Please use a PC Browser to access Register-Tadawul

Why Bitdeer Technologies Group (BTDR) Is Up 35.1% After Strong Bitcoin Output and AI Data Center Launch

Bitdeer Technologies Group Class A BTDR | 7.78 | -2.02% |

- Earlier this month, Bitdeer Technologies Group announced unaudited operating results for September 2025, reporting a 20.5% increase in self-mined Bitcoin to 452 BTC thanks to higher average hashrate from the energization of SEALMINERs.

- This operational update coincided with Bitdeer's expansion into AI data centers, highlighting the company's accelerating push toward high-performance computing and diversification into new growth markets.

- We'll now explore how the boost in mining output and AI infrastructure expansion could reshape Bitdeer's longer-term investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Bitdeer Technologies Group Investment Narrative Recap

To be a shareholder in Bitdeer Technologies Group, you need to believe in the company’s ability to use proprietary ASIC development and diversified infrastructure to capture growth in both Bitcoin mining and high-performance AI computing. The recent news of a 20.5% jump in mined Bitcoin provides an immediate boost to output and may give momentum to the company’s most important short-term catalyst, the ramp-up in self-mining capacity. However, it does not remove key risks tied to high operating expenses and ongoing net losses.

Most relevant to this event, Bitdeer’s announcement that all 570 MW of electrical capacity at its Clarington, Ohio site will be available by late 2026 strengthens the pathway to scaling both mining and AI data center operations. The operational readiness of this site is directly connected to the catalyst of reaching higher hashrate levels and, potentially, new revenue from AI computing.

In contrast, shareholders should remain alert to the persistent risk of negative earnings and the impact of high operating expenses on margin stability if revenue growth fails to keep pace...

Bitdeer Technologies Group's narrative projects $1.8 billion revenue and $343.9 million earnings by 2028. This requires 71.6% yearly revenue growth and a $664.2 million increase in earnings from current earnings of $-320.3 million.

Uncover how Bitdeer Technologies Group's forecasts yield a $28.05 fair value, a 17% upside to its current price.

Exploring Other Perspectives

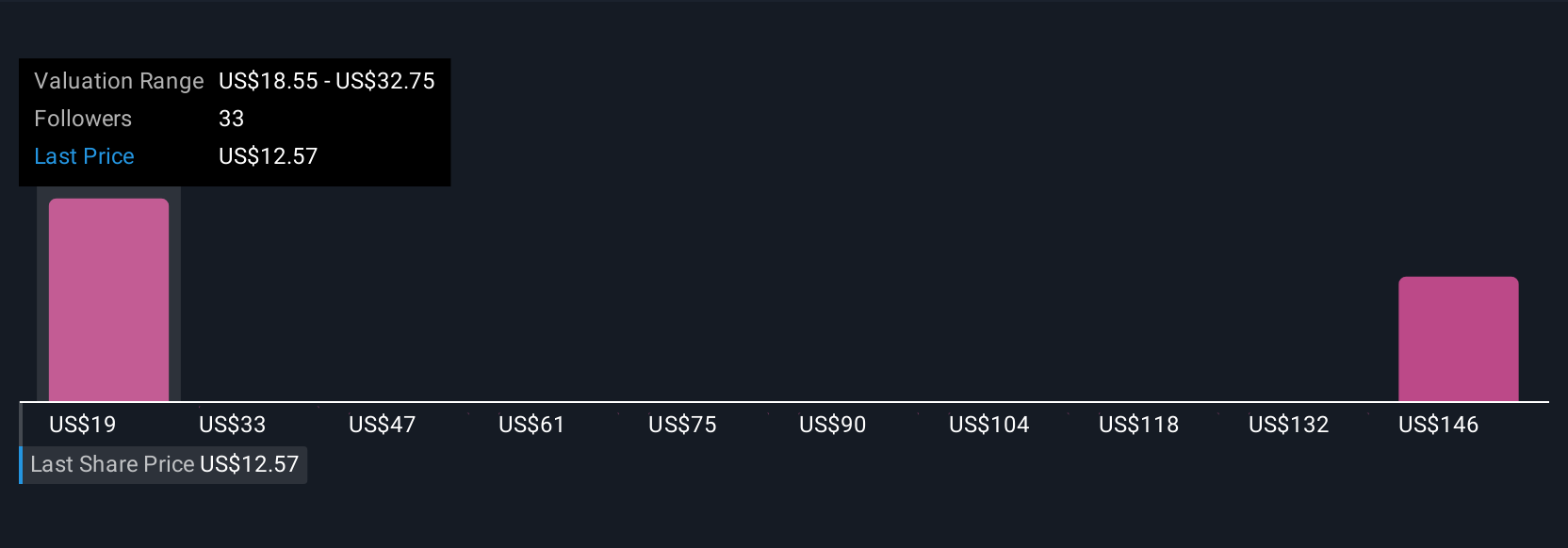

Seven fair value estimates from the Simply Wall St Community range from US$18.55 to US$179.52 per share. Many see opportunity in proprietary ASIC technology, but opinions differ on whether anticipated revenue and margin improvements will outweigh ongoing net losses.

Explore 7 other fair value estimates on Bitdeer Technologies Group - why the stock might be worth 23% less than the current price!

Build Your Own Bitdeer Technologies Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bitdeer Technologies Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bitdeer Technologies Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bitdeer Technologies Group's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.