Please use a PC Browser to access Register-Tadawul

Will ALGM’s New Product Chief Shift Allegro’s Competitive Edge or Reflect Deeper Innovation Goals?

ALLEGRO MICROSYSTEMS, INC. ALGM | 27.11 | -4.81% |

- Allegro MicroSystems recently appointed Troy Coleman as Senior Vice President and General Manager, Products, bringing over 25 years of semiconductor leadership and a background in power and analog solutions at Texas Instruments.

- This executive hire places an industry veteran at the helm of product strategy, potentially impacting Allegro’s innovation focus and competitive positioning in core power and sensing markets.

- We’ll explore how the addition of Troy Coleman could influence Allegro MicroSystems’ investment outlook and response to recent negative analyst sentiment.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Allegro MicroSystems Investment Narrative Recap

To be a shareholder in Allegro MicroSystems, you need confidence in the company’s ability to extend its leadership in power and sensing ICs as electrification and automation trends accelerate, especially in automotive and industrial markets. The recent appointment of Troy Coleman as SVP and General Manager, Products, introduces a seasoned industry leader, but is unlikely to materially change the immediate business catalyst, reacceleration of automotive and industrial demand, or address the core risk of margin pressure as competition intensifies, particularly in China.

Among recent announcements, the launch of XtremeSense™ TMR current sensors tailored for clean energy systems stands out for its relevance. This product reflects Allegro’s focus on innovation and deepening exposure to secular growth areas, aligning well with the expanded leadership team as the company seeks margin improvement and new market share from differentiated products.

However, investors should not overlook the risk of increasing price pressure from Chinese competitors, which could weigh on...

Allegro MicroSystems' outlook anticipates $1.2 billion in revenue and $249.0 million in earnings by 2028. This scenario is based on a projected annual revenue growth rate of 17.3% and an increase in earnings of $317.6 million from current earnings of -$68.6 million.

Uncover how Allegro MicroSystems' forecasts yield a $37.08 fair value, a 28% upside to its current price.

Exploring Other Perspectives

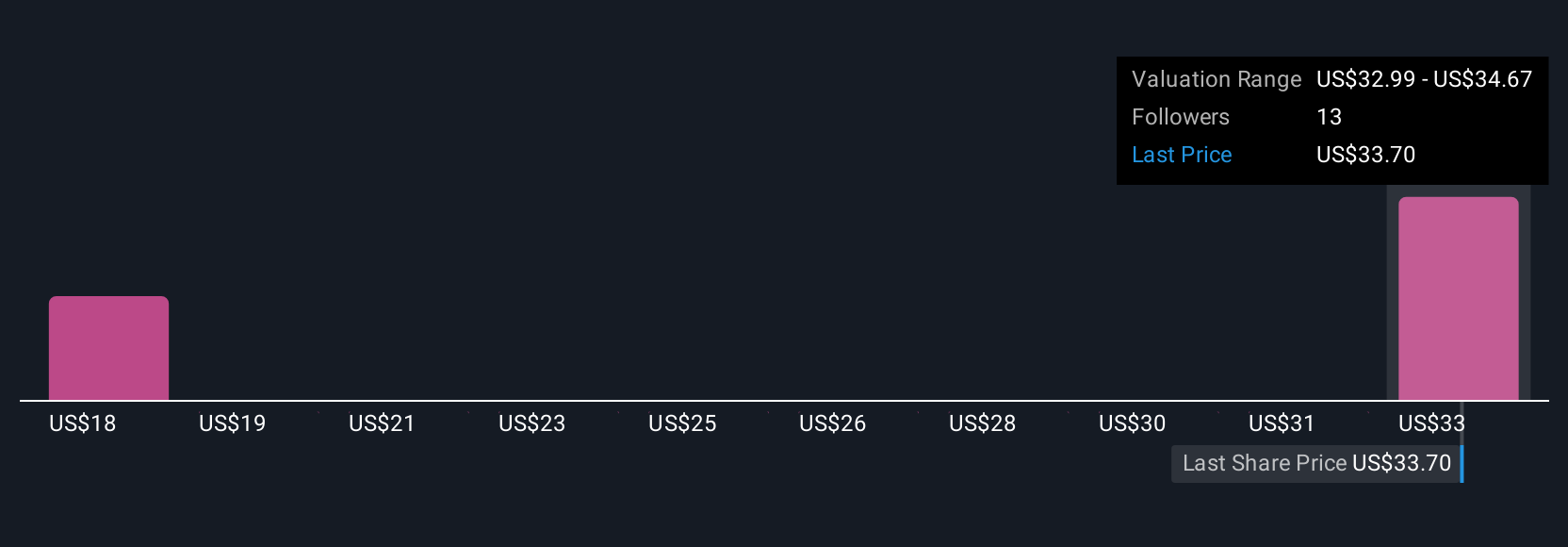

Simply Wall St Community members currently estimate Allegro’s fair value between US$23.00 and US$37.08, reflecting three distinct viewpoints. With price competition from Chinese suppliers affecting margin sustainability, explore the range of peer and community perspectives on where Allegro could head next.

Explore 3 other fair value estimates on Allegro MicroSystems - why the stock might be worth 21% less than the current price!

Build Your Own Allegro MicroSystems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allegro MicroSystems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Allegro MicroSystems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allegro MicroSystems' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.