Please use a PC Browser to access Register-Tadawul

Why Avidity Biosciences (RNA) Is Up 7.4% After FDA Breakthrough Status for Duchenne Drug and What's Next

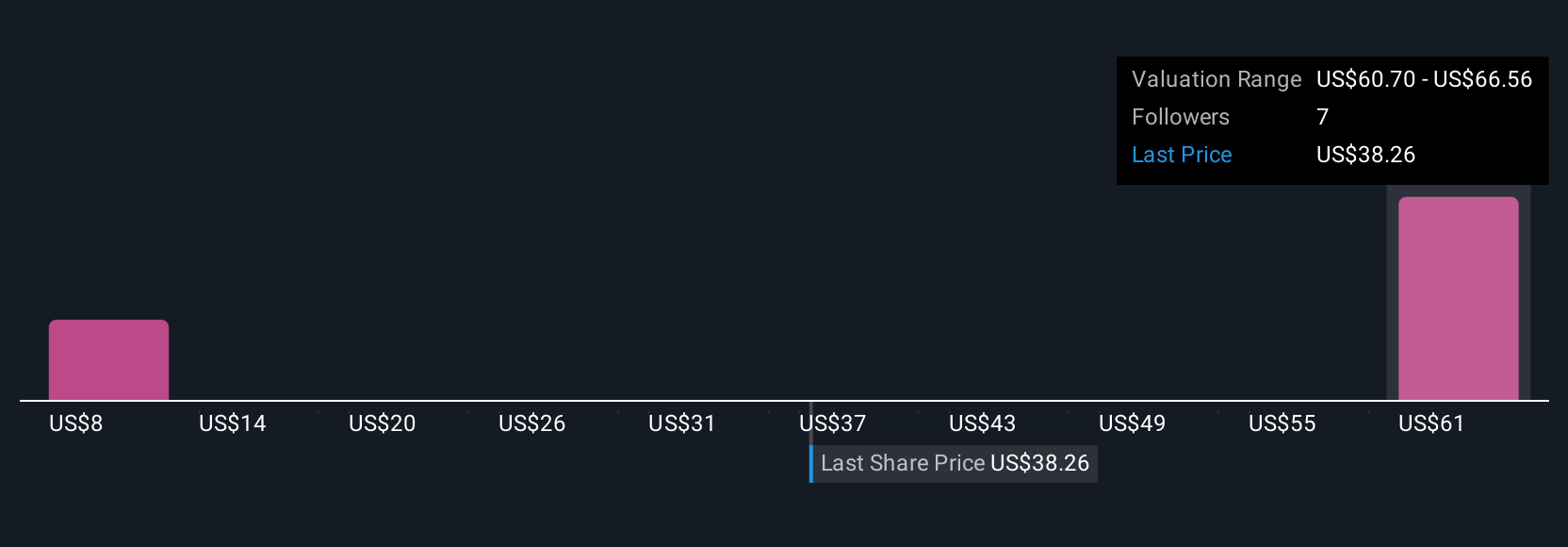

Avidity Biosciences RNA | 71.83 | +0.32% |

- On July 23, 2025, Avidity Biosciences announced that the FDA granted Breakthrough Therapy designation to its investigational drug delpacibart zotadirsen (del-zota) for Duchenne muscular dystrophy patients with exon 44 skipping mutations, following positive phase 1/2 results and full enrollment in the ongoing phase 2 trial.

- This regulatory milestone signals that del-zota has shown substantial clinical benefit in early trials, heightening industry anticipation for upcoming phase 2 data and a potential U.S. launch.

- With FDA Breakthrough Therapy status accelerating clinical development, we'll explore how regulatory momentum reshapes Avidity's investment narrative.

What Is Avidity Biosciences' Investment Narrative?

To be a shareholder in Avidity Biosciences right now, the big idea you need to buy into is the company’s ability to translate exciting early clinical results, especially from its RNA-based therapies for rare muscular diseases, into eventual regulatory and commercial success. The recent FDA Breakthrough Therapy designation for del-zota in Duchenne muscular dystrophy (DMD44) adds momentum to the story, strengthening a key short-term catalyst: the expected pivotal phase 2 data late this year. This increases the focus on regulatory milestones and the runway to a potential US launch, while also bringing market attention to Avidity’s platform and pipeline. At the same time, rising R&D spending has pushed losses higher and, with no profitability expected soon, financial risk remains a major consideration. The Breakthrough Therapy news may shift risk perceptions slightly, but ultimate value still hangs on future clinical and regulatory outcomes.

However, never discount the risk that clinical results may not translate to regulatory approval.

Exploring Other Perspectives

Build Your Own Avidity Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avidity Biosciences research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Avidity Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avidity Biosciences' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.