Please use a PC Browser to access Register-Tadawul

Why Elastic (ESTC) Is Up After Announcing $500M Buyback and New AI Cloud Inference Service

Elastic N.V. ESTC | 76.31 | -3.76% |

- On October 9, 2025, Elastic N.V. announced a US$500 million share repurchase program alongside the launch of the Elastic Inference Service, a GPU-accelerated inference-as-a-service for AI and search workloads on Elastic Cloud, available across all supported regions and clouds.

- This combination of a large buyback authorization and a new, integrated AI product marks a significant move to address developer needs and signal management's confidence to the market.

- We'll explore how the introduction of GPU-accelerated inference and a major share repurchase plan could influence Elastic's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Elastic Investment Narrative Recap

To be an Elastic shareholder, you need to believe that the company’s continued investment in AI and cloud-powered solutions can drive sustained revenue growth and margin expansion, despite intense competition and the risk of product commoditization. The new US$500 million share repurchase and launch of Elastic Inference Service appear value-accretive but do not materially shift the near-term catalyst of driving adoption of integrated AI search and analytics, nor the biggest risk from hyperscaler competition.

The most relevant announcement is the release of the Elastic Inference Service, which enhances Elastic’s AI and generative search capabilities for cloud customers and reinforces the company’s core differentiation focus. By natively integrating GPU-accelerated inference into Elastic Cloud, this move further addresses enterprise demand for performance, scalability, and streamlined workflows, which ties directly into the company’s main growth catalysts.

However, on the other side, it’s important for investors to consider how direct cloud-native competitors might ...

Elastic's outlook projects $2.3 billion in revenue and $50.5 million in earnings by 2028. This assumes annual revenue growth of 13.9% and a $134 million increase in earnings from the current level of -$83.5 million.

Uncover how Elastic's forecasts yield a $120.16 fair value, a 48% upside to its current price.

Exploring Other Perspectives

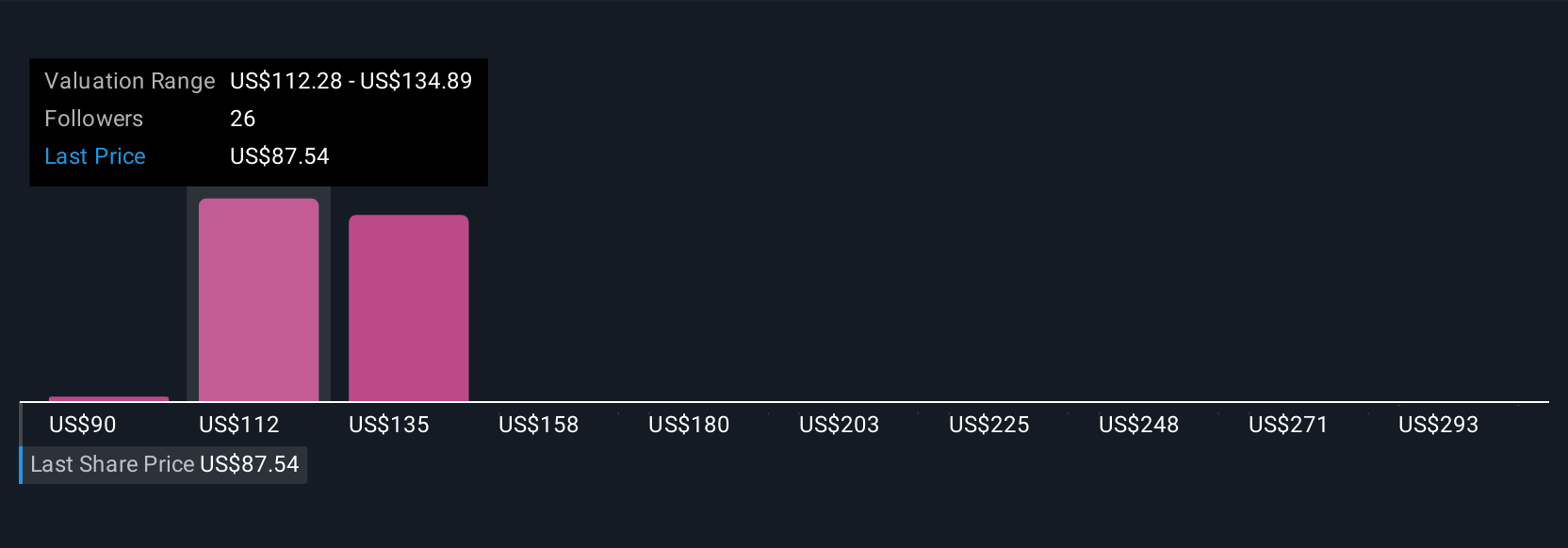

Seven Simply Wall St Community members estimate Elastic’s fair value between US$89.66 and US$315.80. While many see growth potential from AI-powered adoption, the competitive threat from hyperscalers remains an important factor influencing future performance and investor conviction.

Explore 7 other fair value estimates on Elastic - why the stock might be worth just $89.66!

Build Your Own Elastic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Elastic research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Elastic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Elastic's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.