Please use a PC Browser to access Register-Tadawul

Why Buckle (BKE) Is Up on Strong Same-Store Sales and What It Means for Future Growth

Buckle, Inc. BKE | 57.05 | +0.28% |

- The Buckle, Inc. announced that for the 5- and 35-week periods ended October 4, 2025, comparable store net sales rose by 6.9% and 6.5% respectively, with total sales reaching US$108.4 million for the recent month and US$805.5 million for the year-to-date.

- This sustained sales momentum points to ongoing strength in Buckle's core customer base and effective merchandising strategies.

- We'll assess how Buckle's latest surge in comparable store sales may strengthen its investment narrative and future growth outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Buckle Investment Narrative Recap

Buckle shareholders generally look for consistent sales growth, strong customer loyalty, and resilient earnings to support the investment story. While the company’s latest comparable store sales increase affirms its core strengths, it does not immediately resolve the major near-term risk posed by ongoing dependence on mall traffic and high occupancy costs. However, the ability to sustain positive sales trends may help reinforce confidence if consumer preferences remain stable.

The recent announcement of a partnership with country music artist Lanie Gardner is especially relevant, as it reflects Buckle's ongoing efforts to connect with its target audience and maintain brand momentum. Aligning with trending personalities and events is one way Buckle could supplement its in-store performance, complementing the catalysts driving wider recognition and customer engagement.

Yet, despite these encouraging signs, there remains a risk that Buckle's reliance on traditional mall locations could...

Buckle's outlook anticipates $1.4 billion in revenue and $226.1 million in earnings by 2028. This is based on a 4.0% annual revenue growth rate and a $24.5 million increase in earnings from $201.6 million currently.

Uncover how Buckle's forecasts yield a $54.00 fair value, in line with its current price.

Exploring Other Perspectives

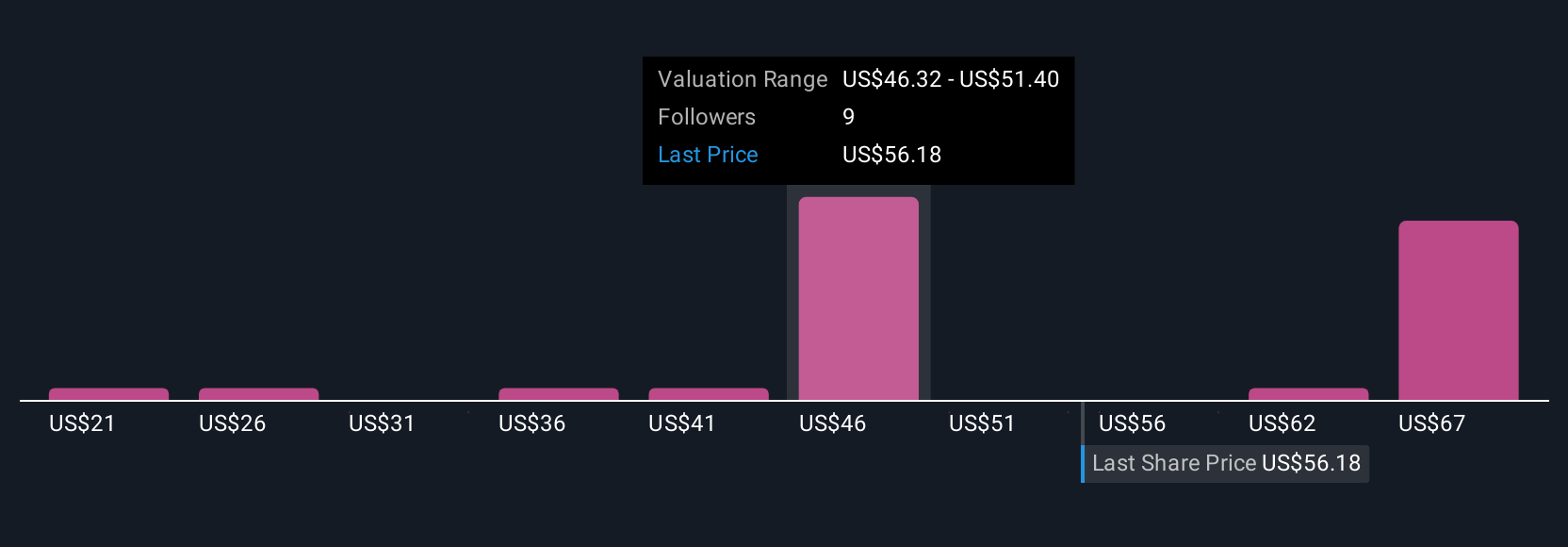

Simply Wall St Community members provided nine distinct fair value estimates for Buckle shares, spanning from US$20.90 to US$77.67. With this breadth of opinion, consider that ongoing store traffic and occupancy costs continue to shape Buckle’s financial resilience.

Explore 9 other fair value estimates on Buckle - why the stock might be worth less than half the current price!

Build Your Own Buckle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Buckle research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Buckle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Buckle's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.