Please use a PC Browser to access Register-Tadawul

Why Investors Shouldn't Be Surprised By MIND Technology, Inc.'s (NASDAQ:MIND) 30% Share Price Surge

Mitcham Industries, Inc. MIND | 7.94 7.94 | -1.85% 0.00% Pre |

MIND Technology, Inc. (NASDAQ:MIND) shares have continued their recent momentum with a 30% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 88%.

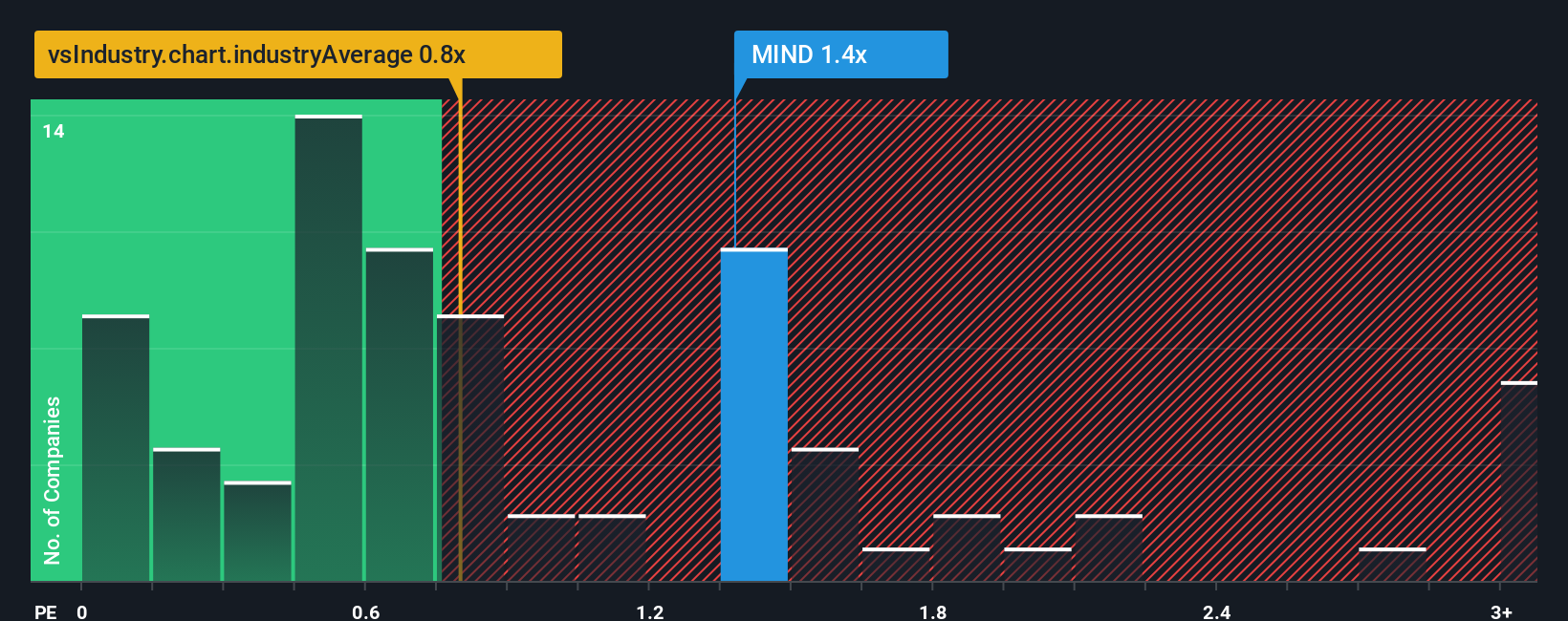

Since its price has surged higher, you could be forgiven for thinking MIND Technology is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.4x, considering almost half the companies in the United States' Energy Services industry have P/S ratios below 0.8x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

What Does MIND Technology's P/S Mean For Shareholders?

MIND Technology has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on MIND Technology will help you shine a light on its historical performance.How Is MIND Technology's Revenue Growth Trending?

In order to justify its P/S ratio, MIND Technology would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 27%. Pleasingly, revenue has also lifted 61% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 0.9%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why MIND Technology's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

MIND Technology's P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that MIND Technology can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

If you're unsure about the strength of MIND Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.