Please use a PC Browser to access Register-Tadawul

Why Intuitive Machines (LUNR) Is Up 12.1% After Raising $345 Million in Convertible Notes - And What's Next

Intuitive Machines, Inc. Class A LUNR | 17.57 | -8.49% |

- Intuitive Machines recently completed a US$345 million convertible senior notes offering, drawing strong investor demand and boosting its liquidity position for operations, R&D, acquisitions, and capped call transactions.

- This financing move not only strengthens the company’s resources, but also helps manage potential dilution as it pursues its long-term growth initiatives.

- We’ll examine how the improved liquidity from this capital raise could influence Intuitive Machines’ growth trajectory and investment outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Intuitive Machines Investment Narrative Recap

To be a shareholder in Intuitive Machines, you need to believe in the company’s ability to capitalize on accelerating commercial and government interest in lunar and deep space services, despite revenue being concentrated around high-stakes mission milestones. The recent US$345 million convertible note offering strengthens short-term liquidity but does not materially change the fact that successful execution of upcoming missions and contract wins remains the core catalyst, while reliance on government contracts continues to be the business’s biggest risk.

Among the latest developments, the successful IM-2 mission lunar lander launch in February 2025 stands out. This achievement connects directly to the company’s catalyst of delivering recurring mission success, validating technical capabilities and supporting longer-term revenue visibility as Intuitive Machines deploys capital from its latest raise to fuel further missions and R&D.

Yet, while the funding boost addresses liquidity, investors should also be aware that government spending shifts or contract delays could...

Intuitive Machines is forecast to reach $502.2 million in revenue and $41.2 million in earnings by 2028. This outlook assumes annual revenue growth of 30.5% and an earnings increase of $283 million from current earnings of -$241.8 million.

Uncover how Intuitive Machines' forecasts yield a $14.38 fair value, a 42% upside to its current price.

Exploring Other Perspectives

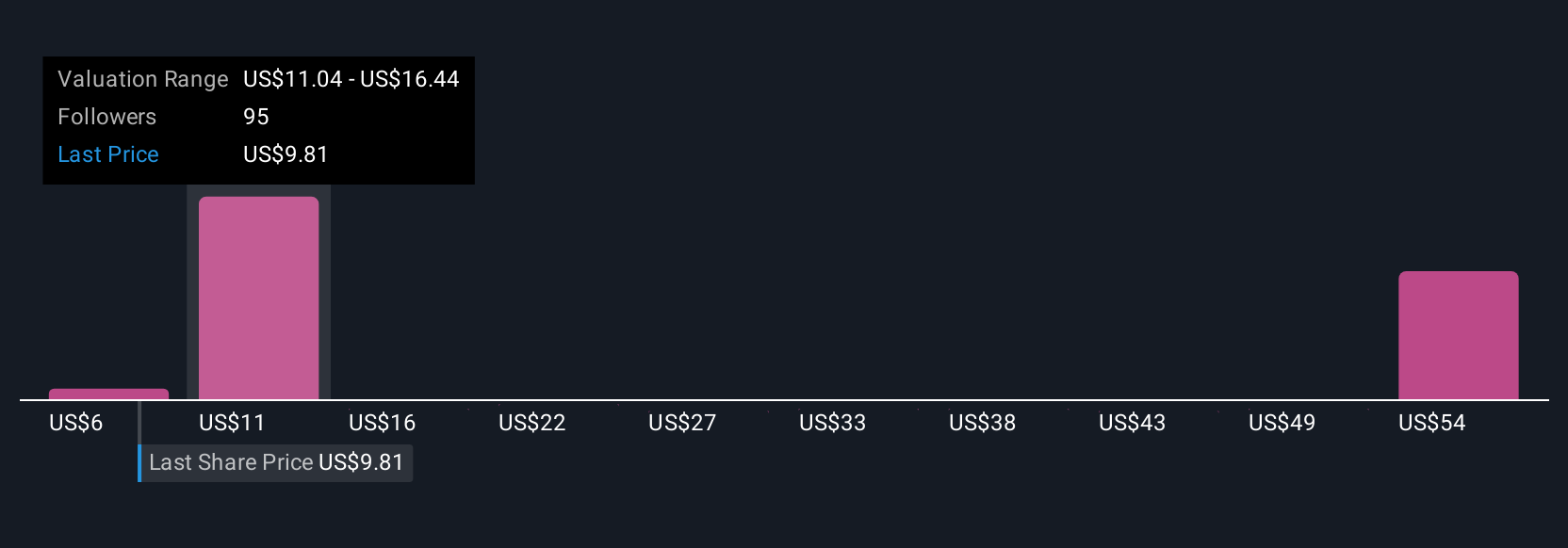

Twenty-seven members of the Simply Wall St Community estimate Intuitive Machines’ fair value from as low as US$5.64 to as high as US$59.15 per share. This broad range of outlooks exists even as the company’s fortunes continue to hinge on securing and performing large government contracts, making it essential to review a variety of perspectives before deciding how you view the business’s future.

Explore 27 other fair value estimates on Intuitive Machines - why the stock might be worth over 5x more than the current price!

Build Your Own Intuitive Machines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intuitive Machines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Intuitive Machines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intuitive Machines' overall financial health at a glance.

No Opportunity In Intuitive Machines?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 30 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.