Please use a PC Browser to access Register-Tadawul

Why Leonardo DRS (DRS) Is Up 6.0% After Analyst Upgrade Citing Strong Backlog and Margin Expansion

Leonardo DRS, Inc. DRS | 34.46 | -0.92% |

- Leonardo DRS recently received an analyst upgrade following robust second-quarter earnings marked by strong bookings, healthy organic revenue growth, and expanding profit margins.

- An expanding backlog driven by advanced sensing and computing contracts has reinforced analyst optimism and led the company to raise its annual revenue guidance.

- We'll examine how growing analyst confidence in core business strength could influence Leonardo DRS's investment narrative.

Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

Leonardo DRS Investment Narrative Recap

To be a shareholder in Leonardo DRS, you need to believe in the long-term demand for advanced defense technologies and the company's ability to win and execute major contracts. The recent analyst upgrade, supported by robust Q2 results and an increasing backlog, reinforces confidence in revenue growth potential, though the sector’s high valuation and ongoing exposure to U.S. government budgets remain the key short-term catalysts and risks. The latest inflation data, which met expectations and suggests stable monetary policy, does not materially change this near-term equation.

Among Leonardo DRS’s recent announcements, the upward revision of its annual revenue guidance after a strong second quarter stands out. This adjustment, driven by increased contract volume in advanced sensing and computing, aligns closely with the optimism that spurred the analyst upgrade and is viewed as a relevant near-term catalyst for additional backlog growth and business momentum.

However, investors should be aware that any shift in U.S. defense spending priorities, particularly with respect to large long-term contracts, could...

Leonardo DRS is projected to reach $4.1 billion in revenue and $351.1 million in earnings by 2028. This outlook is based on a 6.6% annual revenue growth rate and a $101 million increase in earnings from the current level of $250.0 million.

Uncover how Leonardo DRS' forecasts yield a $49.00 fair value, a 12% upside to its current price.

Exploring Other Perspectives

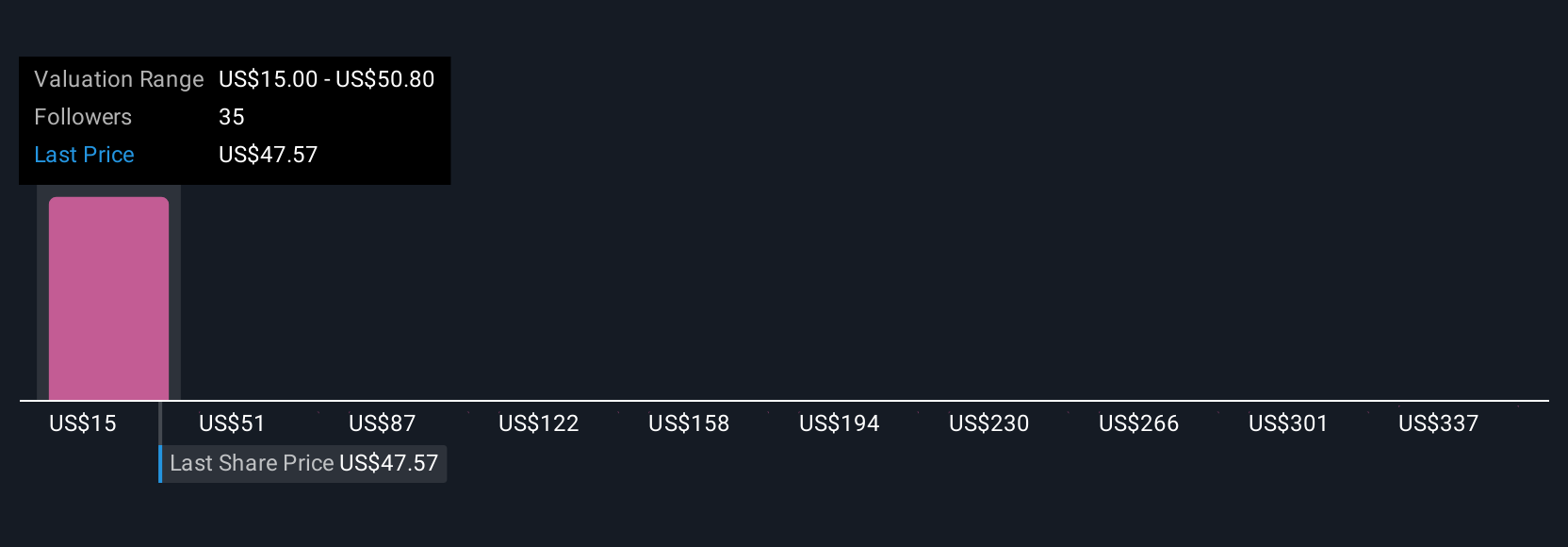

Nine members of the Simply Wall St Community assigned fair values to Leonardo DRS, with estimates ranging from US$15.00 to a remarkable US$372.97. While opinions differ, persistent U.S. and allied defense funding is widely recognized as a primary force shaping future prospects, check out how others assess the outlook and risks.

Explore 9 other fair value estimates on Leonardo DRS - why the stock might be worth less than half the current price!

Build Your Own Leonardo DRS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Leonardo DRS research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Leonardo DRS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Leonardo DRS' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.