Please use a PC Browser to access Register-Tadawul

Why Quanta Services (PWR) Is Up 5.1% After Grid Modernization Initiatives and What’s Next

Quanta Services, Inc. PWR | 438.11 | -6.17% |

- Recently, Quanta Services announced initiatives to align its operations with increasing utility investment, grid modernization, and the growth of U.S.-based energy and manufacturing in response to the Inflation Reduction Act.

- The company also highlighted supply-chain resilience efforts and accelerating demand for large-scale transmission and data center projects, supporting a strong business outlook into 2025.

- We'll explore how Quanta Services' U.S.-based transformer manufacturing investments reinforce its evolving investment narrative amid infrastructure modernization trends.

Quanta Services Investment Narrative Recap

To be a Quanta Services shareholder, you’d need confidence in large-scale infrastructure upgrades, utility grid modernization, and resilient energy supply, driven by long-term investment trends and policies like the Inflation Reduction Act. The recent focus on U.S.-based transformer manufacturing strengthens Quanta’s short-term catalyst of expanding transmission and data center projects, but regulatory and permitting risks remain the most significant threats to timely project execution; no material change to this risk is evident in the latest news.

Among the recent announcements, securing nearly US$1.7 billion in new long-distance transmission contracts stands out as especially pertinent. These wins tie directly into higher utility spending and demand for grid modernization, reinforcing the drivers behind Quanta’s current growth outlook and its reliance on a robust project pipeline.

Yet, in contrast to the upbeat momentum, investors should be alert to the possibility of unforeseen project delays that...

Quanta Services' outlook projects $34.4 billion in revenue and $1.7 billion in earnings by 2028. This assumes 11.5% annual revenue growth and an increase in earnings of about $770 million from the current $930.7 million.

Exploring Other Perspectives

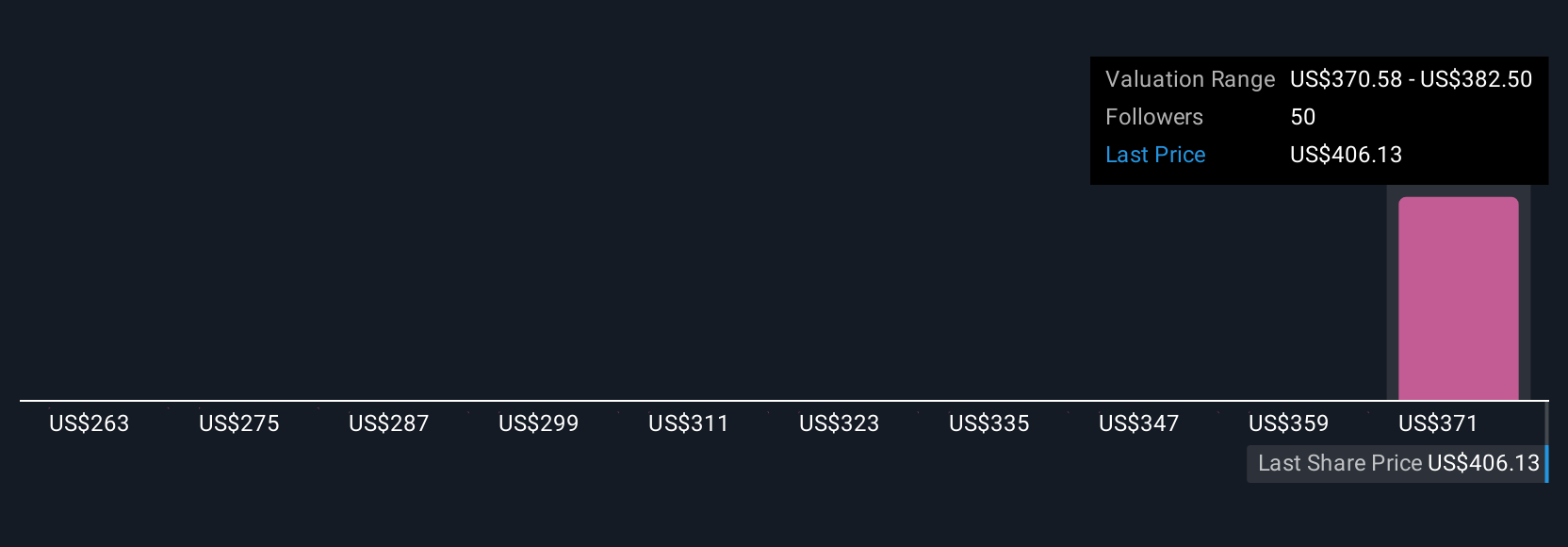

Simply Wall St Community members provided four fair value estimates for Quanta Services, ranging widely from US$250.52 to US$397.92 per share. While large-scale project wins fuel optimism, regulatory or permitting setbacks remain important factors influencing future performance, take a look at how investor opinions differ.

Build Your Own Quanta Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quanta Services research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Quanta Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quanta Services' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.