Please use a PC Browser to access Register-Tadawul

Why TechnipFMC (FTI) Is Up 6.9% After Securing Major Petrobras Subsea Contracts in Brazil

FMC Technologies, Inc. FTI | 46.32 46.32 | -0.22% 0.00% Pre |

- Earlier in September 2025, TechnipFMC announced it was awarded two major subsea contracts by Petrobras to design, engineer, and manufacture flexible pipes for offshore projects in Brazil's Santos and Campos Basins, with manufacturing to take place at its facility in Acu.

- This client win underscores TechnipFMC’s sustained leadership in advanced subsea technology and its continued contribution to local industrial growth in Brazil.

- We'll explore how these Petrobras contract wins could impact TechnipFMC's near-term revenue visibility and positioning in the subsea market.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

TechnipFMC Investment Narrative Recap

To believe in TechnipFMC as a shareholder, one must have confidence in the long-term resilience of global offshore oil and gas development and the company’s edge in subsea innovation. The recent Petrobras contract wins provide a substantial boost to near-term revenue visibility, supporting backlog and market share, but the biggest near-term risk remains the company’s exposure to project delays or volatility in offshore capex cycles. If the momentum from contract awards falters, unpredictable operator spending could still weigh on results.

Among recent developments, the significant iEPCI contract awarded by Equinor in July 2025 is especially relevant. It expands TechnipFMC’s integrated solutions reach beyond Brazil to the Norwegian North Sea, reinforcing the importance of a robust project pipeline and diversified geographical exposure as critical catalysts for sustained performance.

Yet, despite this favorable momentum, investors should also recognize that longer-term sector trends, such as energy transition pressures, could present structural challenges...

TechnipFMC is projected to reach $11.3 billion in revenue and $1.2 billion in earnings by 2028. This outlook assumes a 5.8% annual revenue growth rate and a $262.5 million increase in earnings from the current $937.5 million.

Uncover how TechnipFMC's forecasts yield a $41.14 fair value, in line with its current price.

Exploring Other Perspectives

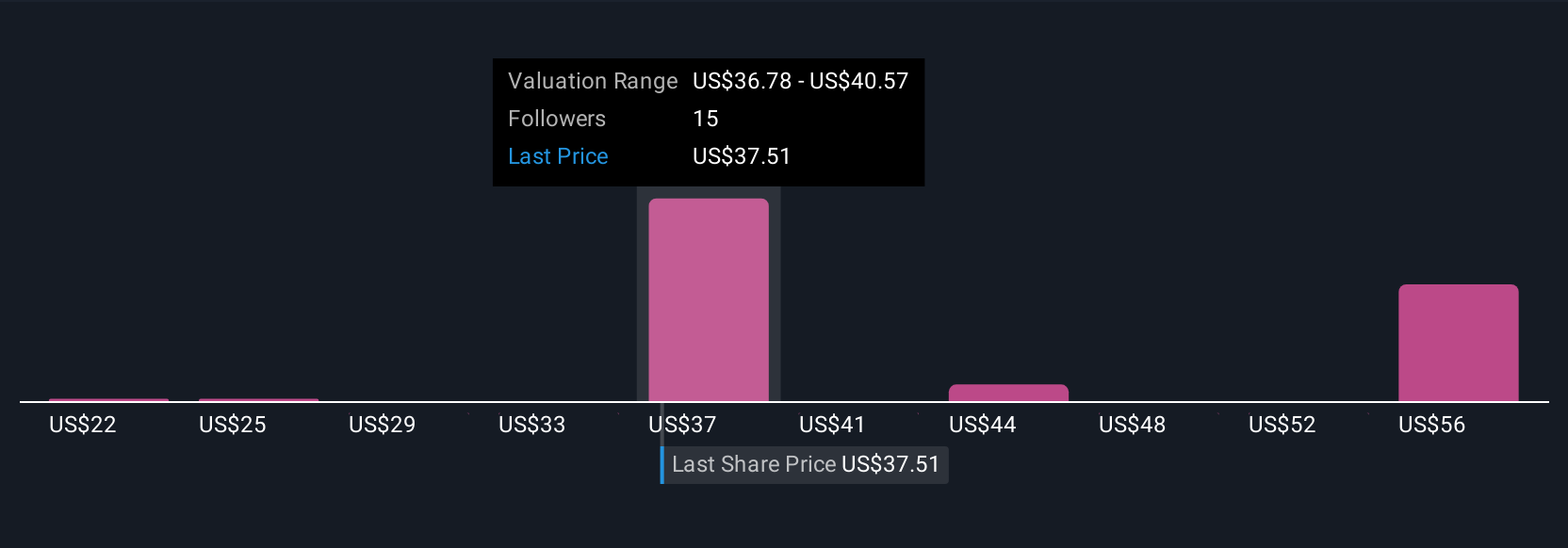

Five members of the Simply Wall St Community provided fair values for TechnipFMC, ranging from US$21.65 to US$50.72 per share. While contract wins support revenue visibility, broad investor opinion highlights how future energy transition trends could significantly impact the company’s growth and valuation expectations.

Explore 5 other fair value estimates on TechnipFMC - why the stock might be worth 47% less than the current price!

Build Your Own TechnipFMC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TechnipFMC research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free TechnipFMC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TechnipFMC's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.