Please use a PC Browser to access Register-Tadawul

Why Winnebago Industries (WGO) Is Up 33.6% After Raising 2026 Guidance and Reporting Strong Results

Winnebago Industries, Inc. WGO | 39.24 | -1.75% |

- Winnebago Industries recently reported strong fourth-quarter and full-year financial results, with fiscal 2026 guidance projecting consolidated net revenues of US$2.75 billion to US$2.95 billion and adjusted earnings per diluted share of US$2.00 to US$2.70.

- Management's confidence is underpinned by improved operating cash flow, enhanced profitability, and ongoing momentum from new product launches and operational enhancements.

- We’ll explore how the combination of improved profitability and 2026 growth guidance impacts Winnebago’s investment narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Winnebago Industries Investment Narrative Recap

To be a shareholder in Winnebago Industries, you need to believe in the company’s ability to drive consistent earnings growth through product innovation and operational efficiency despite cycles in recreational vehicle demand. The recent full-year results and fiscal 2026 guidance signal improved profitability and a strong pipeline of new products, but near-term momentum may not offset lingering macroeconomic uncertainty, the most significant catalyst remains new model launches, while consumer demand softness persists as the major short-term risk. The latest guidance does not materially alter these dynamics for now.

Winnebago's launch of the Grand Design Motorhome Lineage lineup is particularly relevant; it strengthens the company’s presence in the motorized segment, directly supporting the key catalyst of product-driven revenue growth. If this initiative succeeds, it could help Winnebago capture additional market share at a time when dealers are keeping inventory lean and consumer demand trends remain cautious.

However, investors should also be aware that, in contrast to optimism around new products, the risk from softer retail conditions could still put pressure on revenue if...

Winnebago Industries' outlook forecasts $3.4 billion in revenue and $217.6 million in earnings by 2028. Achieving this would require 7.2% annual revenue growth and an increase in earnings of $234.7 million from the current -$17.1 million.

Uncover how Winnebago Industries' forecasts yield a $41.45 fair value, a 3% upside to its current price.

Exploring Other Perspectives

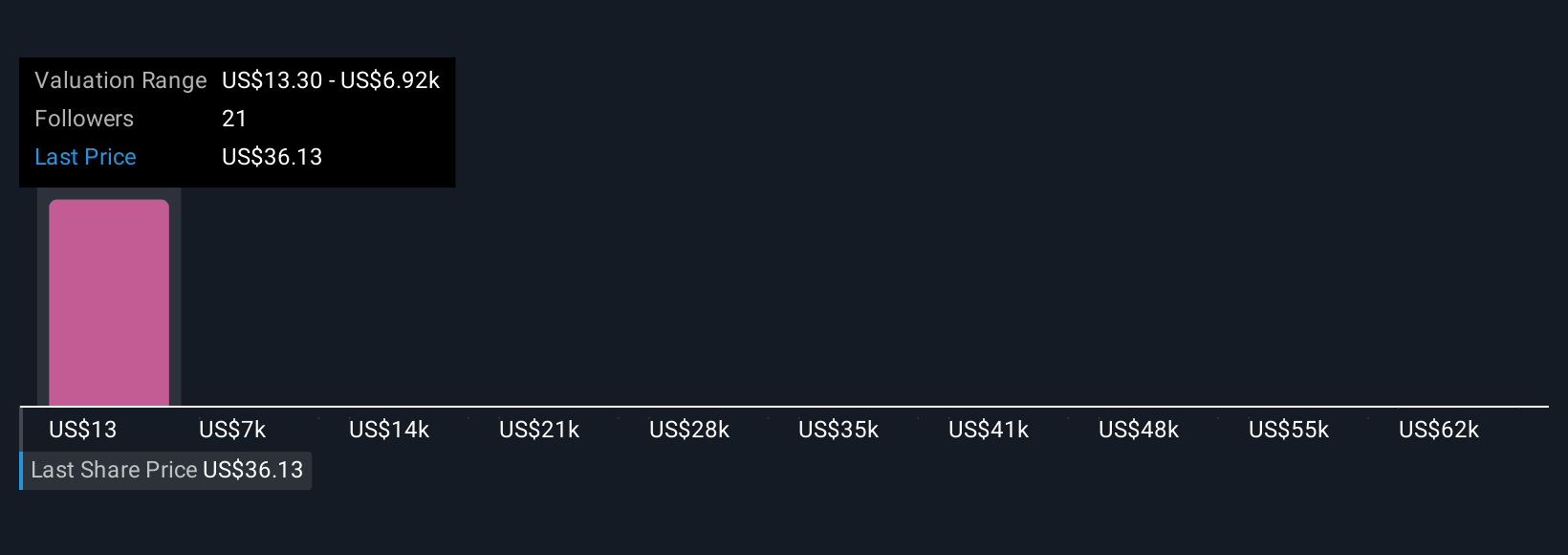

Six fair value estimates from the Simply Wall St Community for Winnebago Industries span from US$13 to over US$69,000 per share. Despite this broad range, weak retail demand remains an important factor shaping how future performance could play out, so examine multiple viewpoints and factor in underlying risks.

Explore 6 other fair value estimates on Winnebago Industries - why the stock might be worth less than half the current price!

Build Your Own Winnebago Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Winnebago Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Winnebago Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Winnebago Industries' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.