Please use a PC Browser to access Register-Tadawul

Why Investors Shouldn't Be Surprised By ProQR Therapeutics N.V.'s (NASDAQ:PRQR) 28% Share Price Plunge

ProQR Therapeutics N.V. PRQR | 1.61 | -0.52% |

To the annoyance of some shareholders, ProQR Therapeutics N.V. (NASDAQ:PRQR) shares are down a considerable 28% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 26% share price drop.

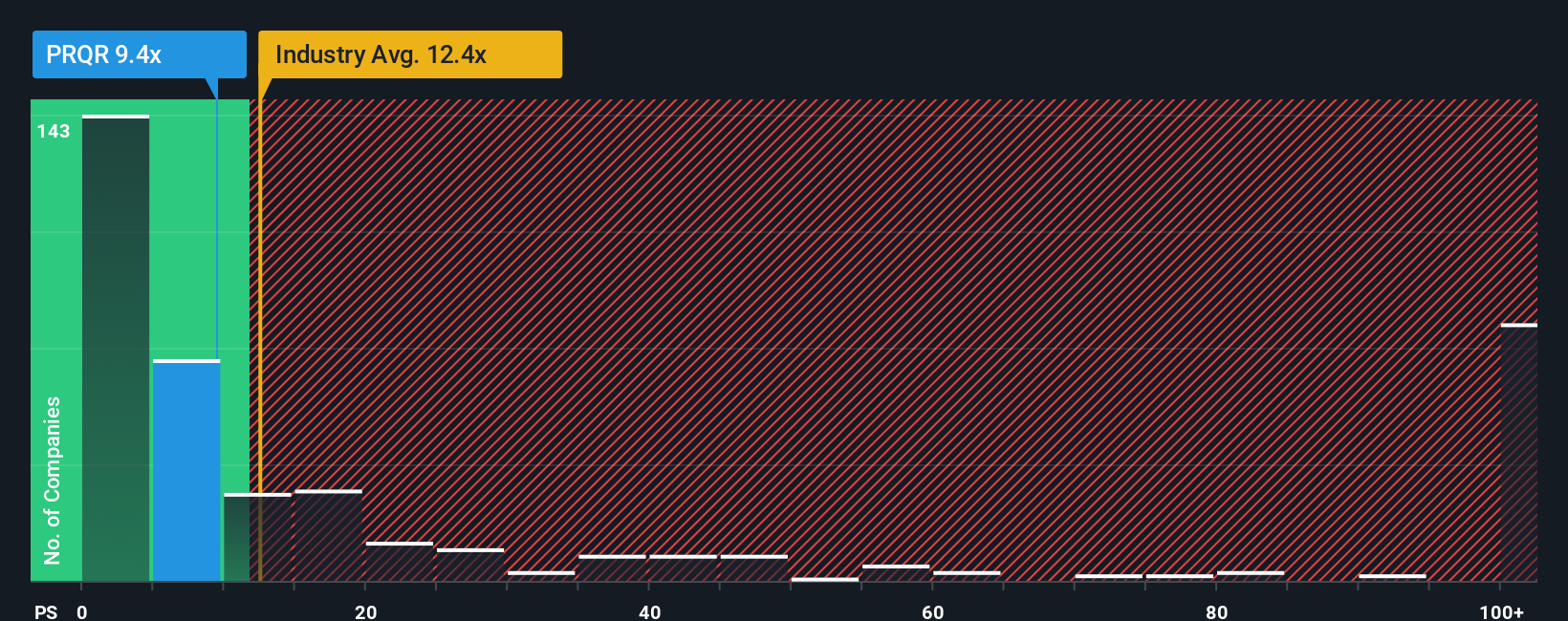

Following the heavy fall in price, ProQR Therapeutics' price-to-sales (or "P/S") ratio of 9.4x might make it look like a buy right now compared to the Biotechs industry in the United States, where around half of the companies have P/S ratios above 12.4x and even P/S above 82x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does ProQR Therapeutics' P/S Mean For Shareholders?

ProQR Therapeutics hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on ProQR Therapeutics will help you uncover what's on the horizon.How Is ProQR Therapeutics' Revenue Growth Trending?

ProQR Therapeutics' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 13%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Turning to the outlook, the next three years should generate growth of 54% each year as estimated by the five analysts watching the company. That's shaping up to be materially lower than the 123% each year growth forecast for the broader industry.

With this in consideration, its clear as to why ProQR Therapeutics' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From ProQR Therapeutics' P/S?

ProQR Therapeutics' P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of ProQR Therapeutics' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

If these risks are making you reconsider your opinion on ProQR Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.