Please use a PC Browser to access Register-Tadawul

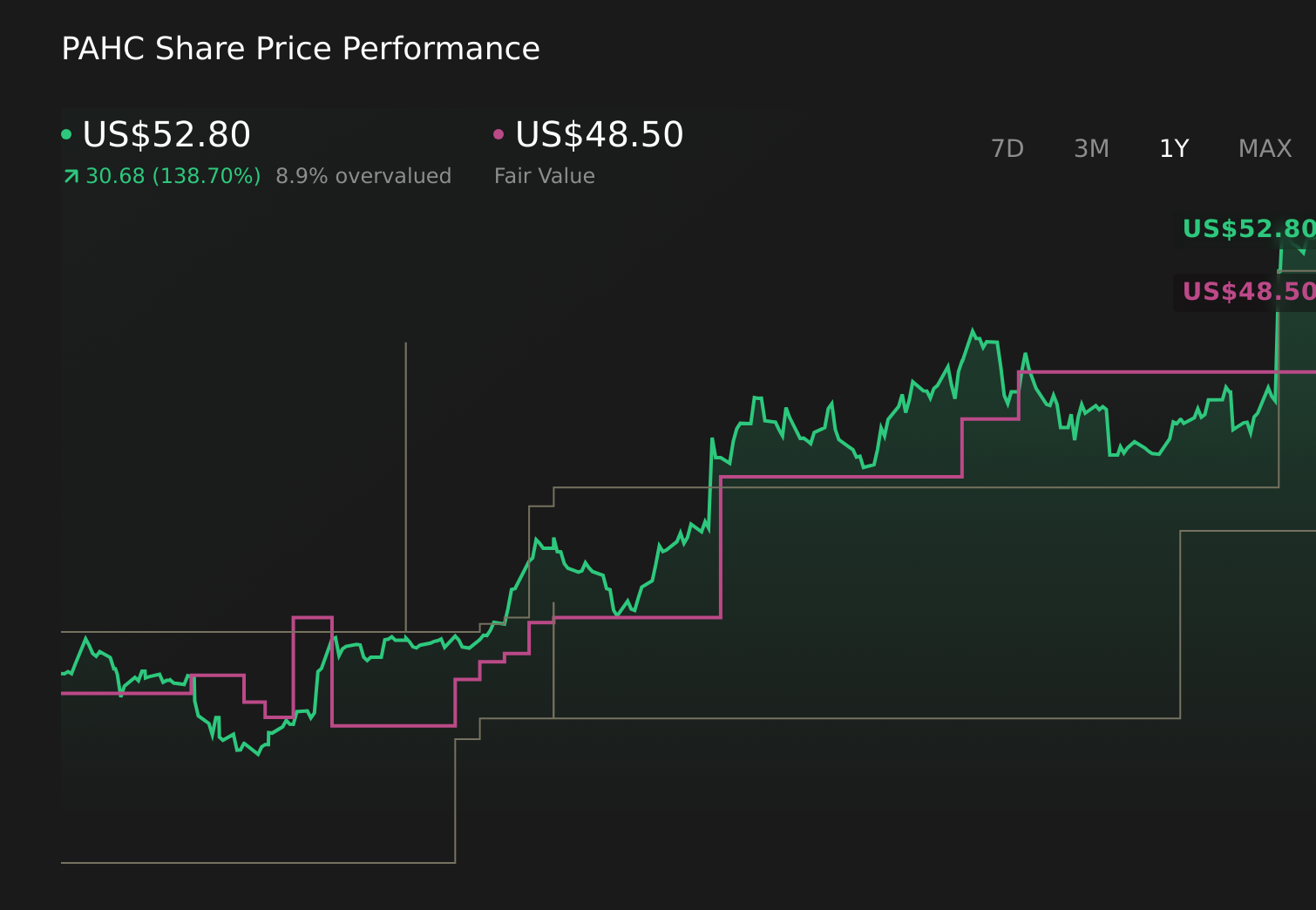

Why Phibro Animal Health (PAHC) Is Up 32.2% After Raising FY26 Guidance On Animal Health Strength

Phibro Animal Health Corporation Class A PAHC | 51.85 | +1.51% |

- In early February 2026, Phibro Animal Health reported stronger second-quarter results, with sales rising to US$373.91 million and net income reaching US$27.46 million, while also raising its fiscal 2026 guidance to net sales of US$1.45–1.50 billion and net income of US$85–95 million.

- A key driver was the Animal Health segment, where gains in medicated feed additives, nutritional specialties, and vaccines, supported by a recent acquisition, materially lifted earnings and underpinned the higher full-year outlook.

- We’ll now examine how this improved guidance, underpinned by Animal Health segment strength and the medicated feed additive acquisition, shapes Phibro’s investment narrative.

Uncover the next big thing with 24 elite penny stocks that balance risk and reward.

What Is Phibro Animal Health's Investment Narrative?

To own Phibro Animal Health, you need to be comfortable backing a fairly mature, cash‑generating animal health business where execution in its core Animal Health segment does much of the heavy lifting. The latest quarter, with stronger earnings and higher fiscal 2026 guidance to net sales of US$1.45–1.50 billion and net income of US$85–95 million, reinforces that story in the near term and helps explain the sharp share price move over recent weeks. Short term, the big catalysts now sit around how well Phibro integrates and grows its medicated feed additive acquisition and whether Animal Health margins hold up against input cost and competitive pressures. At the same time, the faster earnings ramp and regular US$0.12 dividend do not remove underlying concerns about leverage, cash generation, valuation and recent insider selling.

However, one issue around debt coverage and recent insider sales is something investors should not ignore. Phibro Animal Health's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on Phibro Animal Health - why the stock might be worth less than half the current price!

Build Your Own Phibro Animal Health Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Phibro Animal Health research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Phibro Animal Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Phibro Animal Health's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Invest in the nuclear renaissance through our list of 87 elite nuclear energy infrastructure plays powering the global AI revolution.

- The future of work is here. Discover the 28 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

- Capitalize on the AI infrastructure supercycle with our selection of the 33 best 'picks and shovels' of the AI gold rush converting record-breaking demand into massive cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.