Please use a PC Browser to access Register-Tadawul

Will Analyst Coverage and Redevelopment Progress Shift Douglas Emmett's (DEI) Investment Narrative?

Douglas Emmett, Inc DEI | 11.64 | -1.02% |

- Douglas Emmett announced it will release its 2025 third quarter earnings results after market close on Tuesday, November 4, 2025, with a live conference call scheduled for the following day hosted by key executives.

- Recently, Cantor Fitzgerald began coverage on Douglas Emmett, emphasizing the company’s differentiated focus on small office tenants and potential catalysts such as lease-up progress at Studio Plaza and the conversion of its Wilshire acquisition to residential use.

- With analyst attention drawn to Douglas Emmett’s unique small office platform and redevelopment plans, let’s consider how this could shape its investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Douglas Emmett Investment Narrative Recap

To be a shareholder in Douglas Emmett requires confidence in the company’s ability to capitalize on its focus on small office tenants and redevelopment projects, while managing persistent challenges like office occupancy and financial headwinds. The recent analyst coverage and upcoming third quarter earnings announcement shine a light on these factors, but neither event appears to materially change the immediate significance of Studio Plaza lease-up progress as the most important short-term catalyst, or address ongoing concerns around occupancy and earnings pressure.

Among recent announcements, Cantor Fitzgerald’s initiation of coverage stands out, highlighting the operational advantage of Douglas Emmett’s small office tenant mix. This model is touted to drive higher lease-up rates at Studio Plaza and potential future upside from residential conversions, reinforcing the centrality of leasing activity and redevelopment progress as potential catalysts for earnings and improved investor sentiment.

However, in contrast to these growth plans, investors should be aware that the biggest risk remains...

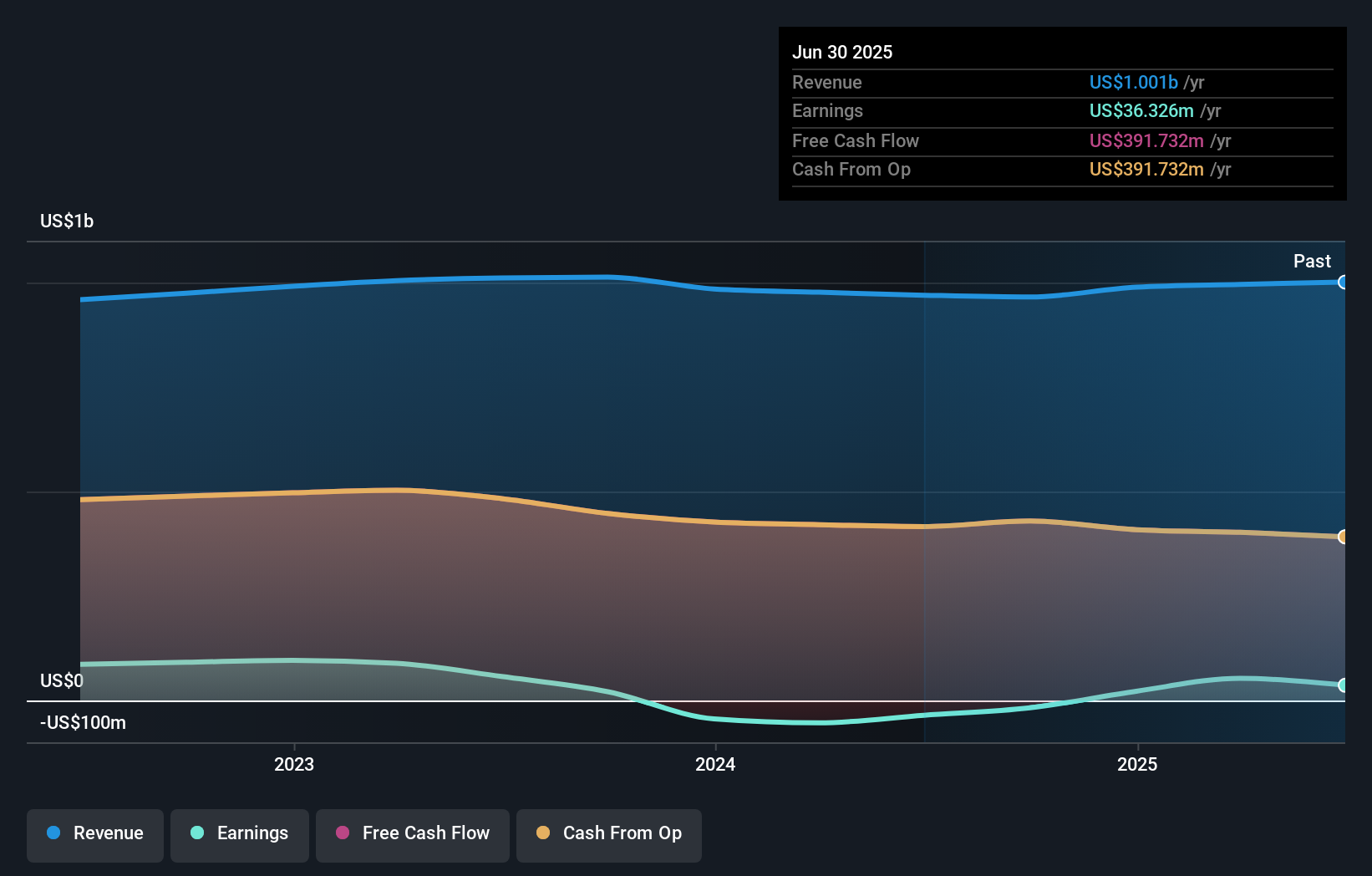

Douglas Emmett's narrative projects $1.0 billion in revenue and $88.1 million in earnings by 2028. This requires 1.1% yearly revenue growth and an increase of $66 million in earnings from current earnings of $22.1 million.

Uncover how Douglas Emmett's forecasts yield a $16.86 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided a single fair value estimate for Douglas Emmett stock at US$16.86. Opinions may differ significantly, especially as ongoing tenant retention and occupancy risks continue to shape the company’s financial outlook.

Explore another fair value estimate on Douglas Emmett - why the stock might be worth as much as 8% more than the current price!

Build Your Own Douglas Emmett Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Douglas Emmett research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Douglas Emmett research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Douglas Emmett's overall financial health at a glance.

No Opportunity In Douglas Emmett?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.