Please use a PC Browser to access Register-Tadawul

Why iShares Bitcoin Trust ETF (IBIT) Is Up 10.7% After Surpassing Deribit in Bitcoin Options Volume and What's Next

Shares Bitcoin Trust IBIT | 51.20 | -1.73% |

- BlackRock’s iShares Bitcoin Trust ETF has recently overtaken Deribit as the world’s largest venue for Bitcoin options trading, marking a major shift toward regulated, U.S.-based digital asset markets.

- This transition reflects a meaningful increase in institutional demand and signals Wall Street’s expanding influence over both spot and derivatives crypto markets.

- We’ll explore how IBIT’s rapid leadership in the Bitcoin options market cements its evolving role in institutional digital asset investment narratives.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is iShares Bitcoin Trust ETF's Investment Narrative?

The case for being a shareholder in iShares Bitcoin Trust ETF (IBIT) starts with the belief that regulated, transparent, and US-listed vehicles are fast becoming the preferred gateway for institutional exposure to Bitcoin and its derivatives. The recent development, IBIT surpassing Deribit as the world’s largest venue for Bitcoin options trading, has clear ramifications in the short term. It puts a spotlight on strengthening institutional flows, increased liquidity, and deepening US market influence, potentially boosting IBIT’s prominence and trading volumes. Yet, this shift comes amid some of the largest ETF outflows recorded in months and a split in demand as seen by contrasting flows between BlackRock and competitors. The sharp rise in Bitcoin’s price and IBIT’s total returns are compelling, but ongoing uncertainty around regulatory changes, concentration risks, and the ETF’s rapid growth could amplify near-term volatility and headline risk. However, investors should not overlook concerns about board independence and potential growing pains that could accompany such rapid scale.

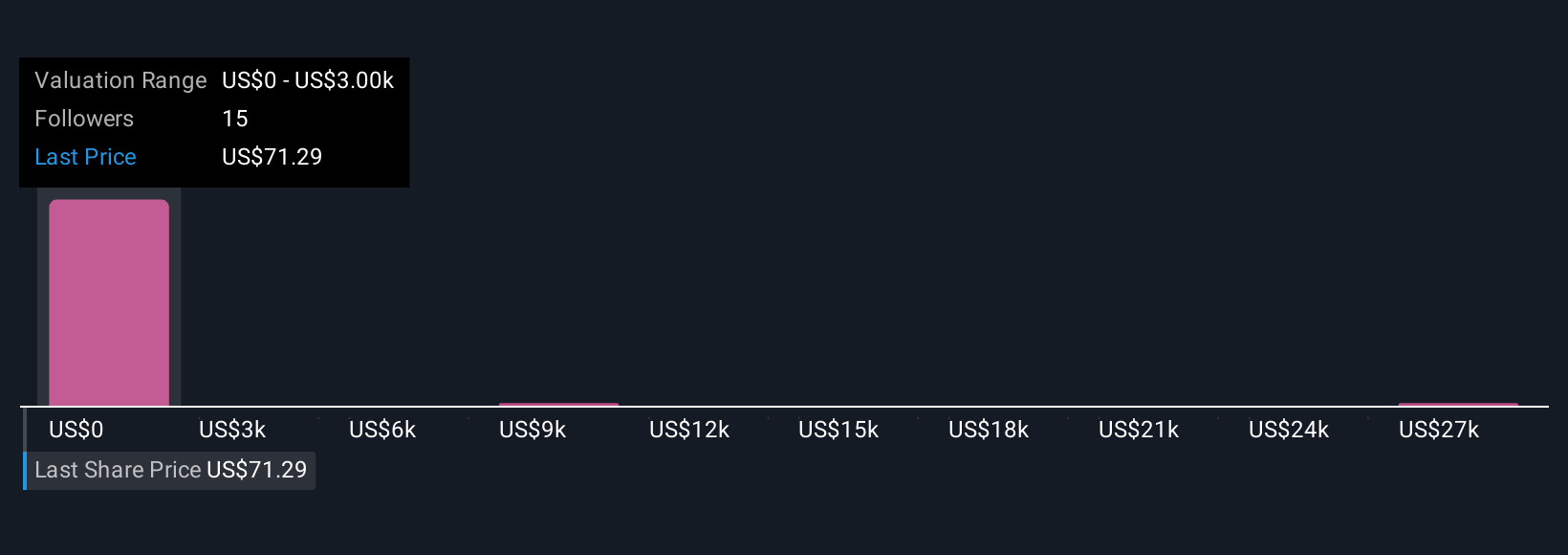

In light of our recent valuation report, it seems possible that iShares Bitcoin Trust ETF is trading beyond its estimated value.Exploring Other Perspectives

Explore 17 other fair value estimates on iShares Bitcoin Trust ETF - why the stock might be worth just $3000!

Build Your Own iShares Bitcoin Trust ETF Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free iShares Bitcoin Trust ETF research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate iShares Bitcoin Trust ETF's overall financial health at a glance.

No Opportunity In iShares Bitcoin Trust ETF?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.