Please use a PC Browser to access Register-Tadawul

Why Tri Pointe Homes (TPH) Is Up 7.7% After Launching Two New Communities and What's Next

TRI Pointe Group Inc TPH | 33.74 | -0.62% |

- Earlier this month, Tri Pointe Homes celebrated the grand openings of two major residential communities: The Tides at River Islands in California and Altis at Serenity in North Carolina, its first 55+ lifestyle community on the East Coast.

- These developments underscore Tri Pointe's expansion into new markets and homebuyer segments, highlighting ongoing efforts to diversify its portfolio and reach new customer bases.

- We'll explore how expansion into the 55+ market could influence Tri Pointe Homes' outlook and future investment narrative.

Tri Pointe Homes Investment Narrative Recap

To be a shareholder in Tri Pointe Homes, you need to believe in its ability to expand into new markets and diversify its offerings, particularly through premium single-family communities and active adult living segments. While the recent grand openings in California and North Carolina showcase diversification, they are not likely to have a material short-term impact on the biggest catalysts, such as improving absorption rates in core markets, or resolve the key risk of a sluggish spring selling season that could affect home orders and revenues.

The recent grand opening of Altis at Serenity, Tri Pointe’s first 55+ community on the East Coast, stands out for its relevance to the company's strategy of targeting new demographics, addressing the catalyst of future revenue growth through geographic and buyer segment expansion. As Tri Pointe looks to broaden its footprint, monitoring the take-up rate and demand for these new developments remains important. However, it's equally important not to overlook the potential earnings pressure if incentives increase to support slower selling conditions elsewhere...

Tri Pointe Homes' outlook projects $3.1 billion in revenue and $161.2 million in earnings by 2028. This assumes a 10.8% annual revenue decline and an earnings decrease of $261.8 million from current earnings of $423.0 million.

Exploring Other Perspectives

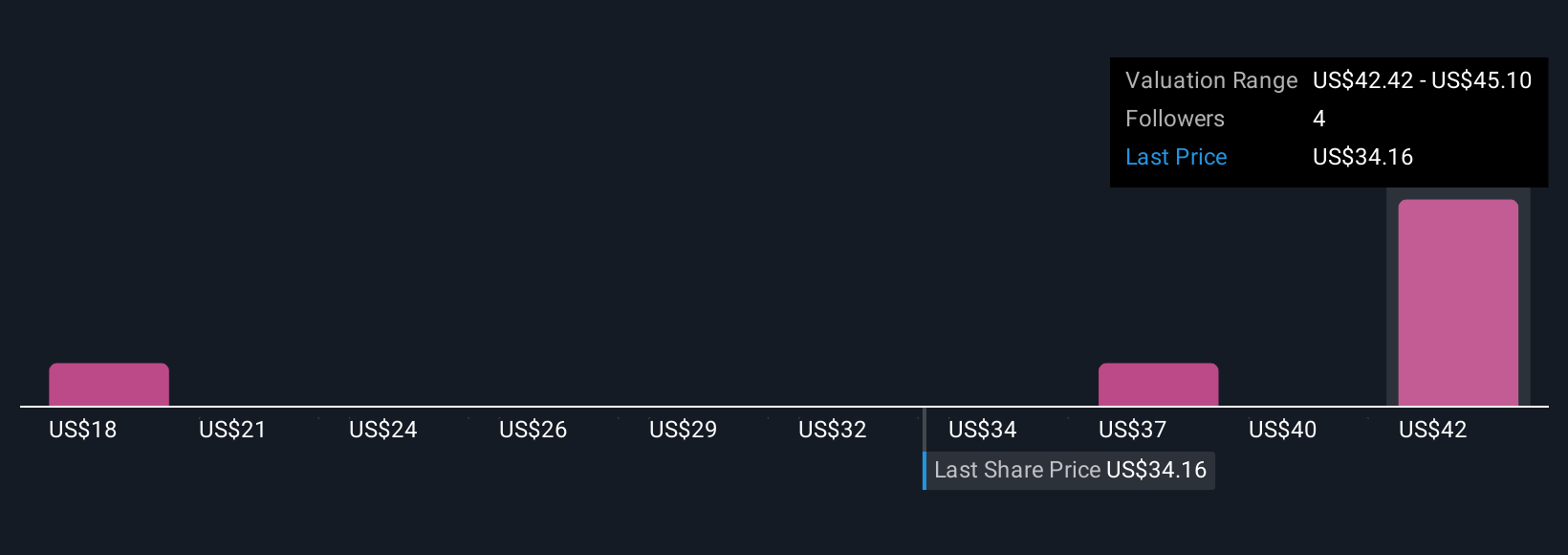

Three private investors in the Simply Wall St Community have estimated Tri Pointe’s fair value between US$18.35 and US$39.10. While opinions span this wide range, the specter of a weaker selling season continues to influence sentiment and could play a role in shaping the stock’s performance, explore how others see it playing out.

Build Your Own Tri Pointe Homes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tri Pointe Homes research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Tri Pointe Homes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tri Pointe Homes' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.