Please use a PC Browser to access Register-Tadawul

Why Bausch Health (BHC) Is Up 9.0% After $900 Million Debt Reduction and What It Means for Investors

Bausch Health Companies Inc. Common Stock BHC | 6.93 | +0.29% |

- Bausch Health Companies recently initiated a significant debt reduction effort, announcing the redemption of approximately US$602 million in 9.25% Senior Notes due 2026 and the full repayment of its US$300 million receivables facility, with actions scheduled for August and October 2025.

- This move highlights Bausch Health’s focus on strengthening its financial position and optimizing its capital structure, using cash on hand to lessen interest obligations.

- We'll look at how the decision to reduce debt and terminate financing agreements could reshape Bausch Health's investment narrative.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Bausch Health Companies Investment Narrative Recap

To be a shareholder in Bausch Health Companies, an investor needs to believe in the company’s ability to stabilize finances and improve operating performance, especially as it addresses its high debt burden and focuses on key product lines. The recent announcement of a US$900 million debt reduction effort reinforces management’s commitment to lowering interest expenses and improving financial flexibility, which could support the most important short-term catalyst: progress toward profitability. While this move mitigates some refinancing risk, the company’s dependence on a few major products remains a significant challenge.

One recent announcement closely tied to this news is the successful US$7.9 billion refinancing, which extended debt maturities and provided more time for operational improvement. Coupled with the new debt repayments, these measures further support the strategy of optimizing the capital structure, reducing pressure from interest costs, and helping to sustain investment in growth initiatives. For investors, monitoring how these financial actions buffer the core business against revenue headwinds is increasingly important as management executes its plans.

In contrast, investors should be aware that even with extensive debt reductions, product concentration risk could still affect future results if...

Bausch Health Companies is projected to reach $10.3 billion in revenue and $1.4 billion in earnings by 2028. This outlook assumes a 1.8% annual revenue growth rate and a $1.44 billion increase in earnings from current earnings of -$40.0 million.

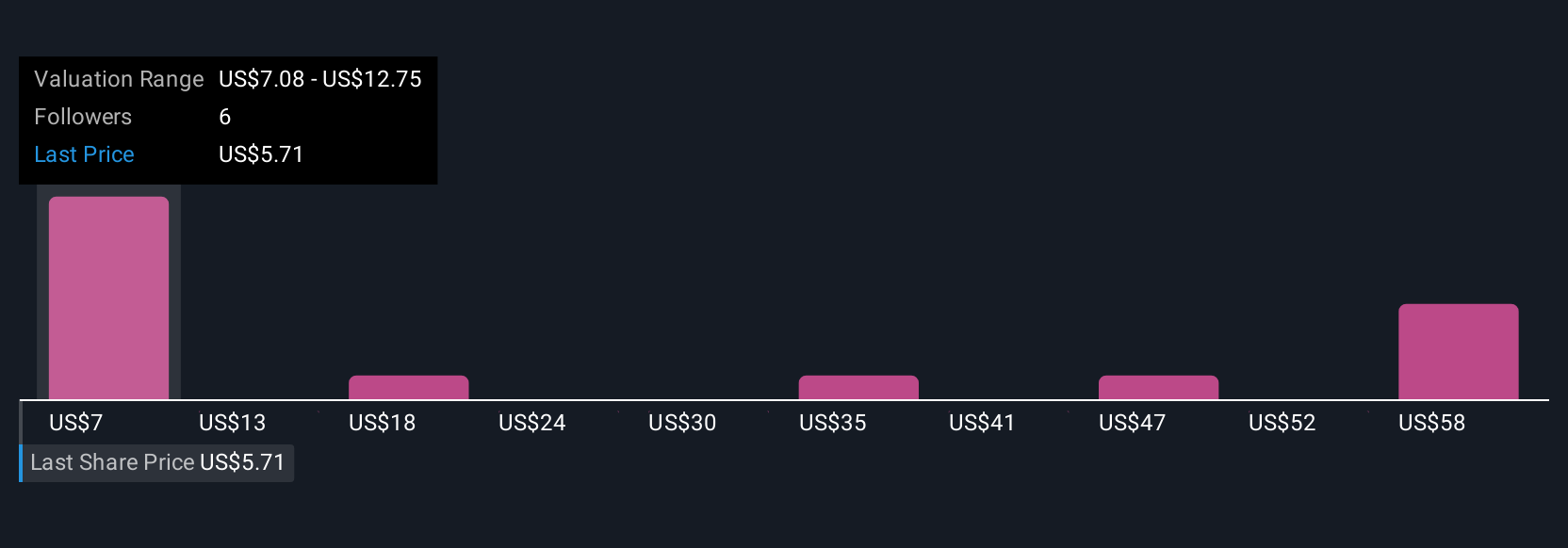

Uncover how Bausch Health Companies' forecasts yield a $7.08 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community fair value estimates for Bausch Health Companies range from US$7.08 to US$63.80 per share. As you review these broad perspectives, remember that the company’s recent focus on cash-funded debt reduction could influence its ability to manage product-specific revenue risks going forward.

Explore 4 other fair value estimates on Bausch Health Companies - why the stock might be worth over 9x more than the current price!

Build Your Own Bausch Health Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bausch Health Companies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bausch Health Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bausch Health Companies' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.