Please use a PC Browser to access Register-Tadawul

Why Fluence Energy (FLNC) Gains Tier 1 Status and Lands Major European Deals—What This Means

Fluence Energy, Inc. FLNC | 21.31 | -0.98% |

- In recent days, Fluence Energy received recognition as a Tier 1 energy storage supplier by S&P Global Commodity Insights and announced technology partnerships for major battery storage projects in Switzerland and Poland. This highlights the company's strengthening reputation in the sector and growing presence in international energy storage markets.

- The combination of industry recognition and new large-scale project contracts underlines confidence in Fluence Energy's ability to deliver reliable solutions and expand globally.

- We'll examine how S&P Global's Tier 1 recognition could influence Fluence Energy's investment outlook and future industry position.

Find companies with promising cash flow potential yet trading below their fair value.

Fluence Energy Investment Narrative Recap

To be a shareholder in Fluence Energy, you need to believe in the accelerating demand for large-scale battery storage driven by grid modernization, renewable integration, and global electrification. The recent Tier 1 recognition by S&P Global Commodity Insights and new international project wins may lift confidence in Fluence's solution quality and market appeal, but do not directly address the immediate challenge of paused U.S. contracts tied to tariff uncertainty, a risk that continues to weigh on the company’s near-term revenue trajectory.

Among Fluence's recent announcements, the launch of its first shipment of U.S.-made lithium-ion battery storage systems stands out. This milestone supports its catalyst of building a resilient domestic supply chain, aimed at mitigating the largest risk from tariff and trade uncertainties affecting project timelines, backlogs, and margins.

However, despite these positive developments, investors should also be mindful of the ongoing risk that fluctuating tariffs and U.S. trade policy...

Fluence Energy's narrative projects $4.2 billion in revenue and $97.9 million in earnings by 2028. This requires 19.5% yearly revenue growth and an $116.3 million increase in earnings from the current level of -$18.4 million.

Uncover how Fluence Energy's forecasts yield a $7.74 fair value, a 27% downside to its current price.

Exploring Other Perspectives

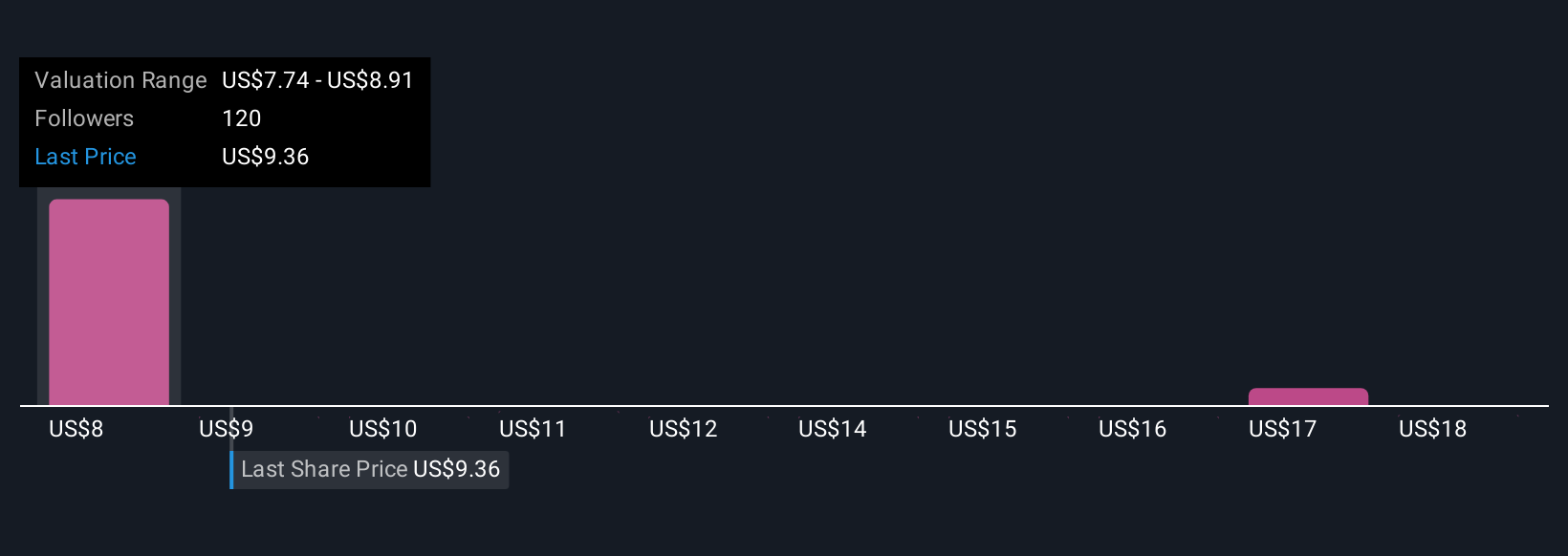

Six fair value estimates from the Simply Wall St Community put Fluence’s worth between US$7.74 and US$19.50 per share. Persistent trade and supply risks could significantly impact how these diverse views on future performance play out across the market.

Explore 6 other fair value estimates on Fluence Energy - why the stock might be worth 27% less than the current price!

Build Your Own Fluence Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fluence Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fluence Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fluence Energy's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 30 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.