Please use a PC Browser to access Register-Tadawul

Why PDF Solutions (PDFS) Is Up 18.7% After Securing Major Semiconductor Analytics Expansion Deal

PDF Solutions, Inc. PDFS | 30.14 | -5.58% |

- PDF Solutions recently announced a multi-year agreement to expand the deployment of its eProbe tools, Characterization Vehicle infrastructure, and Exensio analytics software across several high-volume manufacturing facilities of a prominent global semiconductor manufacturer.

- This contract highlights the rising importance of integrating process characterization and advanced analytics to accelerate yield learning and variability control within the semiconductor industry.

- We'll explore how the expanded contract and full-year revenue guidance reaffirmation may reshape PDF Solutions' investment outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

PDF Solutions Investment Narrative Recap

To believe in PDF Solutions, investors need confidence in the ongoing digitization of semiconductor manufacturing and industry demand for advanced process analytics that drive yield improvements. The recent expansion of a multi-year agreement with a major semiconductor manufacturer serves as a major validation of PDF’s platform, providing short-term revenue visibility and supporting the company’s reaffirmed full-year growth outlook. However, the company’s reliance on large contracts still remains its most important risk, as customer concentration could quickly impact financial results if major accounts reduce spending or delay deployments.

The most relevant recent announcement is the reaffirmation of 2025 full-year revenue growth guidance at 21% to 23% compared to 2024. This guidance, confirmed after the new contract, signals management’s confidence that expanded deployments are translating into real business momentum and helps address near-term concerns around the pace and predictability of revenue generation amid heightened R&D and hiring.

In contrast, investors should also be aware that high customer concentration could leave revenue growth vulnerable if...

PDF Solutions' narrative projects $330.7 million revenue and $47.9 million earnings by 2028. This requires 19.0% yearly revenue growth and a $47.0 million increase in earnings from $859.0 thousand today.

Uncover how PDF Solutions' forecasts yield a $30.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

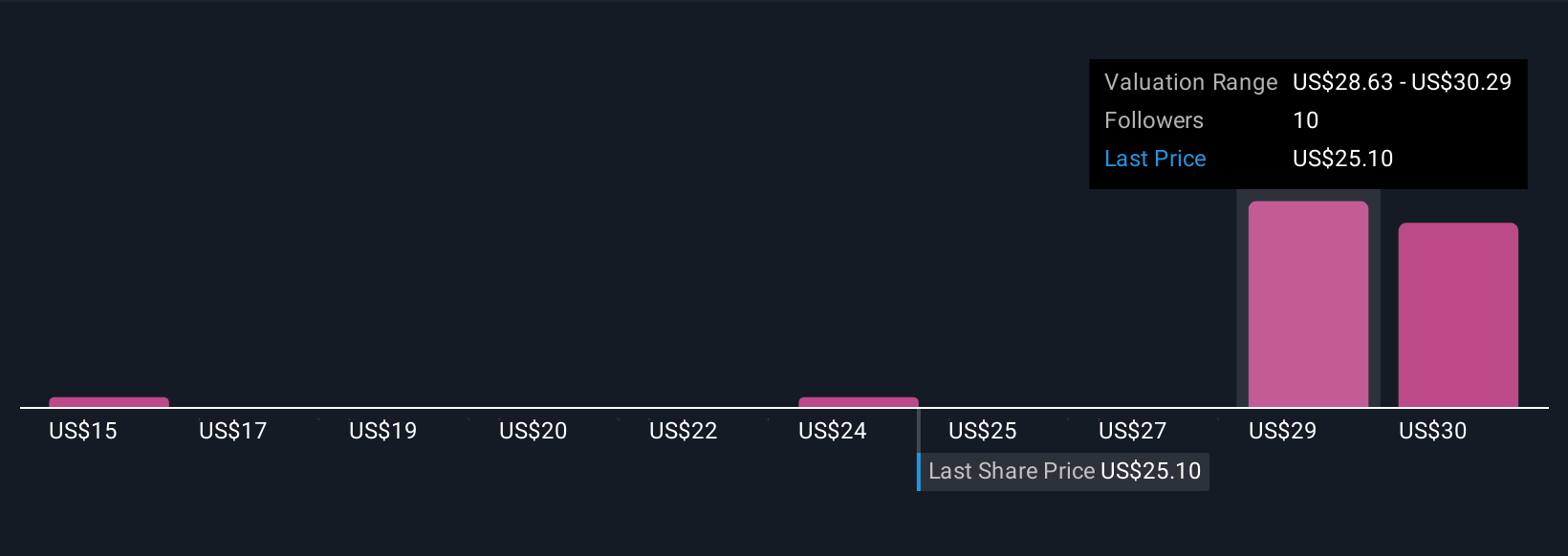

Six fair value estimates from the Simply Wall St Community range from US$15.40 to US$32.49 per share. While PDF Solutions’ platform expansion addresses manufacturer demand for data-driven process control, the differing views underline how investor opinions can move with changes in customer or contract stability.

Explore 6 other fair value estimates on PDF Solutions - why the stock might be worth as much as 24% more than the current price!

Build Your Own PDF Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PDF Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PDF Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PDF Solutions' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.