Please use a PC Browser to access Register-Tadawul

Why Coinbase (COIN) Is Up 5.5% After Acquiring Echo for Onchain Fundraising Expansion

Coinbase COIN | 267.46 | -0.58% |

- Coinbase recently acquired Echo, a crypto-investing and onchain fundraising platform, in a US$375 million deal to enhance its community-driven investment capabilities and broaden its infrastructure for blockchain funding opportunities.

- This move marks Coinbase's eighth acquisition in 2025 and signals a major expansion into regulated token sales, tokenized securities, and early-stage community participation in digital asset funding.

- We'll look at how Coinbase's push into onchain fundraising may reshape its investment narrative and long-term growth prospects.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Coinbase Global Investment Narrative Recap

For shareholders in Coinbase Global, the core belief centers on the company’s ability to drive mainstream adoption of digital assets, facilitate new financial infrastructure through blockchain, and diversify revenue beyond volatile trading. Coinbase’s acquisition of Echo could strengthen new product pipelines, but it does not meaningfully change the near-term catalyst: increasing trading activity, and volumes, remain the critical driver, while persistent competition and market volatility continue as major risks to watch.

The recent launch of the Coinbase US Bitcoin Yield Fund for accredited investors stands out as highly relevant, signaling ongoing efforts to build out non-trading income by tapping demand for yield products. Coupled with new acquisitions, these initiatives highlight Coinbase’s ambition to buffer earnings against trading cycles, though their ultimate impact as a catalyst is tied to ongoing user and asset growth.

But in contrast to promising product rollouts, investors should also be mindful of...

Coinbase Global's narrative projects $8.5 billion in revenue and $2.1 billion in earnings by 2028. This requires 8.3% yearly revenue growth and a $0.8 billion decrease in earnings from the current $2.9 billion.

Uncover how Coinbase Global's forecasts yield a $374.67 fair value, a 6% upside to its current price.

Exploring Other Perspectives

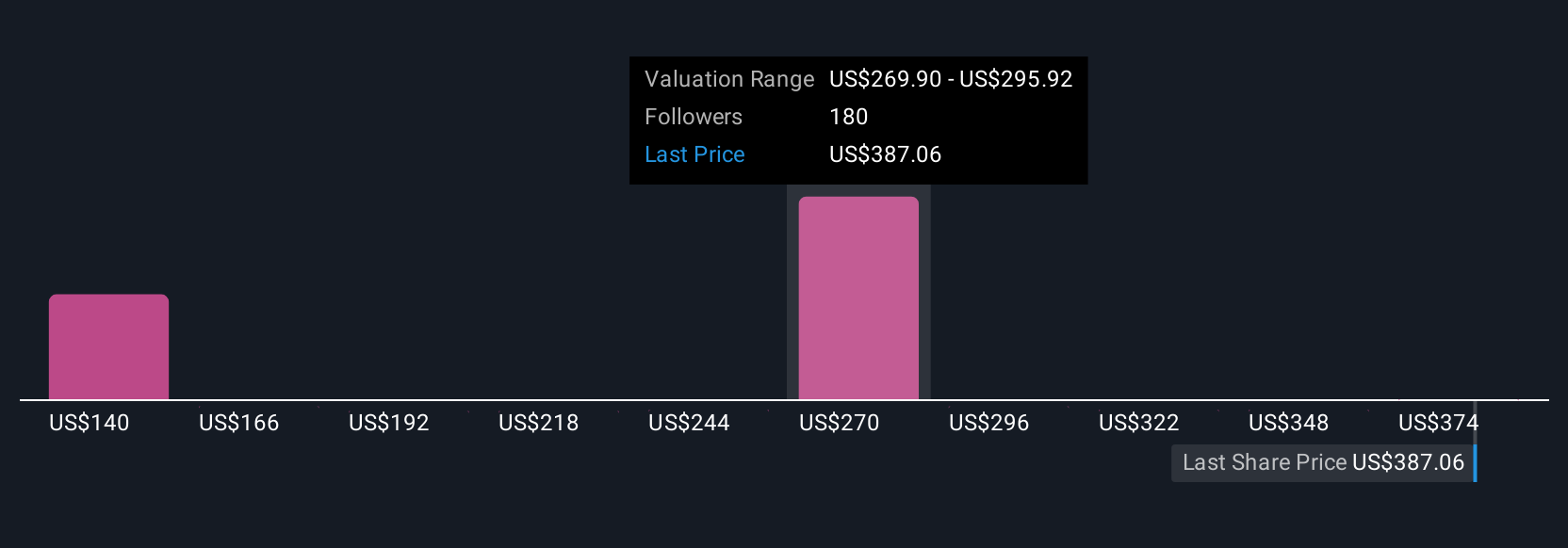

Twenty-five members of the Simply Wall St Community see Coinbase’s fair value anywhere from US$144 to US$510 per share. While opinions range widely, many are watching whether Coinbase’s revenue streams can shift meaningfully away from trading and cushion results in more subdued markets, an issue with big implications for future stability.

Explore 25 other fair value estimates on Coinbase Global - why the stock might be worth less than half the current price!

Build Your Own Coinbase Global Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coinbase Global research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Coinbase Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coinbase Global's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.