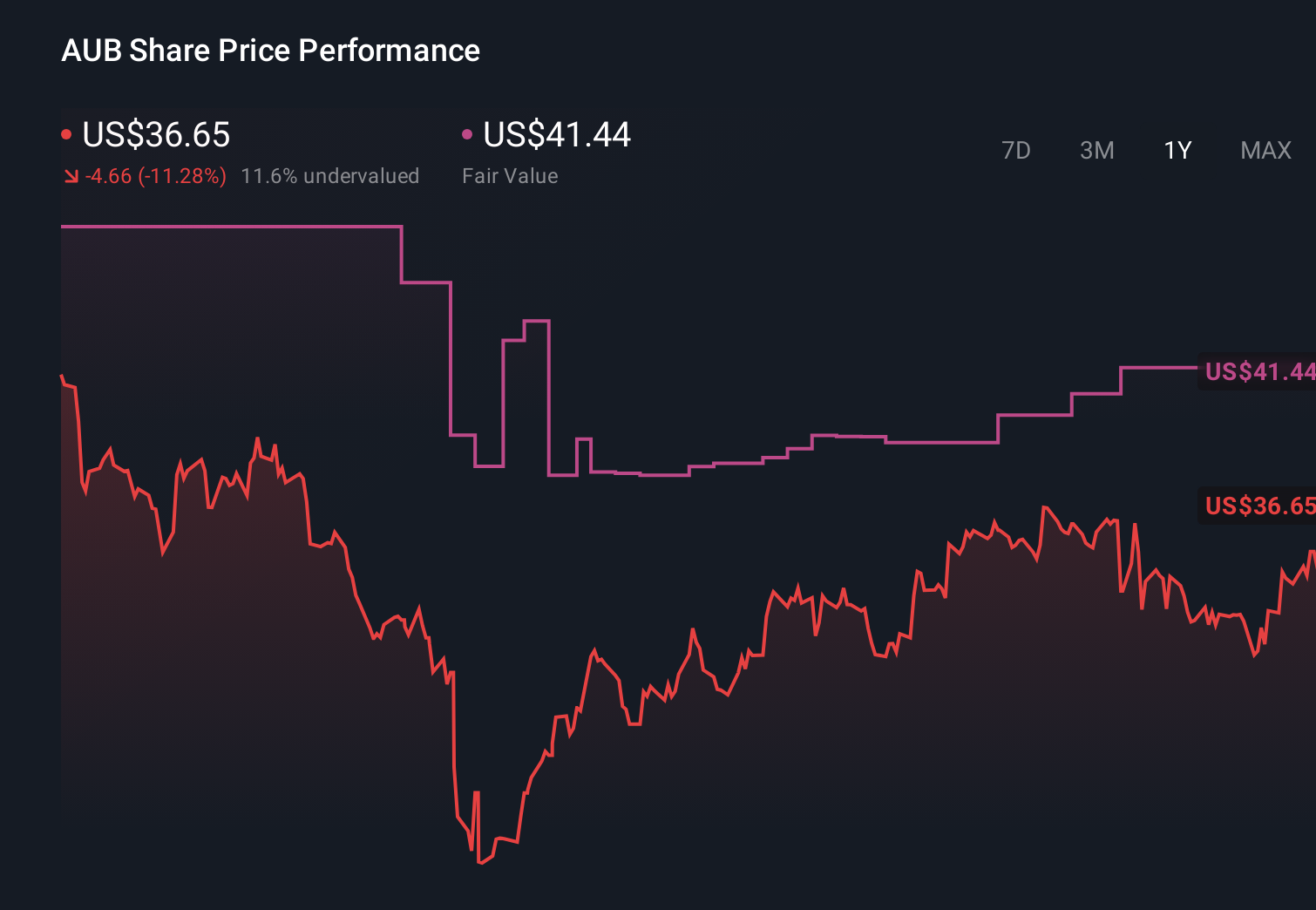

However, the reliance on cleaner credit trends may not fully reflect potential future loan losses investors should be aware of. Atlantic Union Bankshares' shares have been on the rise but are still potentially undervalued by 29%. Find out what it's worth.Exploring Other Perspectives

Three Simply Wall St Community fair value views span roughly US$30 to almost US$58, underscoring how differently investors see Atlantic Union’s earnings power. Set against the recent jump in net interest income and sharply lower net charge-offs, this spread invites you to weigh balance sheet quality and acquisition execution before deciding where you stand.

Explore 3 other fair value estimates on Atlantic Union Bankshares - why the stock might be worth as much as 40% more than the current price!

Build Your Own Atlantic Union Bankshares Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atlantic Union Bankshares research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Atlantic Union Bankshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atlantic Union Bankshares' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 107 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.