Please use a PC Browser to access Register-Tadawul

Why Investors Shouldn't Be Surprised By DouYu International Holdings Limited's (NASDAQ:DOYU) 26% Share Price Plunge

DouYu International Holdings Limited DOYU | 7.00 | +1.45% |

Unfortunately for some shareholders, the DouYu International Holdings Limited (NASDAQ:DOYU) share price has dived 26% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 20% in that time.

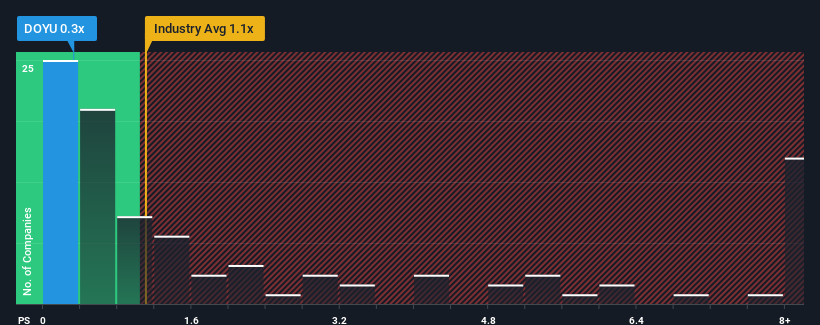

Since its price has dipped substantially, DouYu International Holdings may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.3x, considering almost half of all companies in the Entertainment industry in the United States have P/S ratios greater than 1.1x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does DouYu International Holdings' P/S Mean For Shareholders?

DouYu International Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on DouYu International Holdings will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For DouYu International Holdings?

DouYu International Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 23%. As a result, revenue from three years ago have also fallen 53% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 2.9% each year during the coming three years according to the three analysts following the company. With the industry predicted to deliver 12% growth per year, that's a disappointing outcome.

In light of this, it's understandable that DouYu International Holdings' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On DouYu International Holdings' P/S

DouYu International Holdings' P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's clear to see that DouYu International Holdings maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, DouYu International Holdings' poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.