Please use a PC Browser to access Register-Tadawul

Why Lam Research (LRCX) Is Up 7.2% After Record AI-Driven Revenue Beats Analyst Forecasts

Lam Research Corporation LRCX | 231.01 | +8.30% |

- Lam Research Corporation recently reported quarterly revenue of US$5.32 billion and net income of US$1.57 billion for the period ended September 28, 2025, both exceeding analyst expectations and reflecting a 27% increase in revenue compared to a year ago.

- Despite a US$200 million impact from regulatory export restrictions to China, management emphasized that AI-driven semiconductor demand, especially in NAND and DRAM, has fueled record results and set the stage for continued growth in advanced chip technologies.

- We'll explore how Lam Research's robust quarterly performance and strong AI-related equipment demand may shape its updated investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Lam Research Investment Narrative Recap

To be a shareholder in Lam Research, you need to believe in the continued acceleration of AI-driven semiconductor demand and the company's ability to maintain its leadership in advanced chip manufacturing equipment. The recent impairment of long-lived assets, at just US$5.29 million, is not material relative to the strong quarterly results and does not alter the primary short-term catalyst: ongoing global AI investment, led by NAND and DRAM equipment demand. The main risk remains a potential decline in China-related revenue, especially as regulatory issues persist. Among recent announcements, Lam's strong earnings guidance for the December 2025 quarter stands out, with revenue expected at US$5.20 billion plus or minus US$300 million. This projection, which is above analyst expectations, reinforces confidence in sustained AI-related demand and echoes management’s focus on innovative products supporting both topline growth and margin expansion, even with regional headwinds and sector cyclicality. Yet, a key consideration for investors is the contrast between robust AI-fueled forecasts and the very real exposure to shifts in China revenue, which could...

Lam Research's narrative projects $23.6 billion in revenue and $6.7 billion in earnings by 2028. This requires 8.5% yearly revenue growth and a $1.3 billion increase in earnings from $5.4 billion today.

Uncover how Lam Research's forecasts yield a $130.96 fair value, a 14% downside to its current price.

Exploring Other Perspectives

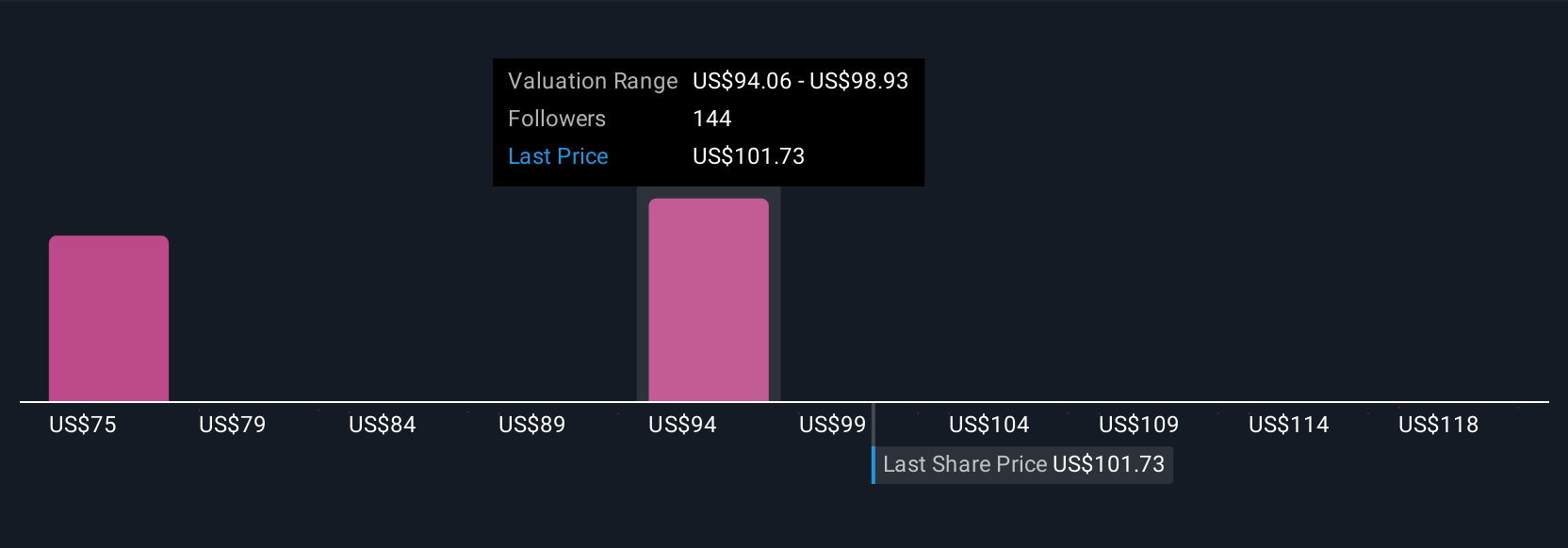

Fourteen members of the Simply Wall St Community have shared fair value estimates for Lam Research ranging from US$66.04 to US$135. With customer concentration and China demand as persistent risks, your view on Lam’s future hinges on which valuation and risk outlook you weigh most.

Explore 14 other fair value estimates on Lam Research - why the stock might be worth less than half the current price!

Build Your Own Lam Research Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lam Research research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Lam Research research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lam Research's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.