Please use a PC Browser to access Register-Tadawul

Why Triumph Financial (TFIN) Is Down 7.4% After Major Tricolor Holdings Loan Exposure – And What's Next

Triumph Financial, Inc. - Common Stock TFIN | 62.48 | +0.35% |

- Earlier this week, Tricolor Holdings, LLC, the lead borrower on a US$60.5 million loan facility from Triumph Financial’s subsidiary TBK Bank, filed for Chapter 7 bankruptcy.

- This situation puts Triumph Financial’s exposure to potential loan losses in focus, as the company steps up efforts to secure and consolidate its vehicle collateral.

- We'll examine how this increased credit risk spotlight may impact Triumph Financial's investment narrative going forward.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Triumph Financial Investment Narrative Recap

Long-term holders of Triumph Financial typically believe in the company's leadership position in digital freight finance and the growth opportunity tied to its technology-driven factoring, payments, and data intelligence solutions. The recent Chapter 7 bankruptcy by Tricolor Holdings and the US$60.5 million loan exposure through TBK Bank brings heightened attention to Triumph's credit risk management, potentially making credit quality the main short-term catalyst and risk to monitor now, as further losses or successful collateral recovery could impact upcoming results.

Among recent announcements, the Q2 2025 earnings report is especially relevant, as it recorded a year-on-year increase in net interest income alongside modest net income growth. With current credit exposures in the spotlight, ongoing earnings results and asset quality metrics may serve as critical indicators for how the company is handling risk and maintaining growth momentum.

Still, compared to earlier optimism about Triumph’s asset quality, investors should be aware of further adverse credit developments that could suddenly affect...

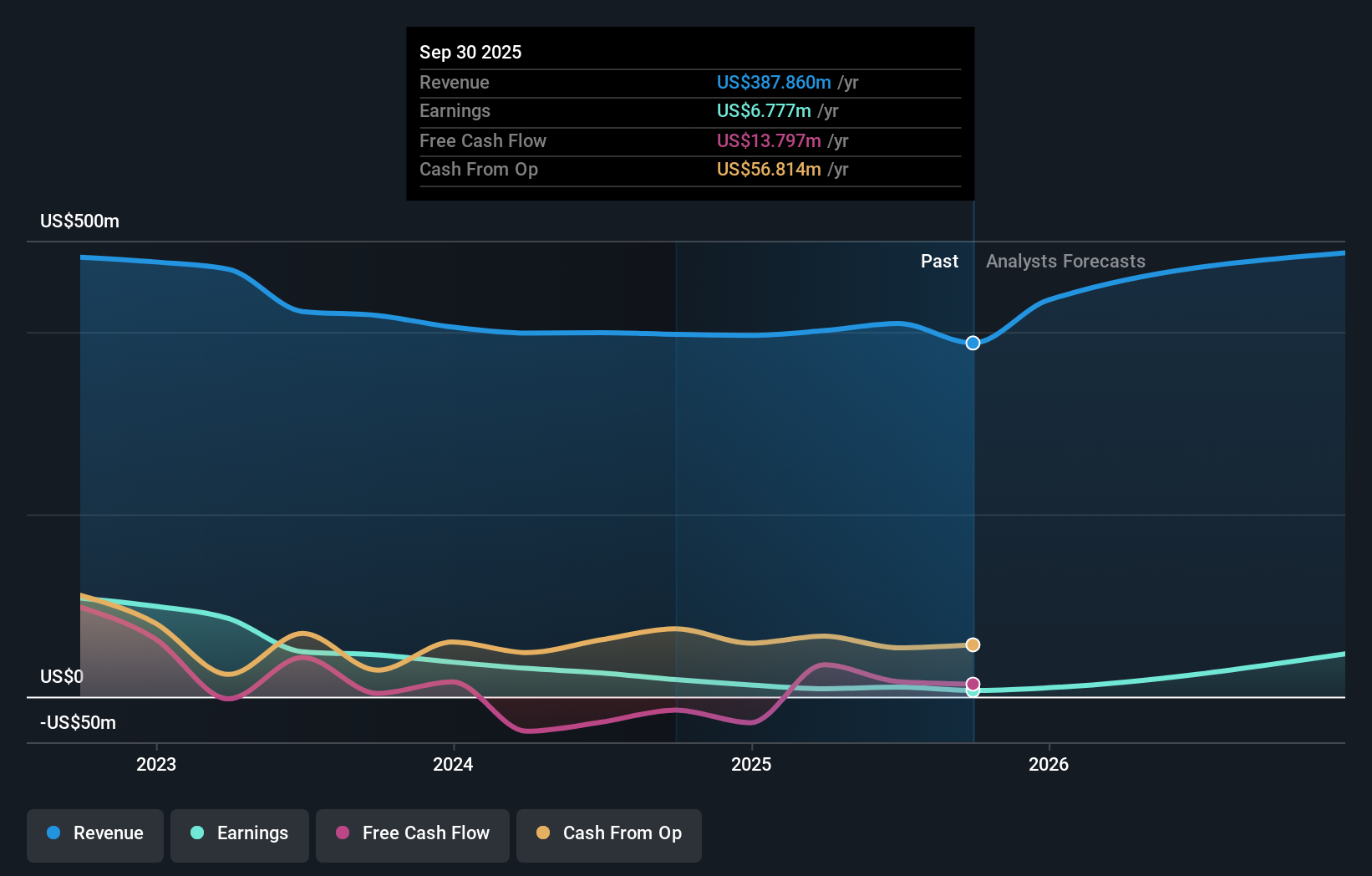

Triumph Financial's outlook anticipates $602.4 million in revenue and $131.3 million in earnings by 2028. This is based on a projected 13.8% annual revenue growth rate and a substantial increase in earnings, rising by $120.9 million from the current $10.4 million.

Uncover how Triumph Financial's forecasts yield a $60.50 fair value, in line with its current price.

Exploring Other Perspectives

Two private investors from the Simply Wall St Community estimate Triumph Financial’s fair value anywhere from US$8.03 to US$60.50 per share. Considering recent events, the company’s concentrated exposure to transportation and emerging credit risks could change how you think about future earnings stability.

Explore 2 other fair value estimates on Triumph Financial - why the stock might be worth as much as $60.50!

Build Your Own Triumph Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Triumph Financial research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Triumph Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Triumph Financial's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.