Please use a PC Browser to access Register-Tadawul

Why TPG (TPG) Is Up 10.5% After Earnings Beat and New Private Markets Fundraising Progress

TPG Inc Class A TPG | 44.51 | -0.16% |

- Earlier this month, TPG Inc. reported second quarter 2025 earnings, achieving US$920.54 million in revenue and a turnaround to US$14.94 million in net income, alongside the declaration of a quarterly dividend and new fundraising progress for its GP-led vehicle.

- An intriguing development is TPG's ongoing discussions to invest in high-growth sectors like digital banking, underscoring the firm's active capital deployment and continued momentum in private markets fundraising.

- We'll examine how TPG’s earnings outperformance and fundraising success impact the company’s investment narrative and future capital allocation outlook.

AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

TPG Investment Narrative Recap

To be a TPG shareholder, one must believe in the firm's ability to outpace fundraising challenges through product innovation, platform expansion, and strong capital deployment into high-growth sectors. The recent Q2 earnings beat and robust revenue growth are positives, but ongoing headwinds in private markets fundraising remain the central risk, as they could directly constrain future fee growth and AUM expansion if institutional allocations slow. The magnitude of this risk is not materially reduced by the latest results, as industry sentiment around alternatives allocations remains cautious.

Among TPG’s recent announcements, the first close of its second GP-led vehicle at US$1.3 billion is particularly relevant. This milestone underscores ongoing investor appetite for specialized private equity structures and ties directly to TPG’s near-term growth catalysts, reinforcing the importance of continued fundraising success in supporting both capital deployment and earnings outlook.

However, while fundraising momentum is encouraging, investors should also be aware that in contrast, any prolonged downturn in private markets capital flows could materially weaken TPG’s earnings visibility...

TPG's narrative projects $2.2 billion revenue and $836.8 million earnings by 2028. This requires a 15.4% annual revenue decline and an earnings increase of $835.6 million from current earnings of $1.2 million.

Uncover how TPG's forecasts yield a $64.08 fair value, a 4% upside to its current price.

Exploring Other Perspectives

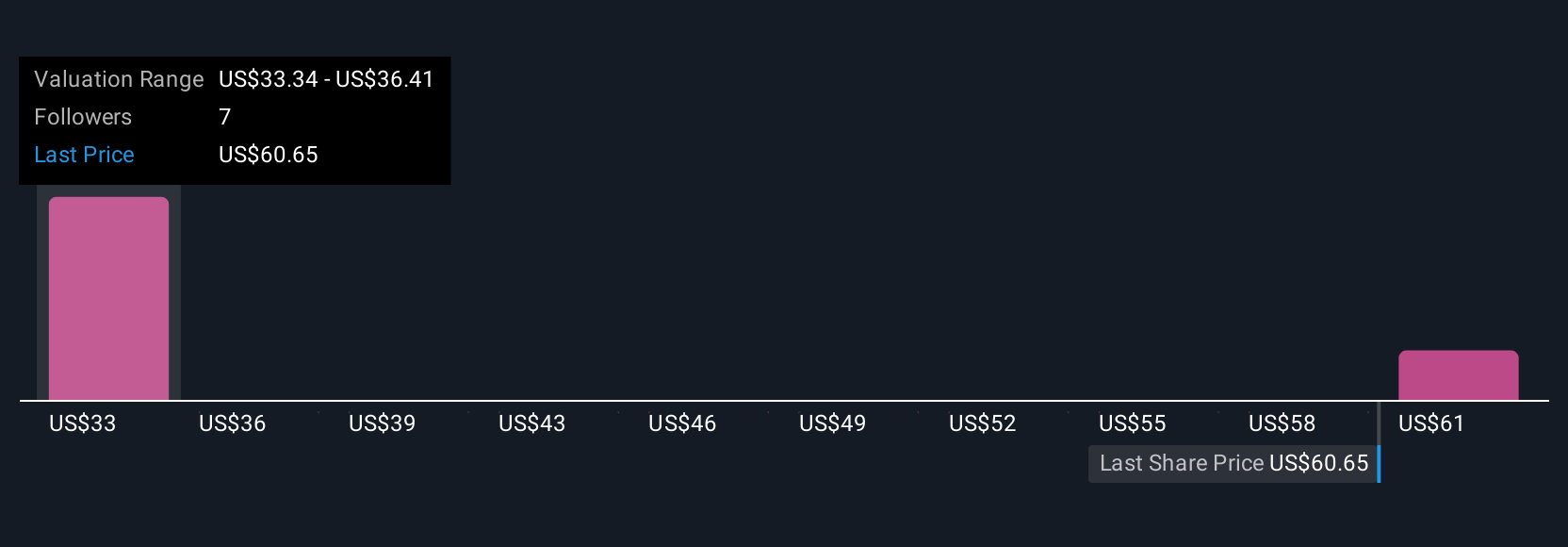

Two members of the Simply Wall St Community set fair value targets for TPG between US$33.18 and US$64.08, showing widely differing expectations. While many focus on growth catalysts like successful fundraising rounds, sustained private markets headwinds could alter these outlooks, explore more views to see how others assess TPG’s prospects.

Explore 2 other fair value estimates on TPG - why the stock might be worth 46% less than the current price!

Build Your Own TPG Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TPG research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TPG research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TPG's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.