Please use a PC Browser to access Register-Tadawul

Why Onto Innovation (ONTO) Is Up 6.6% After Launching Its AI-Focused Atlas G6 Metrology System

Onto Innovation ONTO | 156.36 | -2.50% |

- Onto Innovation Inc. recently introduced the Atlas G6 optical critical dimension metrology system, designed to meet the precise process control requirements of advanced semiconductor nodes, especially for gate-all-around logic and high bandwidth memory supporting AI applications.

- With multiple production orders already secured and advanced machine learning features improving yield and reliability for next-generation chips, the Atlas G6 directly addresses manufacturers' growing need for measurement accuracy at shrinking geometries.

- We'll explore how the Atlas G6's targeted support for AI-driven semiconductor architectures may impact Onto Innovation's broader investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Onto Innovation Investment Narrative Recap

To be a shareholder in Onto Innovation, investors need to believe in the long-term expansion of advanced semiconductor nodes and the company’s ability to deliver high-precision metrology solutions, especially for AI and high bandwidth memory manufacturing. The recent launch of the Atlas G6 directly targets a significant short-term catalyst, the expected rebound in customer demand for AI packaging and advanced logic nodes, but the actual revenue uplift will depend on how quickly customers increase spending. The biggest near-term risk remains a potential delay or weakness in this anticipated demand rebound; if major customers temporarily hold off on orders, this could limit immediate revenue gains from new product launches.

Among recent announcements, Onto Innovation's addition to the PHLX Semiconductor Sector Index stands out as relevant, signaling broader sector exposure and potential increased institutional interest. While index inclusion can enhance visibility for the stock, near-term momentum is still closely tied to adoption of solutions like the Atlas G6, especially as AI-driven manufacturing ramps up.

On the other hand, investors should be aware that revenue stability could be challenged if large customers…

Onto Innovation's projections estimate $1.4 billion in revenue and $311.2 million in earnings by 2028. This outlook assumes 11.0% annual revenue growth and a $111.3 million increase in earnings from the current $199.9 million.

Uncover how Onto Innovation's forecasts yield a $125.00 fair value, a 13% upside to its current price.

Exploring Other Perspectives

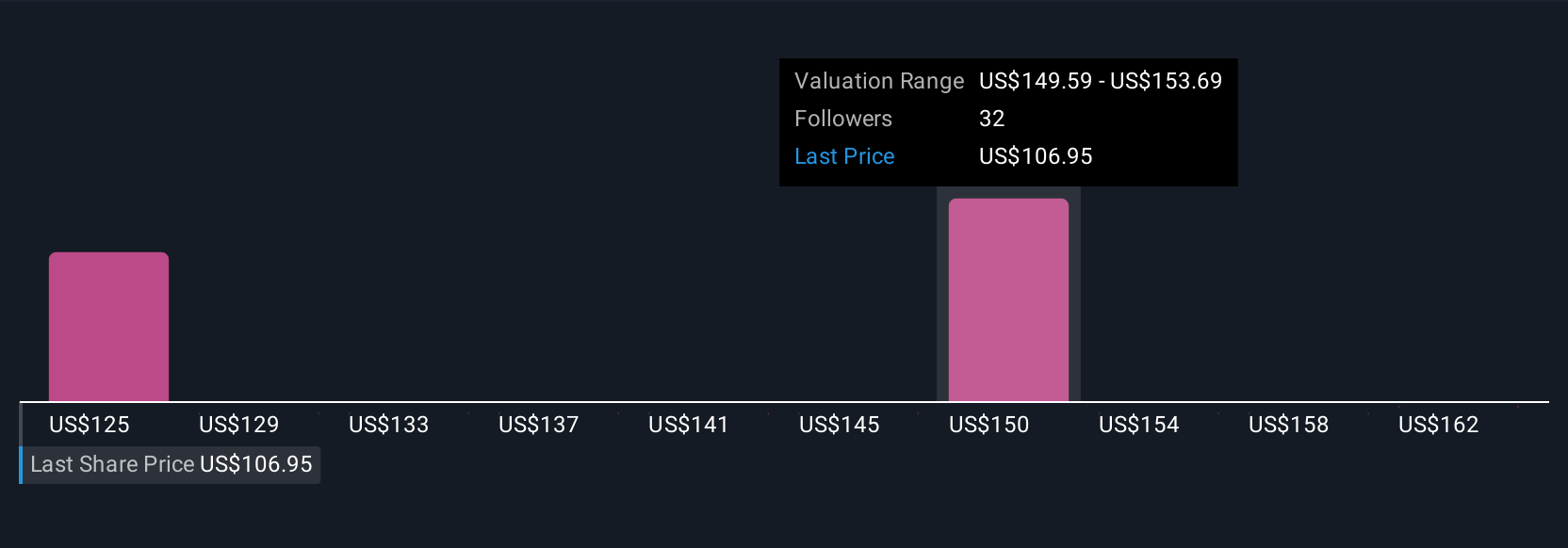

Four members of the Simply Wall St Community value Onto Innovation between US$125 and US$165.99 per share. With customer demand for next-generation AI packaging still uncertain in the coming quarters, it's important to consider how such differences in outlook might affect your own expectations for Onto's future performance.

Explore 4 other fair value estimates on Onto Innovation - why the stock might be worth just $125.00!

Build Your Own Onto Innovation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Onto Innovation research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Onto Innovation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Onto Innovation's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 25 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.