Please use a PC Browser to access Register-Tadawul

Why Nebius Group (NBIS) Is Up After $19.4B AI Partnership With Microsoft and Launch of Aether

Nebius Group NBIS | 87.69 | -6.99% |

- Microsoft recently announced a landmark multi-year AI compute partnership with Nebius Group, valued at up to US$19.4 billion, alongside the rollout of Nebius AI Cloud 3.0 "Aether," which brings new enterprise-grade features aimed at regulated industries.

- This collaboration not only expands Nebius's role in global AI infrastructure but also demonstrates accelerated demand for scalable, high-compliance cloud solutions among healthcare, financial services, and public sector clients.

- We'll now assess how this AI infrastructure partnership with Microsoft and the launch of "Aether" could reshape Nebius Group’s investment outlook.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Nebius Group Investment Narrative Recap

To be a shareholder in Nebius Group, you need to believe in the long-term, global expansion of AI infrastructure and the company's ability to capture recurring, enterprise-grade cloud demand. The recent Microsoft partnership and rollout of AI Cloud 3.0 "Aether" reinforce Nebius's access to high-value clients and advanced technology, but the main short-term catalyst remains the company's rapid revenue growth versus the biggest risk of continued heavy capital spending and potential regulatory hurdles, neither of which are materially altered by this announcement.

One of the most relevant recent developments is the lock-up expiration on October 26, 2025, which could introduce volatility as a large volume of shares become available to trade just weeks after the Microsoft deal. How this absorption of new supply interacts with investor appetite will test market conviction in Nebius's growth trajectory and could quickly sharpen focus on the company's ability to sustain its capital requirements.

By contrast, investors should be aware of how persistent regulatory scrutiny and rising compliance costs in Nebius’s core markets could still...

Nebius Group's narrative projects $3.2 billion revenue and $428.7 million earnings by 2028. This requires 133.9% yearly revenue growth and a $238.5 million earnings increase from $190.2 million today.

Uncover how Nebius Group's forecasts yield a $156.40 fair value, a 47% upside to its current price.

Exploring Other Perspectives

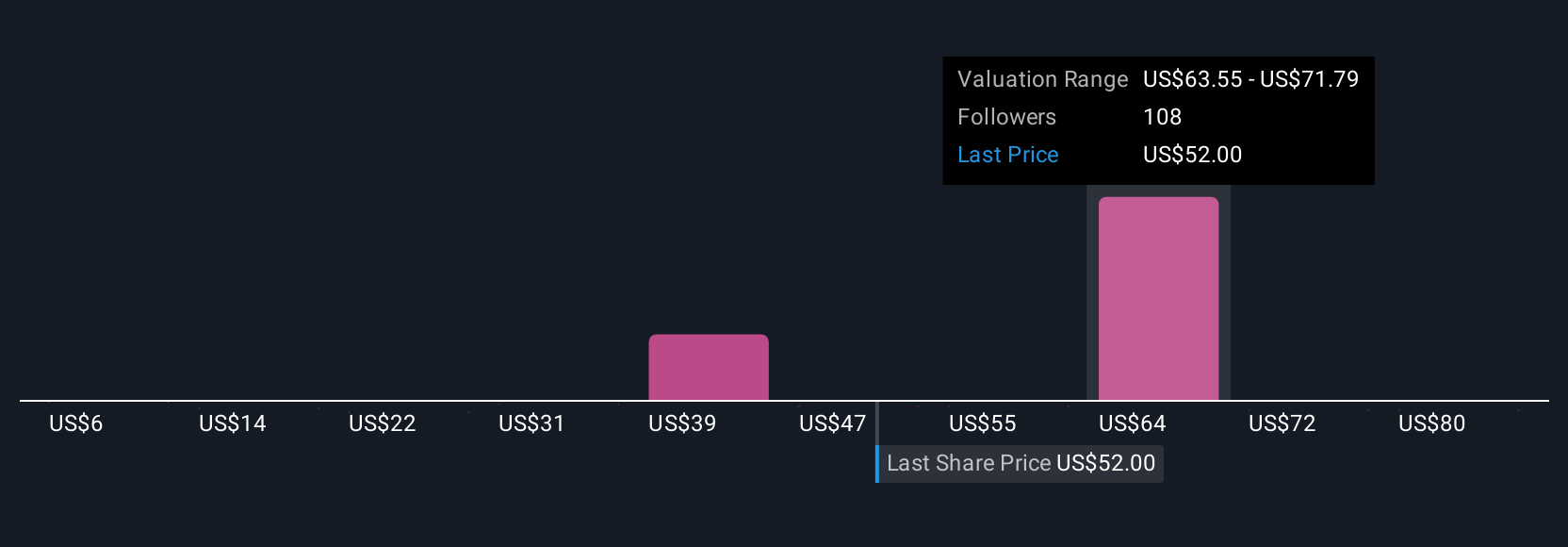

Simply Wall St Community members submitted 38 fair value estimates ranging from US$7.35 to US$269.80 per share. While many anticipate sustained high growth, the views on competitive threats and compliance challenges vary widely, offering you several alternative perspectives to explore.

Explore 38 other fair value estimates on Nebius Group - why the stock might be worth over 2x more than the current price!

Build Your Own Nebius Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nebius Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Nebius Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nebius Group's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.