Please use a PC Browser to access Register-Tadawul

Why CBL & Associates Properties (CBL) Is Up 10.9% After Strong Q3 Earnings and New Buyback Plan

CBL & Associates Properties, Inc. CBL | 38.22 | +2.14% |

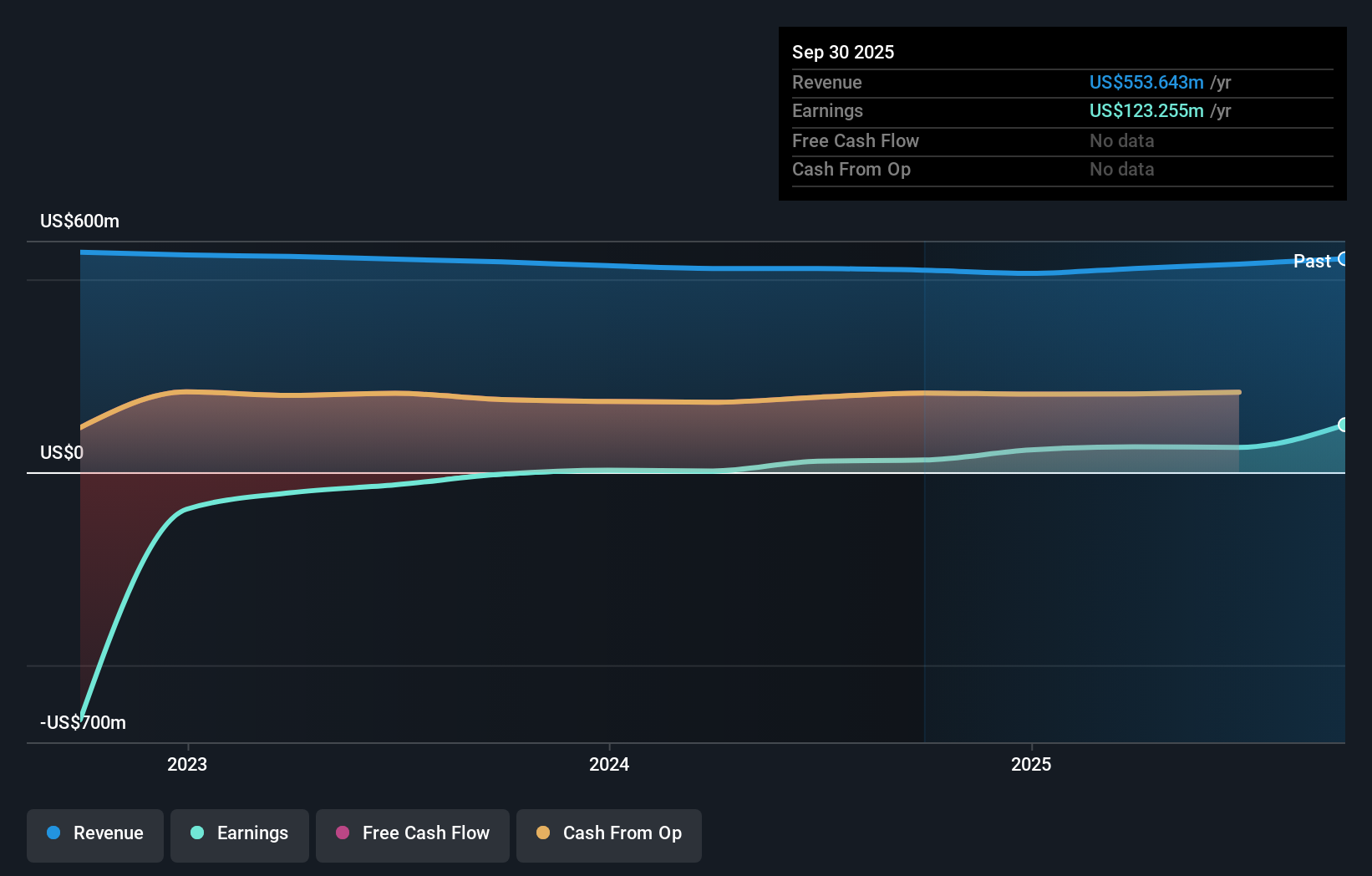

- CBL & Associates Properties reported strong third quarter 2025 results, with net income rising to US$75.43 million and the Board authorizing a new US$25 million stock repurchase program.

- The company also raised its full-year earnings guidance and highlighted successful portfolio initiatives, including new tenant openings and asset acquisitions to enhance operational performance.

- To better understand the implications for investors, we’ll explore how the new stock repurchase program reflects CBL’s focus on returning value to shareholders.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is CBL & Associates Properties' Investment Narrative?

To be a shareholder in CBL & Associates Properties today, you need to believe in the company's ability to balance ambitious portfolio growth with disciplined capital returns, especially as it ramps up asset acquisitions and re-tenanting initiatives. The jump in third quarter net income and raising of 2025 earnings guidance signal that management’s recent moves are resonating with both tenants and investors. The fresh US$25 million buyback program and steady dividend hikes reinforce CBL’s focus on shareholder returns, but also layer in new catalysts, sustained earnings strength and continued dividend support now look more credible. At the same time, risks remain around exposure to one-off items in results, heavy interest payments, and reliance on market conditions for share repurchases, so how the business manages debt and tenant quality will be crucial. Overall, this news strengthens the short-term outlook, though the full impact on longer-term risks still needs watching. In contrast, significant one-off gains and high debt may influence earnings quality, a detail investors should keep in mind.

CBL & Associates Properties' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on CBL & Associates Properties - why the stock might be worth as much as 10% more than the current price!

Build Your Own CBL & Associates Properties Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CBL & Associates Properties research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free CBL & Associates Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CBL & Associates Properties' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.