Please use a PC Browser to access Register-Tadawul

Why Huntington Ingalls (HII) Is Up 10.1% After Strong 2025 Results And AI Shipbuilding Advances

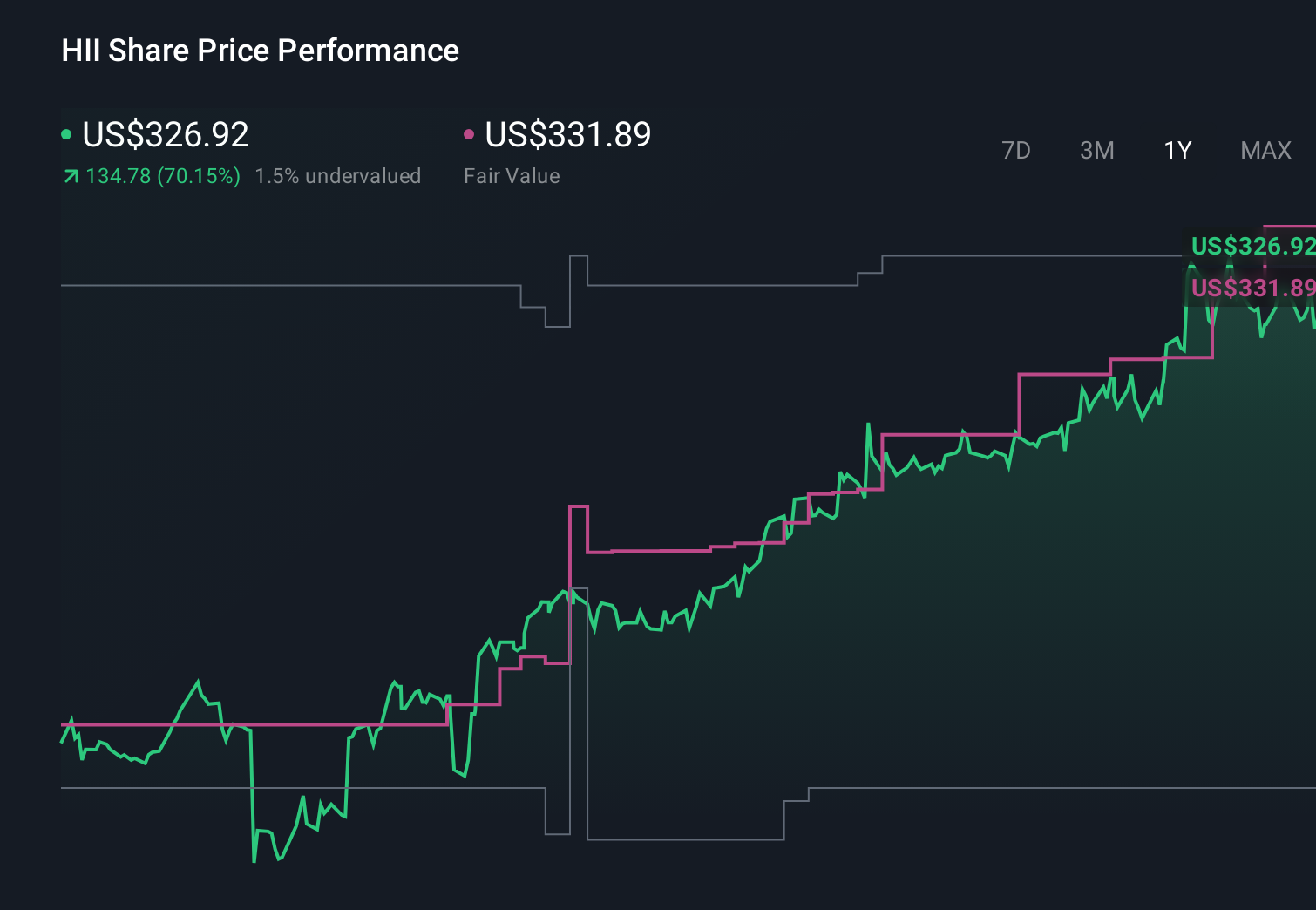

Huntington Ingalls Industries, Inc. HII | 437.57 | -1.26% |

- Huntington Ingalls Industries has recently reported higher fourth-quarter and full-year 2025 revenue and net income, completed builder’s sea trials for the John F. Kennedy (CVN 79) aircraft carrier, and confirmed a quarterly dividend of US$1.38 per share payable on March 13, 2026.

- Together with strong reliability data for its REMUS 100 autonomous underwater vehicle and a new collaboration with Path Robotics on physical AI in manufacturing, these updates highlight how HII is coupling traditional shipbuilding strength with advanced technology and automation capabilities.

- Now we’ll examine how HII’s stronger 2025 earnings and progress in autonomous systems and AI-enabled manufacturing shape its investment narrative.

Find 55 companies with promising cash flow potential yet trading below their fair value.

Huntington Ingalls Industries Investment Narrative Recap

To own Huntington Ingalls Industries, you need to believe its core shipbuilding franchises and growing autonomous systems can keep turning large, long-cycle Navy programs into dependable cash flows. The latest results and CVN 79 sea-trial progress support that narrative, but they do not remove the key short term risk around timing and funding for future submarine and carrier awards, which still drives much of HII’s revenue visibility and earnings stability.

The fourth quarter and full year 2025 earnings release is the most relevant update here, as it shows higher revenue and net income alongside confirmed dividends. Against a backdrop of dependence on major U.S. defense contracts, this earnings strength and continued capital return give investors fresh data to weigh against concerns about future budget decisions and potential program delays.

However, investors should also be aware that if U.S. defense funding priorities were to shift more aggressively toward smaller, unmanned platforms and away from large manned ships, then...

Huntington Ingalls Industries' narrative projects $13.6 billion revenue and $785.0 million earnings by 2028. This requires 5.4% yearly revenue growth and a $260.0 million earnings increase from $525.0 million today.

Uncover how Huntington Ingalls Industries' forecasts yield a $380.60 fair value, a 6% downside to its current price.

Exploring Other Perspectives

Lowest estimate analysts take a much more cautious view, assuming revenue of about US$13.3 billion and earnings near US$767 million by 2028, and they worry that if budgets pivot faster toward autonomous systems than expected, HII’s current shipbuilding progress and Q4 2025 earnings beat might not fully offset that shift.

Explore 6 other fair value estimates on Huntington Ingalls Industries - why the stock might be worth 44% less than the current price!

Build Your Own Huntington Ingalls Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Huntington Ingalls Industries research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Huntington Ingalls Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Huntington Ingalls Industries' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with 27 elite penny stocks that balance risk and reward.

- Invest in the nuclear renaissance through our list of 87 elite nuclear energy infrastructure plays powering the global AI revolution.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.