Please use a PC Browser to access Register-Tadawul

Why Canaan (CAN) Secured a Record U.S. Order and Texas Deal for Next-Gen Bitcoin Mining

Canaan Inc. CAN | 0.79 | -3.82% |

- Earlier this month, Canaan Inc. secured its largest order in three years for over 50,000 Avalon A15 Pro miners from a leading U.S. bitcoin miner and, together with Soluna Holdings, announced an agreement to deploy 20 megawatts of Avalon A15 XP miners at a renewable-powered site in Texas, with deployment expected in the first quarter of 2026.

- These milestones signal strong institutional demand for Canaan’s next-generation hardware and emphasize the company’s push into sustainable, large-scale North American mining infrastructure.

- We'll examine how the record-breaking U.S. purchase order and Texas deployment agreement influence Canaan's investment outlook and sector positioning.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Canaan Investment Narrative Recap

To be a shareholder in Canaan, you have to believe in the resilience and long-term growth potential of institutional bitcoin mining, as well as the company's ability to compete in a rapidly evolving and volatile sector. The recent record-breaking U.S. purchase order and Texas deployment agreement affirm demand for Canaan’s latest hardware and may serve as a key short term catalyst by supporting order flow; however, the business still faces the ever-present risk of revenue volatility tied to Bitcoin price cycles, which remains unaddressed by this news.

Among recent announcements, the large-scale sale of over 50,000 Avalon A15 Pro units to a leading U.S. miner is especially relevant, as it demonstrates Canaan’s traction with major industry players at a time when institutional interest is crucial to offset cyclical downturns. For investors, this order highlights both the growing adoption of next-generation mining technology and Canaan’s ability to remain competitive with its product offerings, directly aligning with the catalysts underpinning the investment case.

However, despite these positive signals, investors should also be aware of the potential impact of sudden regulatory shifts on Canaan’s ability to deliver and...

Canaan's outlook anticipates $1.2 billion in revenue and $83.1 million in earnings by 2028. This projection is based on a 52.0% annual revenue growth rate, representing a $349.1 million increase in earnings from the current level of -$266.0 million.

Uncover how Canaan's forecasts yield a $2.43 fair value, a 123% upside to its current price.

Exploring Other Perspectives

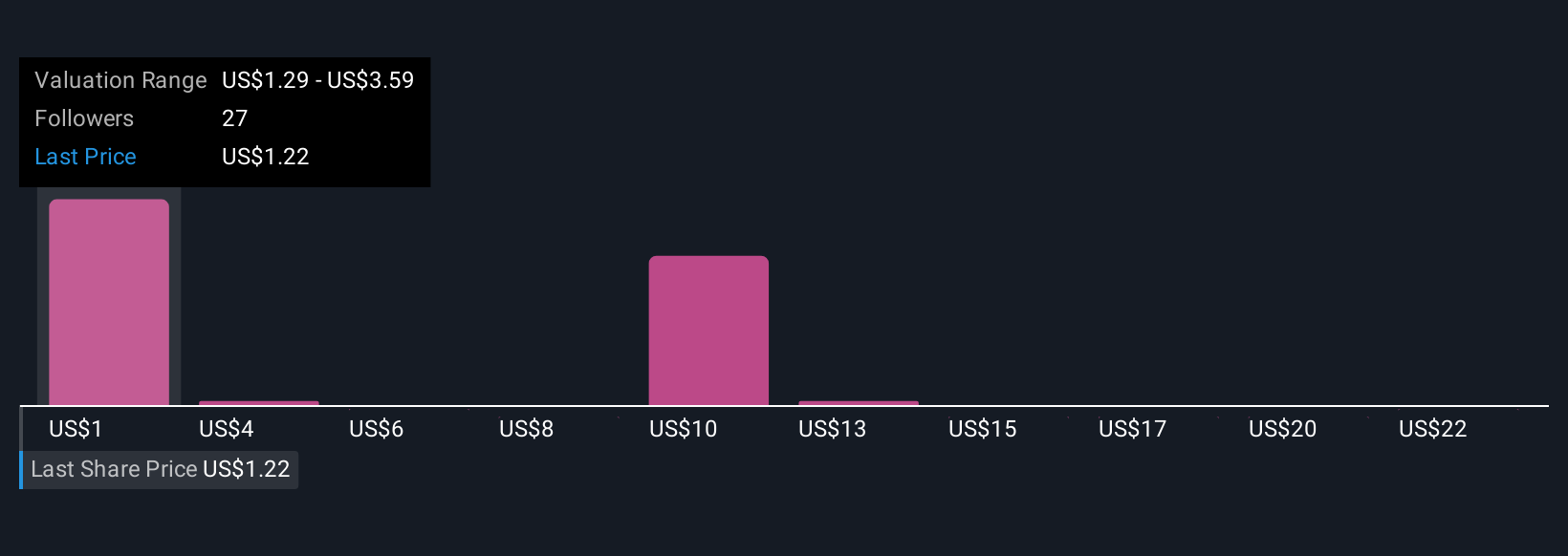

The Simply Wall St Community’s 14 fair value estimates for Canaan range from US$1.29 to US$24.26 per share, capturing a wide spread of investor expectations. While some see opportunity, ongoing volatility tied to Bitcoin prices and mining profitability remains a central issue that can shape both sentiment and outcomes for Canaan’s future performance.

Explore 14 other fair value estimates on Canaan - why the stock might be a potential multi-bagger!

Build Your Own Canaan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canaan research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Canaan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canaan's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.