Please use a PC Browser to access Register-Tadawul

Why Quantum Computing (QUBT) Is Down 9.0% After Reports of Potential Federal Equity Investment

Quantum Computing Inc. QUBT | 12.05 | -6.08% |

- In the past week, reports surfaced that the Trump administration is exploring acquiring equity stakes in several major U.S. quantum computing companies, including Quantum Computing Inc., in exchange for federal funding to enhance national leadership in quantum technology.

- This rare move signals an unprecedented potential for direct federal involvement in the sector, which could speed up research, reduce capital constraints, and reshape industry dynamics as quantum computing becomes increasingly critical on the global stage.

- We'll examine how the prospect of federal equity investment could alter Quantum Computing Inc.'s investment narrative and broader growth opportunities.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Quantum Computing's Investment Narrative?

To be a shareholder in Quantum Computing Inc. right now, conviction centers on the idea that quantum technology could transform critical industries and, if executed well, QUBT’s bold investments in new facilities, acquisitions, and government partnerships will secure early advantages. News that the Trump administration might acquire equity stakes in key U.S. quantum firms injects both excitement and uncertainty into the near-term picture. If government ownership materializes, that could reshape short-term catalysts by improving QUBT’s access to capital, fostering new contract opportunities, and elevating the company’s strategic profile. Yet, even with speculation driving short-lived price moves, underlying risks remain unchanged, QUBT’s minimal revenue, persistent losses, heavy competition (including Google’s headline breakthroughs), unresolved legal issues, and significant insider selling all weigh as real challenges. Whether or not federal investment eventuates, the company’s actual operating results and ability to deliver meaningful commercial breakthroughs still dominate the risk-reward balance. On the flip side, ongoing insider selling deserves close attention from investors.

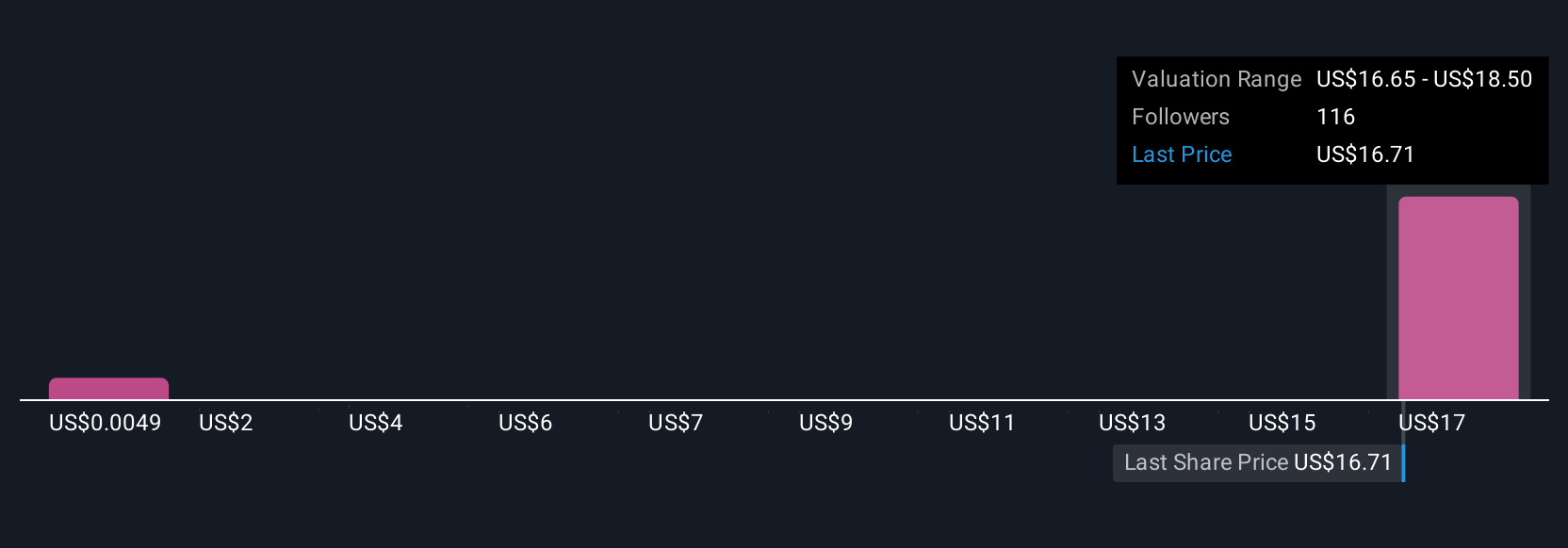

In light of our recent valuation report, it seems possible that Quantum Computing is trading beyond its estimated value.Exploring Other Perspectives

Explore 31 other fair value estimates on Quantum Computing - why the stock might be worth less than half the current price!

Build Your Own Quantum Computing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quantum Computing research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Quantum Computing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quantum Computing's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.