Please use a PC Browser to access Register-Tadawul

Why Upstart Holdings (UPST) Is Up After Projecting 73 Percent Revenue Growth and Strong Analyst Optimism

Upstart UPST | 49.35 | +0.45% |

- Upstart Holdings recently reported that it expects very large earnings per share growth and revenue to rise over 73% year-over-year for the most recent quarter.

- Analyst confidence is particularly strong, with the company currently holding a favorable Zacks Rank indicating positive sentiment regarding its operations and profit prospects.

- We’ll now examine how strong analyst sentiment around Upstart Holdings’ earnings growth expectations could influence its investment outlook.

This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

Upstart Holdings Investment Narrative Recap

For investors interested in Upstart Holdings, the core thesis centers on belief in the power of its AI-driven lending platform to deliver sustainable loan growth while effectively managing credit risk in a changing economic environment. The company’s guidance for strong earnings per share growth and a 73% year-over-year revenue jump reinforces expectations around rapid expansion, making near-term performance a central catalyst; however, persistent worries about credit model accuracy and macro-driven default risks remain top of mind and could quickly materialize despite upbeat quarterly numbers.

Among recent developments, Upstart’s steady addition of new credit union partners, most recently Cornerstone Community Financial and ABNB Federal Credit Union, directly ties into the growth story underpinning its platform revenue and origination volume. Expanded partnerships not only reflect lender trust but also feed into elevated analyst expectations, contributing to short-term optimism while raising stakes for model reliability as volumes scale.

By contrast, a sudden increase in loan default rates, however unlikely in the current quarter, would be an important risk investors should keep an eye on...

Upstart Holdings' outlook anticipates $1.8 billion in revenue and $337.2 million in earnings by 2028. This scenario is built on a 27.2% annual revenue growth rate and an increase in earnings by $343.6 million from the current earnings of -$6.4 million.

Uncover how Upstart Holdings' forecasts yield a $80.85 fair value, a 28% upside to its current price.

Exploring Other Perspectives

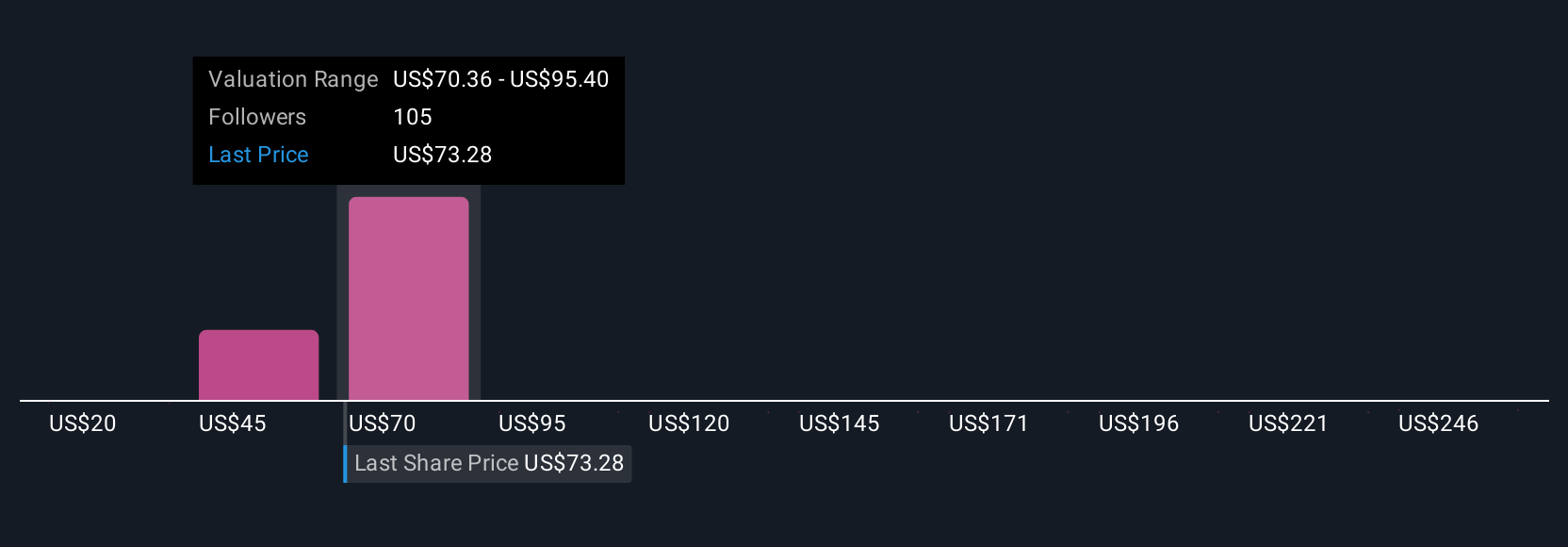

The Simply Wall St Community’s 14 fair value estimates for Upstart Holdings range widely from US$21.91 to US$85, highlighting divided opinions on valuation. Analysts’ strong focus on earnings acceleration could influence whether these community forecasts align with future performance, so consider several points of view.

Explore 14 other fair value estimates on Upstart Holdings - why the stock might be worth less than half the current price!

Build Your Own Upstart Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Upstart Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Upstart Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Upstart Holdings' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.