Please use a PC Browser to access Register-Tadawul

Will Analyst Buzz Around ORX750 Shift Centessa (CNTA)’s Narrative on Innovation and Clinical Risk?

CENTESSA PHARMACEUTICALS PLC CNTA | 25.82 | -1.26% |

- Centessa Pharmaceuticals recently presented at high-profile industry events, including the World Sleep Congress in Singapore and the Morgan Stanley Global Healthcare Conference in New York, showcasing its lead asset ORX750.

- Heightened analyst interest and discussion at these events have reinforced expectations that upcoming Phase 2a data for ORX750 could be a significant milestone for the company.

- We'll explore how anticipation of clinical trial results for ORX750 is shaping Centessa’s investment narrative in light of recent analyst confidence.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Centessa Pharmaceuticals' Investment Narrative?

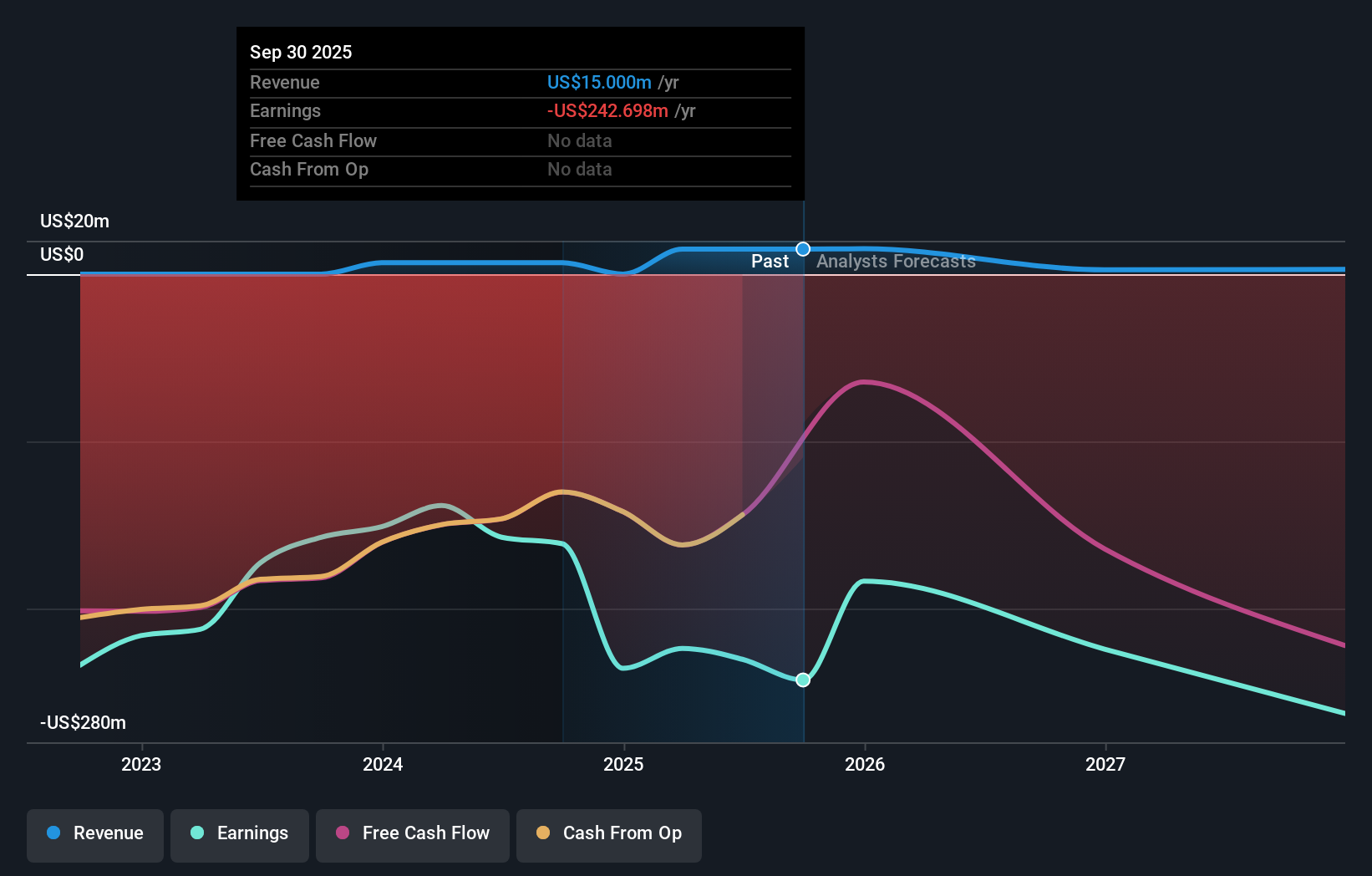

For anyone considering Centessa Pharmaceuticals, the central belief is that ORX750 can become a meaningful treatment option for narcolepsy and perhaps broader sleep disorders, with clinical success acting as the single most important short-term catalyst. The recent wave of conference presentations, analyst coverage, and robust price movements reflects growing optimism as the company nears the release of critical Phase 2a data. Compared to analysis prior to these events, the visibility and commentary from multiple analysts have made the potential impact of ORX750 much more central, raising expectations and possibly compressing the risk-reward scenario around clinical trial results. Shortcomings remain: Centessa is unprofitable, spending is high, and uncertainty about long-term profitability persists. The excitement around the stock could amplify volatility, especially if trial outcomes deviate from analyst enthusiasm.

But despite this renewed optimism, the risk from an unproven pipeline may be even more important now. Centessa Pharmaceuticals' shares have been on the rise but are still potentially undervalued by 28%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Centessa Pharmaceuticals - why the stock might be worth as much as 40% more than the current price!

Build Your Own Centessa Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centessa Pharmaceuticals research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Centessa Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centessa Pharmaceuticals' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.