Please use a PC Browser to access Register-Tadawul

Will Aehr Test Systems' (AEHR) Shift to Net Loss Redefine Its Investment Narrative?

Aehr Test Systems AEHR | 24.48 | -7.38% |

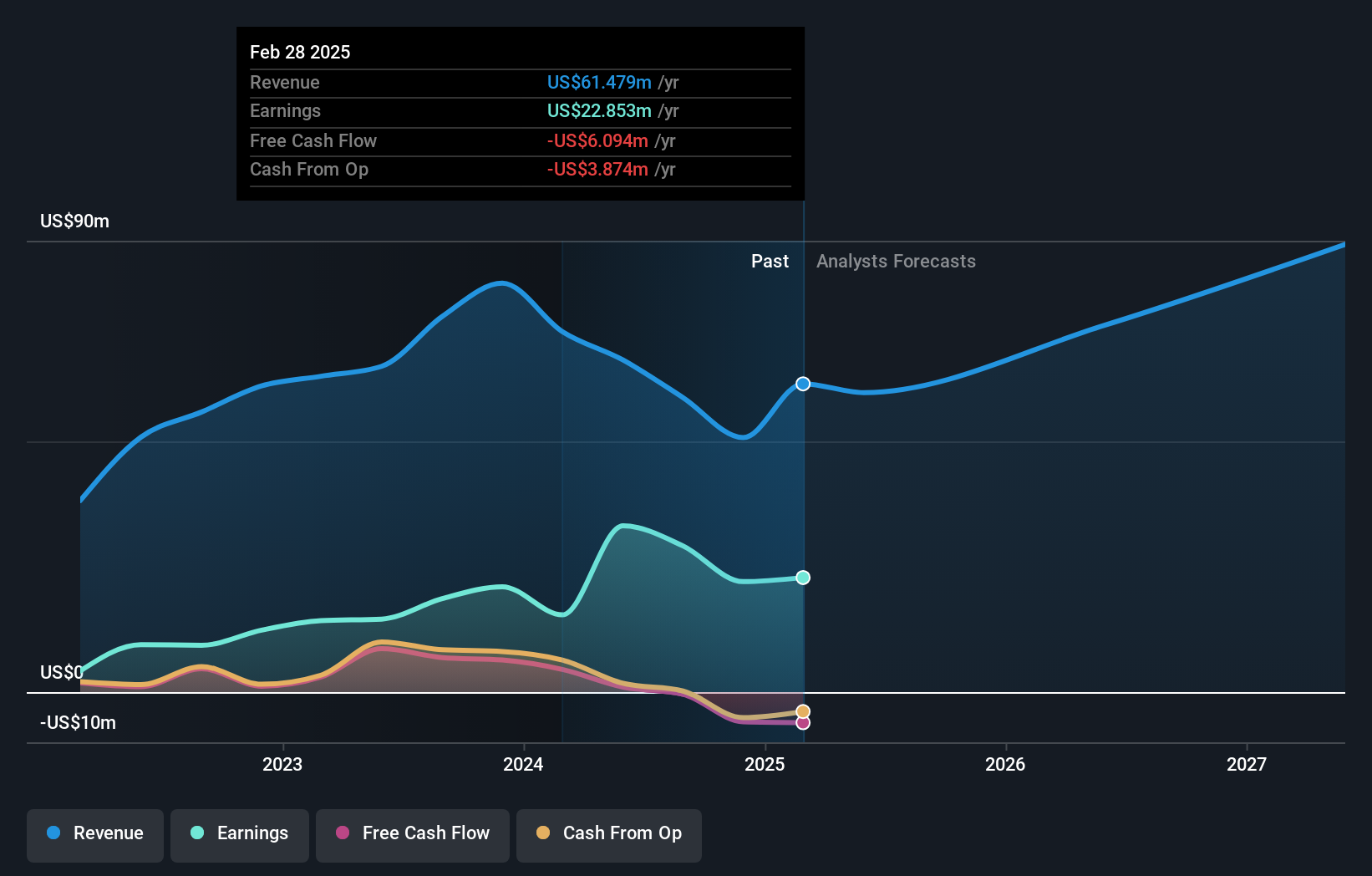

- Aehr Test Systems recently reported its first-quarter earnings for the period ended August 29, 2025, with sales of US$10.97 million and a net loss of US$2.08 million, compared to a net profit a year earlier.

- This shift from profitability to a loss, alongside lower sales, marks a significant change in the company's financial performance over the past year.

- We'll explore how the transition from net income to net loss shapes the current investment narrative for Aehr Test Systems.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Aehr Test Systems' Investment Narrative?

To believe in Aehr Test Systems as a shareholder, you’d need confidence in its long-term demand from the automotive and AI semiconductor markets, set against the reality of short-term swings in revenue and profitability. The recent earnings release, showing a first-quarter net loss and decreased sales, has recast the risk profile and may temporarily overshadow optimism about strong customer orders or optimistic revenue guidance given earlier in the year. This change signals that the company’s ability to meet forward-looking goals is now under more scrutiny, and could reduce the likelihood that previously highlighted catalysts, such as large client wins or index additions, will drive positive momentum soon. Risks like high valuation metrics and ongoing legal matters feel more immediate, especially with the company missing guidance and reporting consecutive quarterly losses. The new results raise important questions about near-term growth potential that need to be considered alongside longer-term conviction. On the flip side, attention to the legal situation could become even more relevant.

Aehr Test Systems' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 11 other fair value estimates on Aehr Test Systems - why the stock might be worth over 2x more than the current price!

Build Your Own Aehr Test Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aehr Test Systems research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Aehr Test Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aehr Test Systems' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.