Please use a PC Browser to access Register-Tadawul

Why ThredUp (TDUP) Is Up 18.1% After Strong Q2 Growth and Upbeat Guidance – And What's Next

thredUP, Inc. Class A TDUP | 4.64 | -3.73% |

- ThredUp Inc. recently reported second-quarter results, highlighting a 16% year-over-year sales increase to US$77.66 million and a substantial reduction in net loss to US$5.18 million.

- The company also issued robust revenue guidance for the upcoming quarters and full year 2025, indicating confidence in sustained growth and improved operational performance.

- We’ll examine how ThredUp’s continued revenue growth and improved profitability outlook shape its investment narrative amid evolving market drivers.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

ThredUp Investment Narrative Recap

To be a ThredUp shareholder, you need to believe in the continued expansion of online resale, consumer willingness to buy secondhand, and the company’s ability to sustain revenue growth while narrowing losses. The recent strong quarterly results and upgraded revenue guidance may provide momentum for the stock, but the key near-term catalyst remains ThredUp’s capacity to maintain topline growth without further escalating marketing and logistics costs. The biggest risk is still the potential for higher customer acquisition costs or margin pressure, though this quarter’s news does not materially shift that risk.

Among recent announcements, ThredUp’s earnings guidance stands out: management is forecasting third-quarter revenue growth of 25% year-over-year at the midpoint, and full-year revenue growth of 15%. This aligns with the current growth narrative and underscores that maintaining rapid revenue momentum will be crucial, especially as competition continues to increase and marketing spends stay high.

However, investors should be aware that if rising logistics and processing costs per item were to outpace revenue growth...

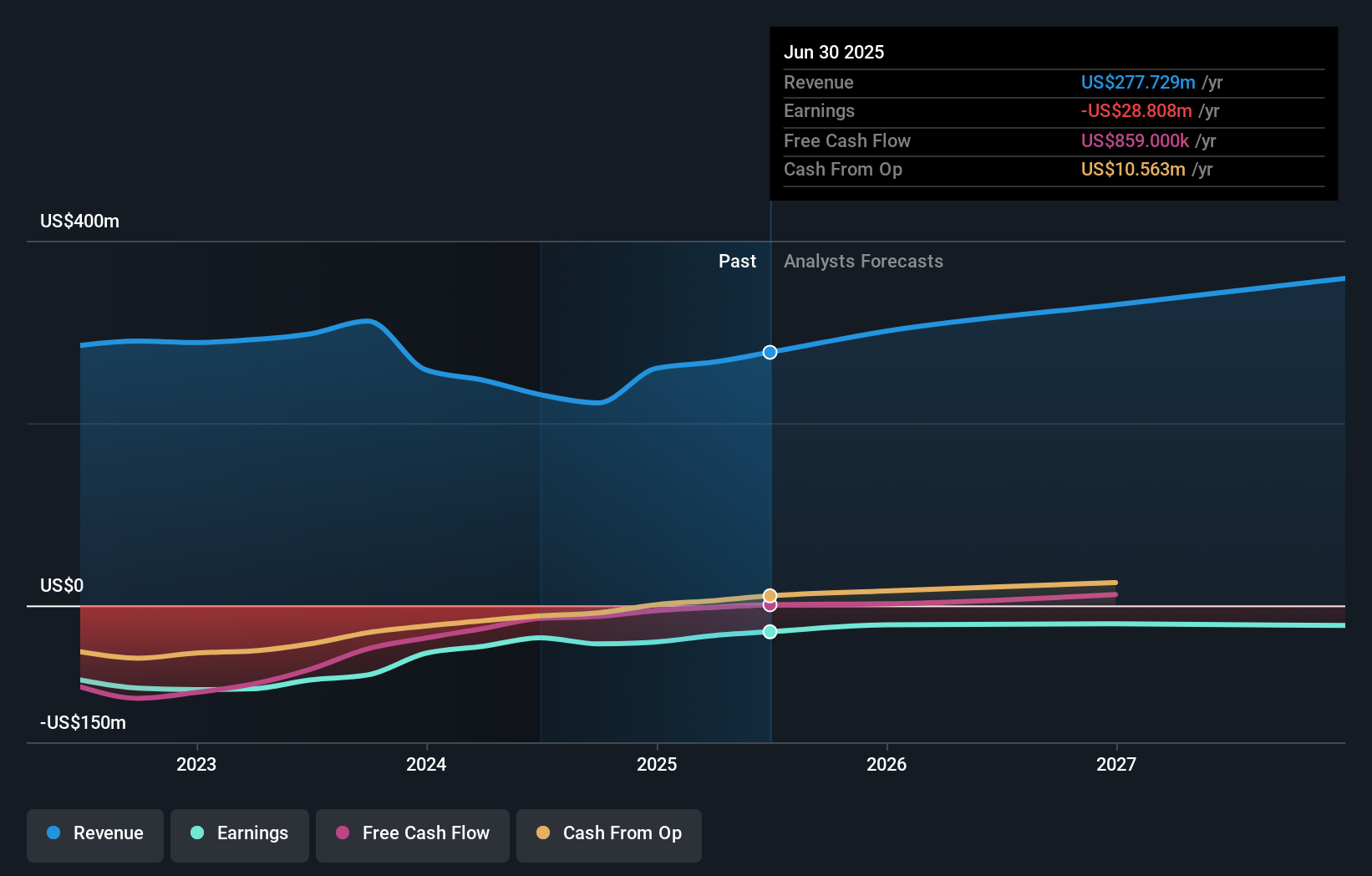

ThredUp's outlook anticipates $379.2 million in revenue and $17.0 million in earnings by 2028. This projection is based on an annual revenue growth rate of 10.9% and a $45.8 million improvement in earnings from the current level of -$28.8 million.

Uncover how ThredUp's forecasts yield a $13.00 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members shared two fair value estimates for ThredUp stock, ranging from US$12.14 to US$13. Strong consensus on double-digit growth potential contrasts with ongoing concerns about intensifying competition affecting margins. See how other market participants are weighing these factors.

Explore 2 other fair value estimates on ThredUp - why the stock might be worth just $12.14!

Build Your Own ThredUp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ThredUp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ThredUp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ThredUp's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.