Please use a PC Browser to access Register-Tadawul

Why IPG Photonics (IPGP) Is Up 6.4% After Launching CROSSBOW MINI for Advanced Counter-Drone Defense

IPG Photonics Corporation IPGP | 0.00 |

- IPG Photonics recently showcased its CROSSBOW MINI 3 kW high-energy laser system at Defence and Security Equipment International (DSEI) UK, highlighting its capabilities to neutralize Group 1 and 2 drones, and announced broader availability for its CROSSBOW product range.

- This marks a move into practical counter-drone defense solutions with proven field results, reflecting a shift toward new advanced markets beyond traditional industrial lasers.

- Let's explore how the launch of CROSSBOW MINI, proven to neutralize over 100 drones, could influence IPG Photonics' investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

IPG Photonics Investment Narrative Recap

To be an IPG Photonics shareholder today, you need to believe the company's pivot toward advanced laser applications, especially defense, can open new high-growth markets that offset the softness in legacy industrial segments. The CROSSBOW MINI launch is a clear short-term catalyst, spotlighting real-world adoption in defense, but ongoing pressure from tariff risks and unpredictable demand remain the biggest immediate challenges; this event may not fully offset those headwinds just yet.

Among the recent announcements, IPG's showcase of new high-power lasers at Laser World of Photonics stands out. This move reinforces the company’s effort to expand into markets where reliability and footprint matter, supporting its strategy to build growth drivers outside the traditional core and potentially accelerating adoption in new segments when paired with defense-focused launches.

But on the other hand, there are growing concerns around the unpredictable revenue environment caused by tariff and geopolitical risks that investors should be aware of...

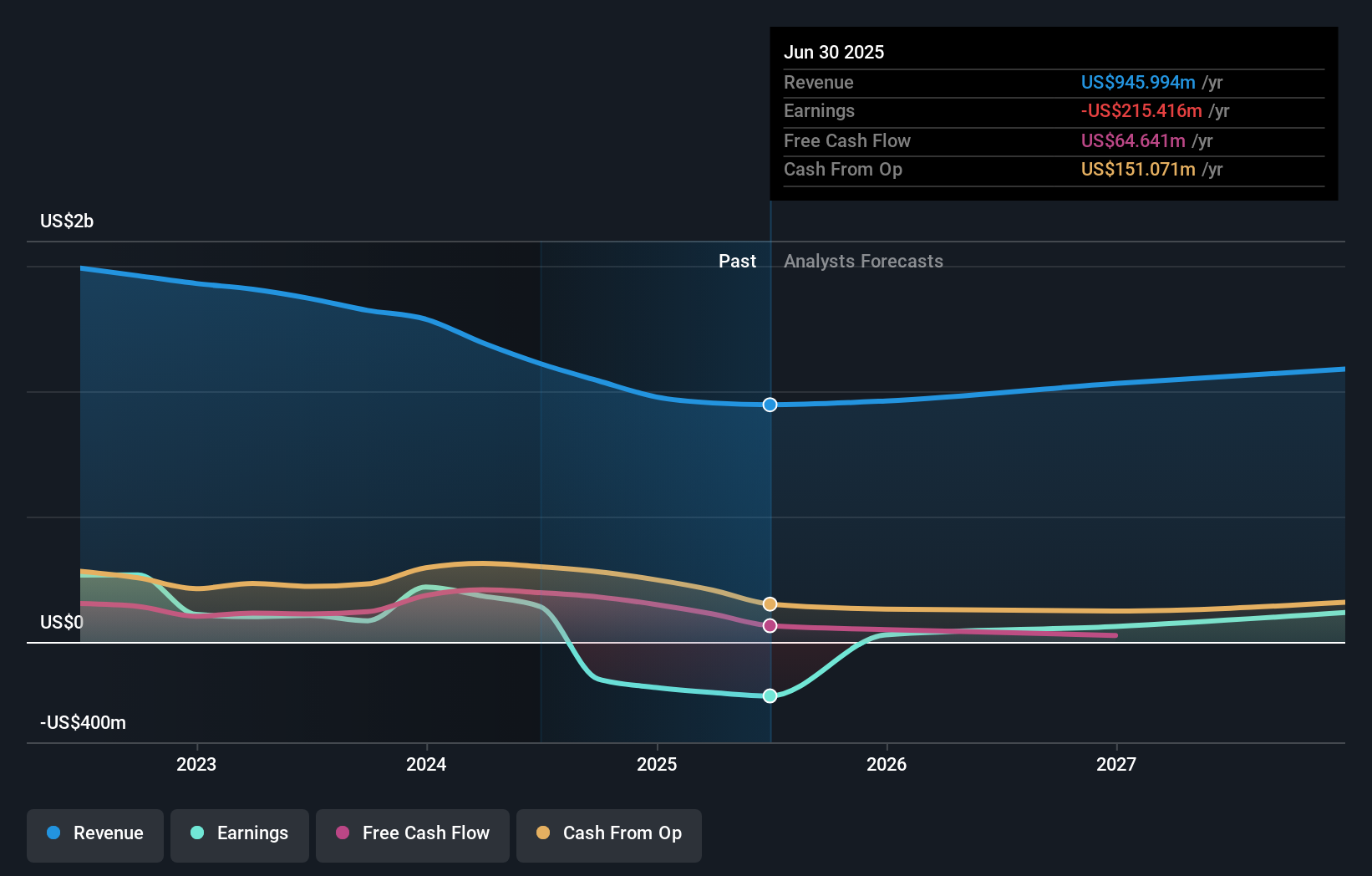

IPG Photonics' outlook anticipates $1.2 billion in revenue and $133.9 million in earnings by 2028. This scenario is based on an 8.1% annual revenue growth rate and a $349.3 million increase in earnings from current earnings of -$215.4 million.

Uncover how IPG Photonics' forecasts yield a $80.20 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Three fair value opinions from the Simply Wall St Community range from as low as US$3.92 to US$80.20 per share. With tariff and demand volatility still unresolved, your own outlook on future earnings stability shapes how you see the opportunity.

Explore 3 other fair value estimates on IPG Photonics - why the stock might be worth less than half the current price!

Build Your Own IPG Photonics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IPG Photonics research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free IPG Photonics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IPG Photonics' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.