Please use a PC Browser to access Register-Tadawul

Why Western Digital (WDC) Is Up 12.9% After Unveiling Its AI-Focused 40TB–100TB HDD Roadmap

Western Digital Corporation WDC | 284.67 287.80 | -4.01% +1.10% Pre |

- In early February 2026, Western Digital used its Innovation Day to outline an AI-centric storage roadmap featuring 40TB hard drives in customer qualification, a path to 100TB+ capacities by 2029, new high-bandwidth and power-optimized HDD technologies, and an intelligent software layer targeting large-scale data users.

- The company coupled these technology disclosures with a US$4.00 billion increase to its share repurchase authorization, bringing the total program to US$6.00 billion and underscoring how its transformation into an AI-focused storage infrastructure provider is reshaping capital allocation priorities.

- With the shares delivering a strong one-week gain, we’ll examine how Western Digital’s AI-optimized 40TB–100TB HDD roadmap reshapes its investment narrative.

The future of work is here. Discover the 28 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

What Is Western Digital's Investment Narrative?

For Western Digital, the big picture you need to buy into is that AI-era data storage will increasingly favor very high-capacity, power-efficient hard drives, and that the company can turn its technology roadmap into durable earnings, not just headlines. Innovation Day sharpened that story: qualifying 40TB drives with hyperscalers, a path to 100TB, and an intelligent software layer all aim to deepen Western Digital’s role in AI infrastructure while justifying its richer valuation after a very large 1-year total return. In the near term, key catalysts remain execution on Q3 guidance, continued demand from cloud customers, and actual customer adoption of the new HDD and platform features. The expanded US$6.00 billion buyback adds support, but also raises the stakes if AI-driven storage spending slows or if these ambitious roadmaps slip.

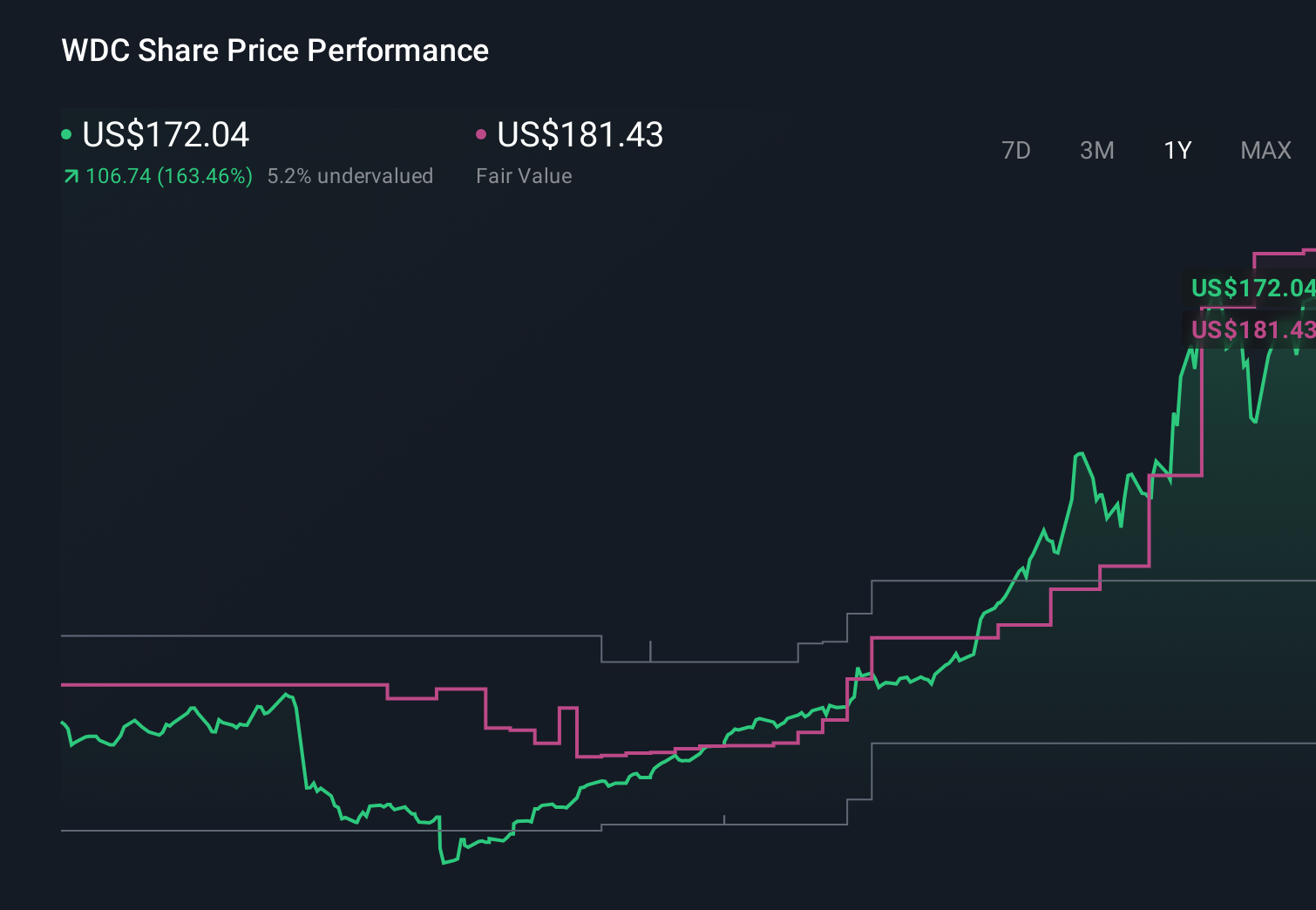

However, one execution risk around those ultra-high-capacity AI drives is easy to underestimate. Western Digital's shares are on the way up, but they could be overextended by 9%. Uncover the fair value now.Exploring Other Perspectives

Explore 6 other fair value estimates on Western Digital - why the stock might be worth 34% less than the current price!

Build Your Own Western Digital Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Digital research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Western Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Digital's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Invest in the nuclear renaissance through our list of 87 elite nuclear energy infrastructure plays powering the global AI revolution.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 22 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.