Please use a PC Browser to access Register-Tadawul

Why Dragonfly Energy Holdings (DFLI) Is Up 24.8% After Patent Win and $55 Million Equity Raise

Dragonfly Energy Holdings Corp - Common Stock DFLI | 0.73 | -8.47% |

- Earlier this week, Dragonfly Energy Holdings Corp. completed a US$55.35 million follow-on equity offering and announced the issuance of a key patent by the U.S. Patent and Trademark Office for its connected battery technology, Dragonfly IntelLigence, which enables multiple battery systems to communicate wirelessly over a mesh network.

- This development expands the company's intellectual property portfolio, potentially enhancing system reliability and positioning Dragonfly Energy as a leader in advanced battery system communication for U.S. energy storage markets.

- We'll now examine how the company’s new patent approval for connected battery technology could influence its long-term investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Dragonfly Energy Holdings Investment Narrative Recap

To be a Dragonfly Energy Holdings shareholder, you need to believe that proprietary lithium battery innovation and expanding OEM partnerships will grow revenue faster than risks from economic slowdown or supply chain disruptions. The patent approval for connected battery technology appears promising for long-term product differentiation, but in the short term, the successful execution of new OEM deals, particularly in the RV and trucking markets, remains the most important catalyst and a major area of risk, as macroeconomic uncertainty continues to challenge consumer and fleet purchasing decisions.

One recent announcement that stands out is the preliminary third-quarter results, highlighting a 26% year-over-year net sales increase driven by OEM order growth and cost controls. However, this topline improvement does not fully offset persistent risks around exposure to cyclical end-markets, ongoing unprofitability, and potential delays in the heavy-duty trucking segment’s adoption of new battery systems.

By contrast, investors should be aware that even as revenue rises, the company’s ongoing exposure to end-market volatility...

Dragonfly Energy Holdings is projected to reach $142.6 million in revenue and $14.5 million in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 37.8% and a $45 million improvement in earnings from the current level of -$30.5 million.

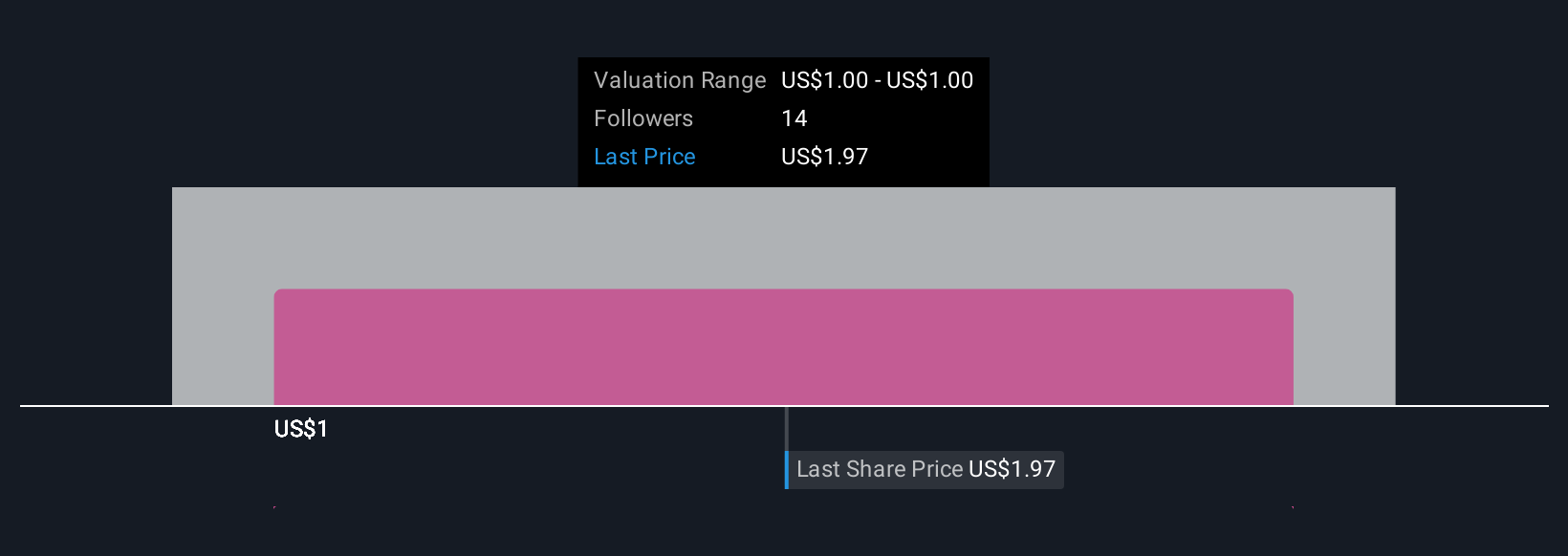

Uncover how Dragonfly Energy Holdings' forecasts yield a $1.00 fair value, a 26% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s sole fair value estimate for Dragonfly Energy Holdings sits at US$1. You’ll find peers concerned about unprofitability and cyclical market risks, which could impact the share price outlook.

Explore another fair value estimate on Dragonfly Energy Holdings - why the stock might be worth 26% less than the current price!

Build Your Own Dragonfly Energy Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dragonfly Energy Holdings research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Dragonfly Energy Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dragonfly Energy Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.