Please use a PC Browser to access Register-Tadawul

Why Helios Technologies (HLIO) Is Up 37.5 Percent After Raising 2025 Sales Guidance and Strategic Moves

Helios Technologies, Inc. HLIO | 72.70 72.70 | +0.25% 0.00% Post |

- Helios Technologies recently raised its full-year 2025 net sales guidance to a range of US$810 million to US$830 million, following the announcement of stronger-than-expected second quarter results and the completion of a 200,000 share buyback for US$6.46 million.

- The company also announced the sale of its Australian-based Custom Fluidpower business and introduced the Atlas Connect Gateway, underscoring Helios' increased focus on operational efficiency, product innovation, and margin improvement.

- With management now expecting higher annual sales and making moves to streamline operations, we'll explore how this revised outlook impacts Helios Technologies' investment narrative.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

Helios Technologies Investment Narrative Recap

To be a Helios Technologies shareholder, an investor must have confidence in the company’s ability to drive margin expansion and organic growth through innovation and operational streamlining, especially as the industrial sector continues to prioritize automation and integrated solutions. The recent lift in full-year net sales guidance highlights stronger near-term momentum but, given persistent end-market volatility and longer-term industry shifts toward electrification, these updates may not fully resolve the key risk of cyclical earnings pressure.

Of the recent announcements, the launch of the Atlas Connect Gateway stands out as most relevant, illustrating Helios’ commitment to next-generation IoT-enabled products that could boost OEM adoption and solidify its push toward higher-value offerings. With this in mind, the successful market traction of new technologies like Atlas Connect will play an important role in determining whether Helios can offset pressures from traditional hydraulics exposure and strengthen its competitive position.

Yet, despite the improved outlook, it is important for investors to keep in mind the ongoing threat from end-market cyclicality and...

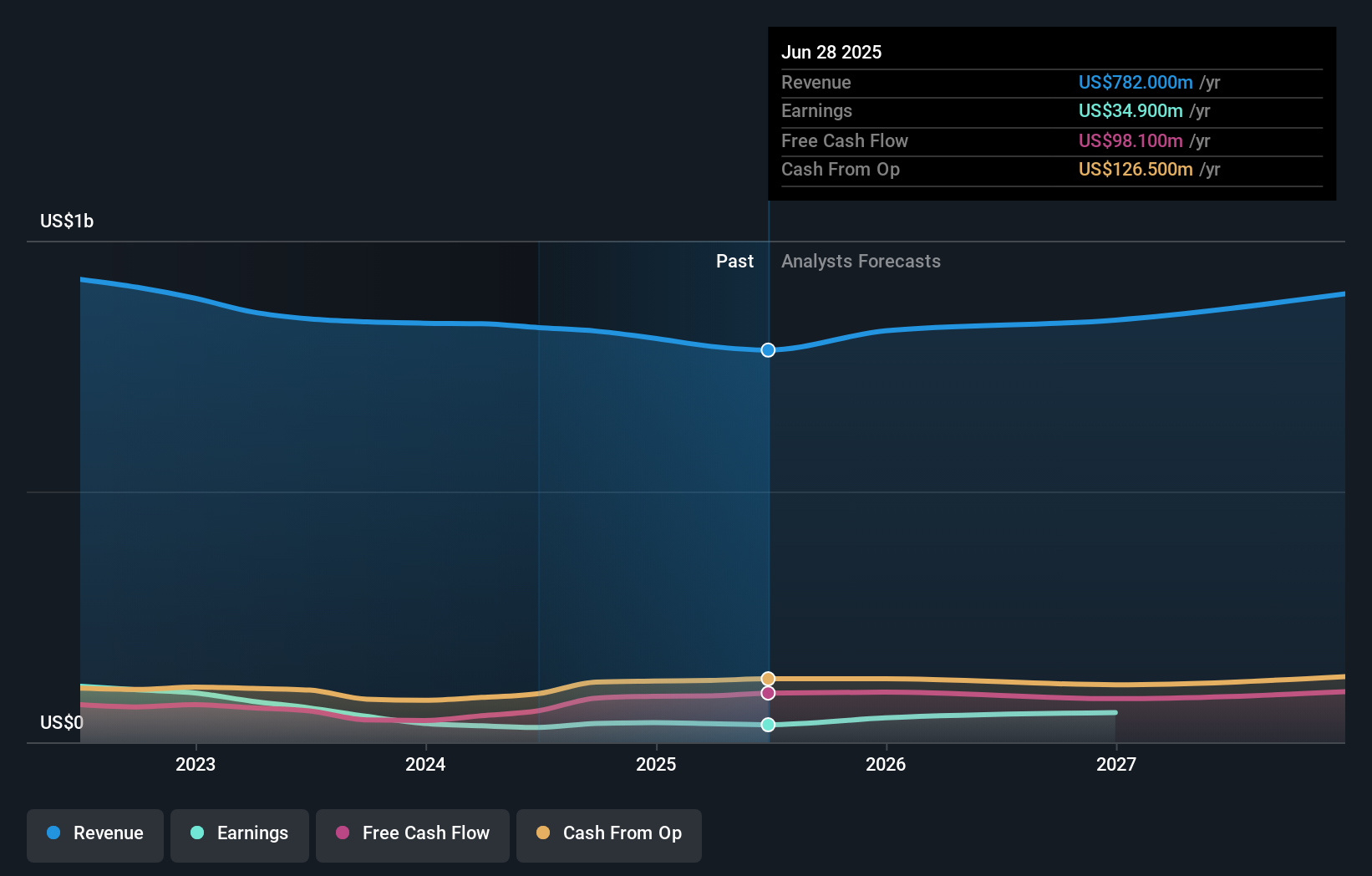

Helios Technologies' outlook projects $881.8 million in revenue and $94.8 million in earnings by 2028. This reflects a 4.1% annual revenue growth and a $59.9 million increase in earnings from the current $34.9 million.

Uncover how Helios Technologies' forecasts yield a $55.40 fair value, a 14% upside to its current price.

Exploring Other Perspectives

The only community fair value submitted to Simply Wall St is US$55.40, capturing one unique viewpoint. While Helios raised its annual sales guidance, persistent volatility in its key end markets remains a factor you cannot ignore.

Explore another fair value estimate on Helios Technologies - why the stock might be worth as much as 14% more than the current price!

Build Your Own Helios Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Helios Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Helios Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Helios Technologies' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.