Please use a PC Browser to access Register-Tadawul

Will Analyst Optimism and Upgraded Earnings Momentum Shift Xeris Biopharma’s (XERS) Investment Narrative?

XERIS PHARMACEUTICALS INC XERS | 7.22 | +0.70% |

- In the past week, Xeris Biopharma Holdings received a Momentum Style Score of B and a Zacks Rank of #2, reflecting increased positive analyst sentiment following upward revisions to earnings estimates and notable outperformance versus its peers and the S&P 500.

- This combination of favorable analyst reviews and earnings momentum has supported a reassessment of the company's near-term outlook among market participants.

- We'll examine how this recent wave of analyst optimism and earnings estimate upgrades could influence Xeris Biopharma's investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Xeris Biopharma Holdings Investment Narrative Recap

To be a shareholder in Xeris Biopharma Holdings, you need to believe in the company's ability to convert strong revenue momentum for its key products, Gvoke, Recorlev, and Keveyis, into sustainable profitability, while expanding commercial reach and advancing its pipeline, especially XP-8121. The recent surge in positive analyst sentiment and upward earnings revisions reinforces market confidence about near-term revenue traction, but it does not fully address the underlying risk of heavy reliance on a concentrated product lineup, which remains a critical vulnerability if competitive or market disruptions arise. Among recent developments, the company's Q2 earnings report stands out as especially relevant: Xeris reported revenue of US$71.54 million (up from US$48.07 million last year) and a significantly narrowed net loss, indicating continued sales growth and improved operating leverage. While this financial progress underpins the short-term optimism captured in the new analyst ratings, it does not eliminate longer-term concerns around product concentration and rising expenses tied to commercial and R&D expansion. Yet despite this positive momentum, investors should be aware that if a key product faces an unexpected challenge in its market...

Xeris Biopharma Holdings' outlook anticipates $440.9 million in revenue and $84.8 million in earnings by 2028. This scenario assumes 21.5% annual revenue growth and a $116.8 million increase in earnings from the current level of -$32.0 million.

Uncover how Xeris Biopharma Holdings' forecasts yield a $9.00 fair value, a 20% upside to its current price.

Exploring Other Perspectives

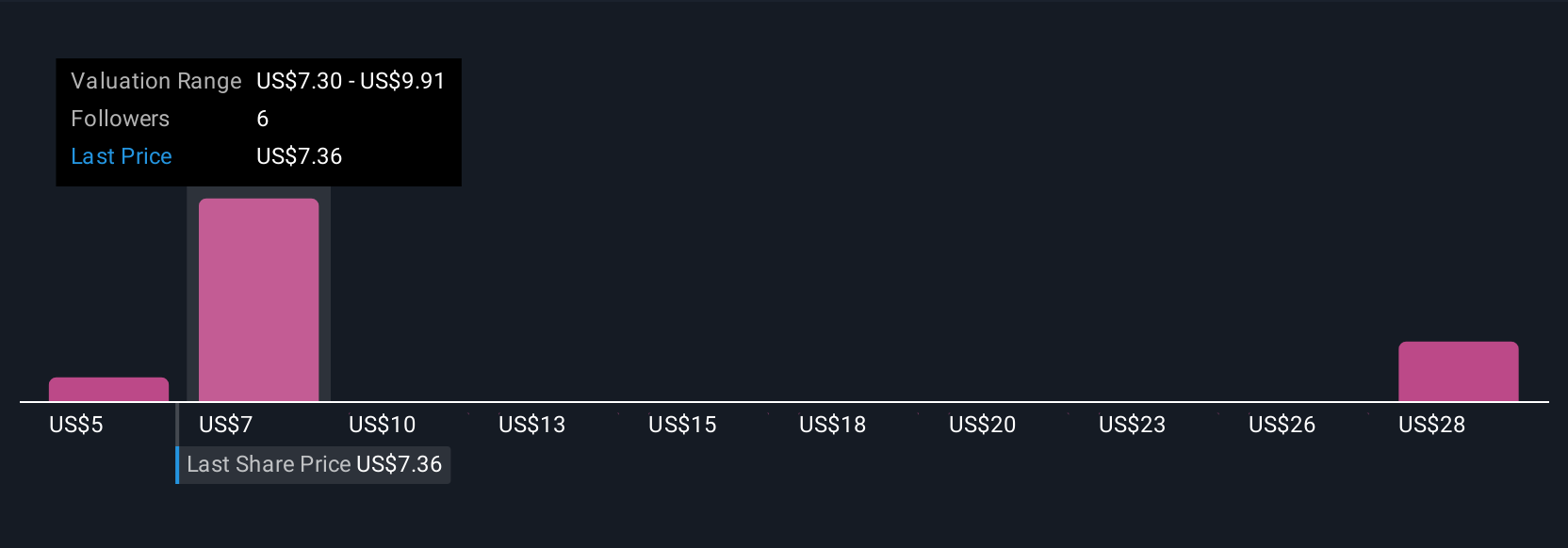

Three members of the Simply Wall St Community offered fair value estimates for Xeris Biopharma ranging from US$4.69 to US$30.79, reflecting highly varied expectations. With continued dependence on three main drugs, the diverse views highlight how uncertainty around new competitors could impact future growth and returns.

Explore 3 other fair value estimates on Xeris Biopharma Holdings - why the stock might be worth over 4x more than the current price!

Build Your Own Xeris Biopharma Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Xeris Biopharma Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Xeris Biopharma Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Xeris Biopharma Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 25 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.