Please use a PC Browser to access Register-Tadawul

Why ATRenew (RERE) Is Up 16.3% After Posting First Profitable Half-Year and Strong Revenue Outlook

AiHuiShou International Co. Ltd. RERE | 5.41 | +2.85% |

- ATRenew Inc. reported a strong turnaround for the second quarter and first half of 2025, moving from a net loss to net income of CN¥72.34 million and CN¥115.14 million, respectively, and issued revenue guidance projecting 24.7% to 27.1% year-over-year growth for the next quarter.

- This marks the company's first profitable half-year period, highlighting a significant improvement in operational performance and management outlook.

- We’ll explore how ATRenew’s move to profitability could reshape its investment narrative rooted in digitalization and growth in China’s recycling sector.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

ATRenew Investment Narrative Recap

To be a shareholder in ATRenew right now, you need to believe in the company's ability to continually expand digital recycling in China, driven by government policies and increasing consumer participation. The latest profitable results and strong revenue guidance may help reinforce confidence in this growth narrative and serve as a short-term catalyst, but the biggest immediate risk still centers on sustainability of government subsidies and the company’s ability to keep operating costs in check; this news does not materially reduce those concerns.

Of ATRenew’s recent announcements, the new Q3 2025 revenue guidance, forecasting year-over-year growth of 24.7% to 27.1%, is directly relevant, as it shows the company expects growth to continue at a substantial pace. This projection aligns with digital adoption trends and consumer trade-in behavior, underlining short-term momentum while keeping the spotlight on whether these gains can outpace increasing expenses.

But for investors, it’s equally important to understand how much ATRenew’s results rely on ongoing subsidies and whether a change in government support could…

ATRenew's narrative projects CN¥32.0 billion in revenue and CN¥1.1 billion in earnings by 2028. This requires 22.7% yearly revenue growth and a CN¥972.6 million earnings increase from current earnings of CN¥127.4 million.

Uncover how ATRenew's forecasts yield a $5.00 fair value, a 8% upside to its current price.

Exploring Other Perspectives

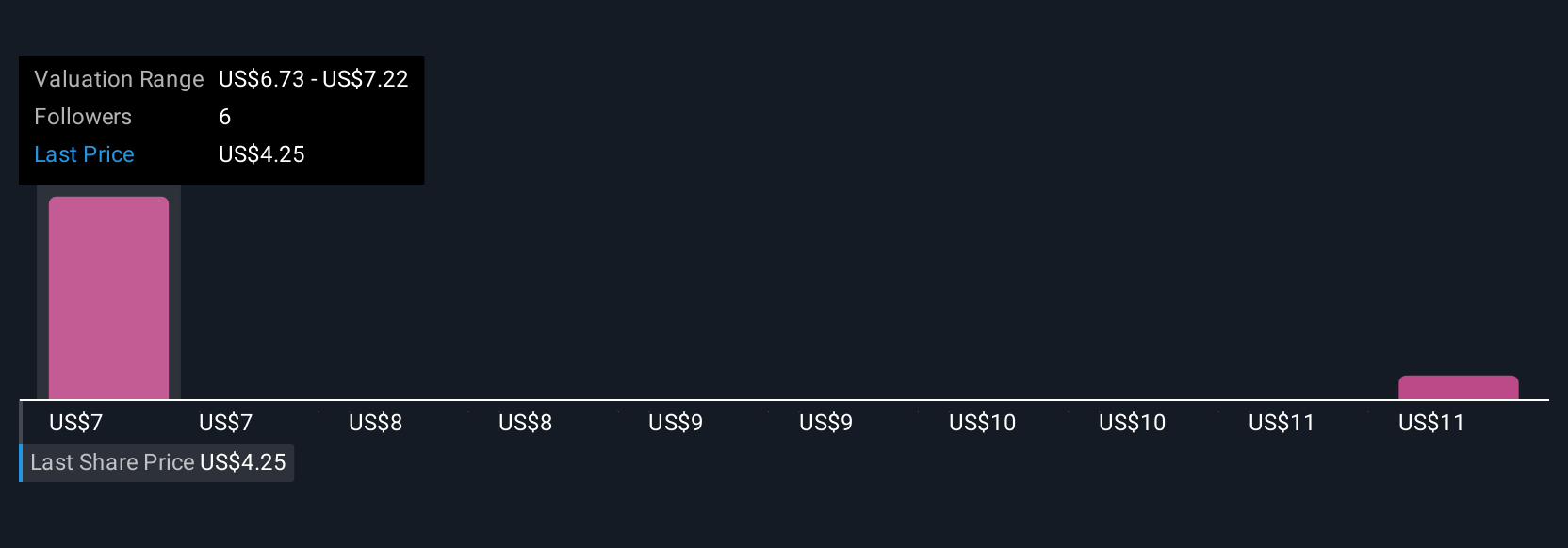

Three fair value estimates from the Simply Wall St Community span from CN¥4.999792 to CN¥11.64, highlighting broad divergence in sentiment about ATRenew’s outlook. With recent strong earnings, ongoing expansion, and policy reliance still present, you can see why opinions vary, review these community perspectives for alternative takes on future performance.

Explore 3 other fair value estimates on ATRenew - why the stock might be worth over 2x more than the current price!

Build Your Own ATRenew Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ATRenew research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ATRenew research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ATRenew's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.