Please use a PC Browser to access Register-Tadawul

Why Super Micro Computer (SMCI) Is Up After Raising 2026 Revenue Guidance on Surging AI Demand

Super Micro Computer, Inc. SMCI | 33.76 33.54 | +13.78% -0.65% Pre |

- In early November 2025, Super Micro Computer raised its full-year 2026 revenue guidance to at least US$36 billion, following mixed first-quarter results and the release of new second-quarter outlook figures.

- This upward guidance was supported by analyst upgrades and highlights strong demand for the company’s AI GPU platforms, which now account for over 75% of total sales and help drive a multi-billion dollar order backlog.

- We'll examine how the higher revenue outlook and robust AI demand reshape Super Micro Computer's long-term investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Super Micro Computer Investment Narrative Recap

To be a shareholder in Super Micro Computer, you need to believe in the continued global build-out of AI infrastructure and the company’s unique position as a fast-moving, high-performance server provider. The recent upward revision in full-year revenue guidance to at least US$36 billion highlights robust AI-driven order momentum, but does not materially resolve the critical short-term catalyst, ongoing enterprise adoption of new AI architectures, or the persistent risk posed by heavy dependence on a small number of very large customers.

Of all the recent company announcements, the raised revenue guidance stands out as most relevant. Not only does it reinforce surging demand for Super Micro’s AI GPU platforms, but it also fuels optimism that the company can turn its multi-billion dollar order backlog into meaningful sales acceleration, a key catalyst that could reshape perceptions of growth consistency in the coming quarters.

Yet, against these upbeat projections, investors should also be alert to the realities that come with customer concentration risk if orders shift or taper off unexpectedly...

Super Micro Computer's outlook anticipates $48.2 billion in revenue and $2.4 billion in earnings by 2028. This scenario assumes 29.9% annual revenue growth and a $1.4 billion earnings increase from the current $1.0 billion.

Uncover how Super Micro Computer's forecasts yield a $50.94 fair value, a 49% upside to its current price.

Exploring Other Perspectives

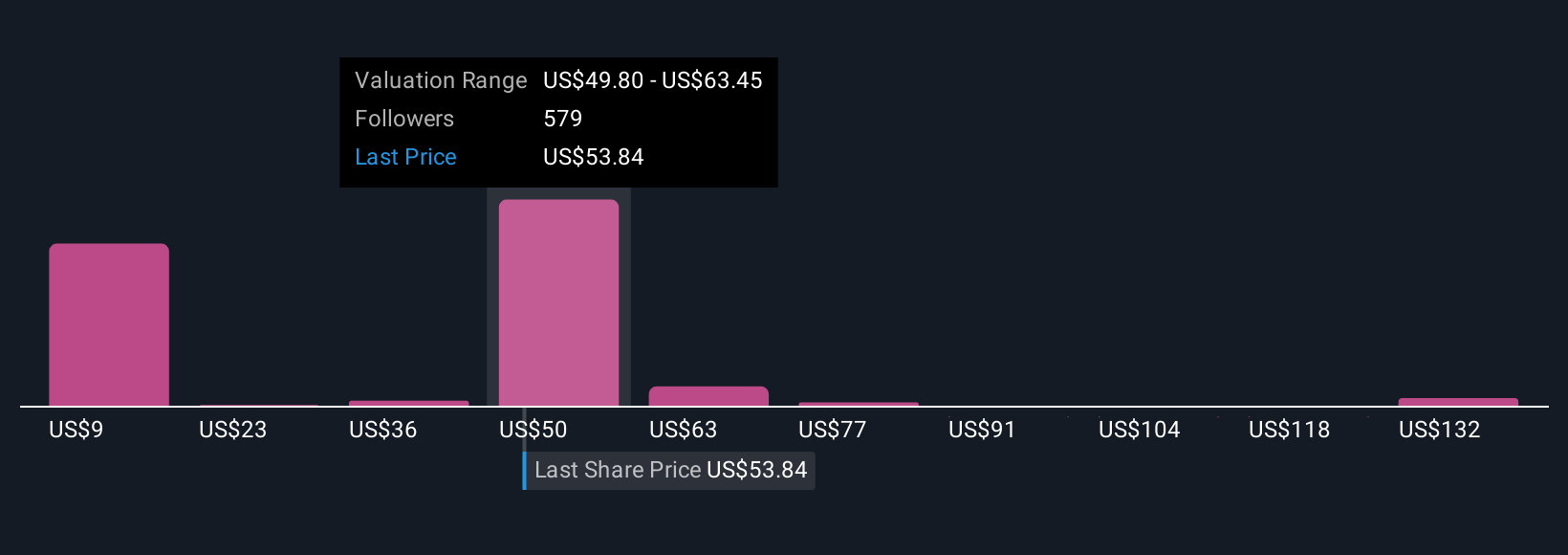

Thirty-five members of the Simply Wall St Community value Super Micro Computer between US$49.35 and US$82.39 per share, offering a wide spectrum of opinion. With multi-billion dollar AI orders underpinning the company’s revenue forecasts, it is worth considering how concentrated customer exposure could influence both performance and sentiment going forward.

Explore 35 other fair value estimates on Super Micro Computer - why the stock might be worth just $49.35!

Build Your Own Super Micro Computer Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Super Micro Computer research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Super Micro Computer research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Super Micro Computer's overall financial health at a glance.

No Opportunity In Super Micro Computer?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.