Please use a PC Browser to access Register-Tadawul

Why XPeng (XPEV) Is Up 5.2% After Record August Deliveries and New P7 Launch

XPENG INC. XPEV | 18.99 | -1.04% |

- XPeng Inc. recently reported record-breaking monthly Smart EV deliveries in August 2025, with 37,709 units sold, a very large year-over-year increase, and launched the new XPENG P7 with nationwide deliveries beginning August 28.

- This surge in vehicle deliveries, combined with the new model launch, highlights XPeng’s ability to accelerate demand and quickly execute new product rollouts in the highly competitive Chinese EV market.

- We’ll explore how XPeng’s record August deliveries and latest P7 launch reshape the company’s investment narrative and growth outlook.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

XPeng Investment Narrative Recap

To invest in XPeng, you need conviction in the company’s ability to turn robust EV sales growth into sustainable profitability, while navigating fierce price competition in China. The record August deliveries and the new P7 launch serve as short-term catalysts, but the company’s persistent net losses and industry-wide pricing pressures remain the biggest risks, these results do not materially shift that risk profile, though they do underscore momentum on sales.

The timely launch and immediate delivery of the new XPENG P7 stand out, as it reinforces the company’s capacity to introduce and scale new models, supporting volume-based top-line growth, a key catalyst identified by analysts for XPeng’s path toward margin improvement.

Yet, in contrast, investors should remember that accelerating sales do little to address the persistent risk of ongoing net losses if costs outpace revenue...

XPeng's narrative projects CN¥137.4 billion in revenue and CN¥6.4 billion in earnings by 2028. This requires 31.6% yearly revenue growth and a CN¥10.7 billion increase in earnings from the current level of CN¥-4.3 billion.

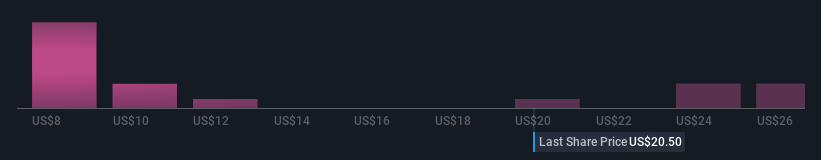

Uncover how XPeng's forecasts yield a $26.29 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Fourteen private investors in the Simply Wall St Community set fair values for XPeng between CN¥9.23 and CN¥33.26, highlighting wide differences in growth assumptions. While many see opportunity in the company’s rapid new model launches, ongoing high expenses remain a critical factor influencing future performance, explore these alternative viewpoints to inform your own analysis.

Explore 14 other fair value estimates on XPeng - why the stock might be worth as much as 59% more than the current price!

Build Your Own XPeng Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your XPeng research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free XPeng research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate XPeng's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.