Please use a PC Browser to access Register-Tadawul

Will a US$500 Million Convertible Bond Issue Reshape JBT Marel's (JBTM) Capital Strategy?

JBT Marel Corp. Ordinary Shares JBTM | 153.26 | -1.21% |

- Earlier this month, JBT Marel Corporation completed a US$500 million fixed-income offering of 0.375% senior unsecured convertible notes due in 2030 and amended its credit agreement to lower borrowing costs and increase flexibility for future debt issuance.

- These moves highlight the company’s proactive approach to managing its capital structure and securing funding, which can support growth initiatives and improve financial resilience.

- We'll examine how the US$500 million convertible bond issue and amended credit terms could reshape JBT Marel's investment narrative moving forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

JBT Marel Investment Narrative Recap

To own shares in JBT Marel, you need to believe in the long-term growth of global protein consumption and the company’s ability to leverage automation, integration, and digitalization to drive recurring, higher-margin revenue streams. The recent US$500 million convertible bond issue and amended credit agreement strengthen JBT Marel’s funding position, but they do not immediately address the accelerating risk from ongoing global tariffs, which remain the biggest short-term threat to near-term margins.

Among the latest news, the September 3 credit agreement amendment is particularly relevant as it reduces borrowing costs and explicitly permits the issuance of unsecured convertible notes. This step gives JBT Marel greater flexibility in funding ongoing merger integration and could support margin initiatives if realized synergies offset ongoing margin headwinds from tariffs and supply chain changes.

Yet, on the other hand, investors should be especially mindful of how persistent tariff-driven cost pressures may challenge...

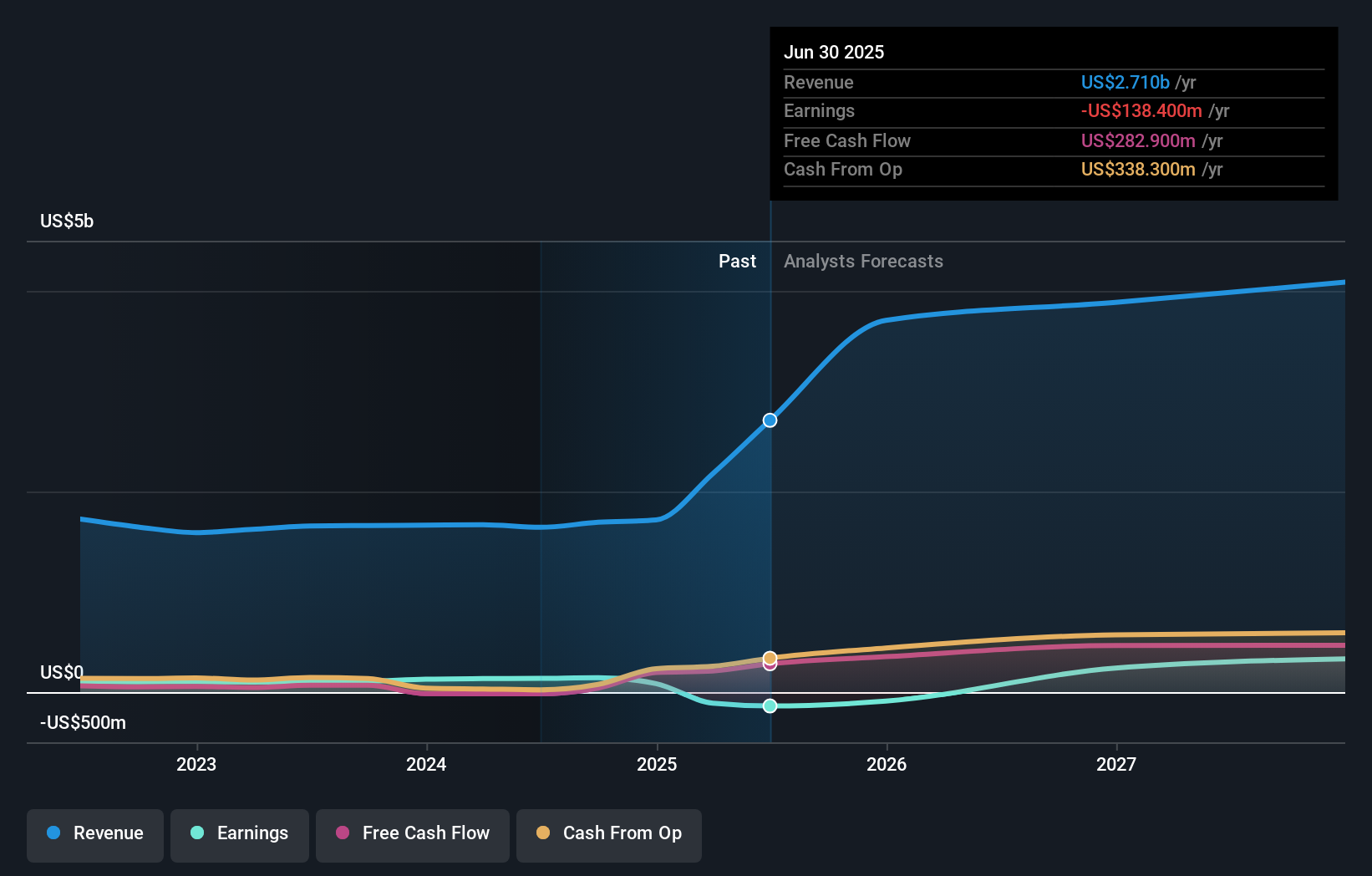

JBT Marel's outlook anticipates $4.6 billion in revenue and $591.0 million in earnings by 2028. This implies an annual revenue growth rate of 19.0% and an earnings increase of $729.4 million from current earnings of -$138.4 million.

Uncover how JBT Marel's forecasts yield a $162.30 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members estimate JBT Marel’s fair value between US$86.42 and US$162.30 per share, reflecting a broad range of outlooks. Persistent concerns over margin risks tied to global tariffs could have a far-reaching impact on results, so it pays to consider different viewpoints.

Explore 3 other fair value estimates on JBT Marel - why the stock might be worth as much as 18% more than the current price!

Build Your Own JBT Marel Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JBT Marel research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free JBT Marel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JBT Marel's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 25 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.