Please use a PC Browser to access Register-Tadawul

Why Summit Therapeutics (SMMT) Is Up After AstraZeneca Licensing Talks For Cancer Drug

Summit Therapeutic SMMT | 17.57 | -2.33% |

- Summit Therapeutics has entered advanced negotiations with AstraZeneca for the potential licensing of its experimental lung cancer drug, ivonescimab, in a deal reportedly valued up to US$15 billion and involving significant upfront and milestone payments.

- An important insight from these talks is that despite ivonescimab not yet achieving statistically significant overall survival benefits, the drug is drawing major pharmaceutical interest, reflecting its perceived promise in the competitive oncology market.

- We’ll explore how AstraZeneca’s interest in ivonescimab could shift Summit Therapeutics’ investment narrative and spotlight its oncology potential.

What Is Summit Therapeutics' Investment Narrative?

For anyone considering Summit Therapeutics, the key idea is a bold pivot: investing here is a bet on the clinical and commercial future of ivonescimab, with Summit’s entire story tied to the high-risk, high-reward world of oncology drug development. Recent news of negotiations with AstraZeneca for a potential US$15 billion licensing deal has clearly shifted the short-term narrative, creating new possibilities for non-dilutive funding and industry validation that simply didn’t exist before.

Recent index changes, removal from multiple value and small cap benchmarks and inclusion in large-cap growth indexes, further signal a shift in perception from value to growth. Risks, however, remain substantial: Summit is still unprofitable, with a lengthy runway to revenue, a heavy reliance on regulatory milestones, and its lead drug did not deliver statistically significant overall survival in late-stage trials. The AstraZeneca news could ease dilution worries in the near term but also intensifies scrutiny on whether ivonescimab will ever reach commercial success. Keep in mind, the FDA’s bar for approval is still a significant hurdle investors should watch.

Exploring Other Perspectives

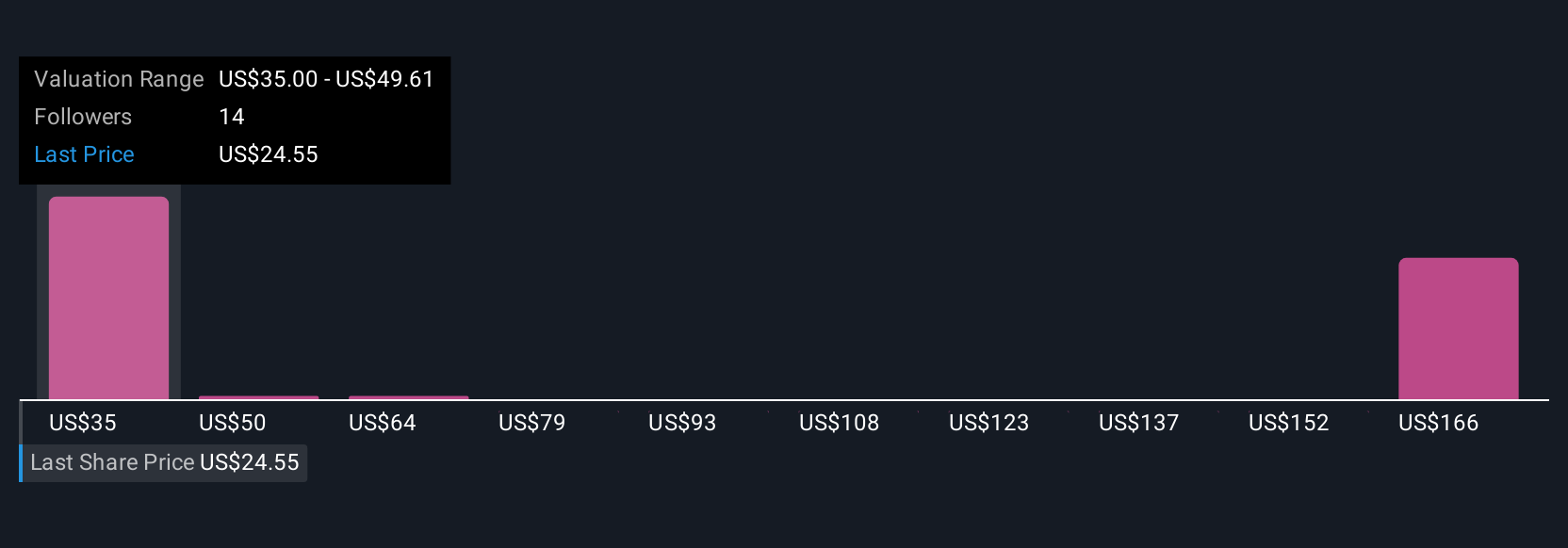

Fair value estimates from four Simply Wall St Community members range from US$35.00 up to US$181.04 per share, highlighting very large differences in how participants project Summit’s future. With this diversity of opinion, keep in mind that near-term catalysts around regulatory outcomes remain a prominent source of both risk and potential.

Build Your Own Summit Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Summit Therapeutics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Summit Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Summit Therapeutics' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.